The Bank of England (BoE), European Central Bank (ECB) and most recently, the US Federal Reserve, have all issued their most recent monetary policy statements in the past two weeks. All of these three major central banks opted for inaction – the BoE and ECB refrained from implementing post-Brexit stimulus measures for the time being while the Fed again deferred a long-postponed rate hike. Friday finally brings the Bank of Japan’s (BoJ) highly-anticipated policy statement, which will most likely buck this recent trend of inaction.

On Wednesday, Japanese Prime Minister Shinzo Abe revealed an unexpectedly sizable 28 trillion yen government stimulus package, which placed immediate pressure on the BoJ to follow suit by expanding its stimulus program. The key question weighing now on the global markets, and the yen in particular, is the extent to which the central bank will cooperate with Abe’s aims to boost Japanese economic growth.

Most analysts expect some form of stimulus from the central bank, including possible asset purchases and/or a further interest rate cut, but the uncertainty lies in the magnitude of these actions. This magnitude will likely serve as one of the main drivers of market movement on Friday and into next week for both the Japanese yen and major equity markets. Of course, in the very unlikely event that there is no BoJ action at all, volatility in the markets should be particularly pronounced, potentially leading to a dramatic surge for the yen.

As usual, USD/JPY will be one to watch, as it can serve as a good barometer of yen movement. Another key currency pair that should also see high volatility during this event, however, will be EUR/JPY, especially since Friday also brings a solid series of European economic data.

In the event of more comprehensive stimulus than expected from the BoJ on Friday, the yen will likely be pressured to retreat sharply, pushing EUR/JPY to rise and extend its rebound from recent multi-year lows. In the opposite event of a substantially lighter stimulus package that disappoints Abe and other Japanese government officials, the yen could resume its longer-term strengthening, potentially pressuring EUR/JPY to continue its downtrend of the past year.

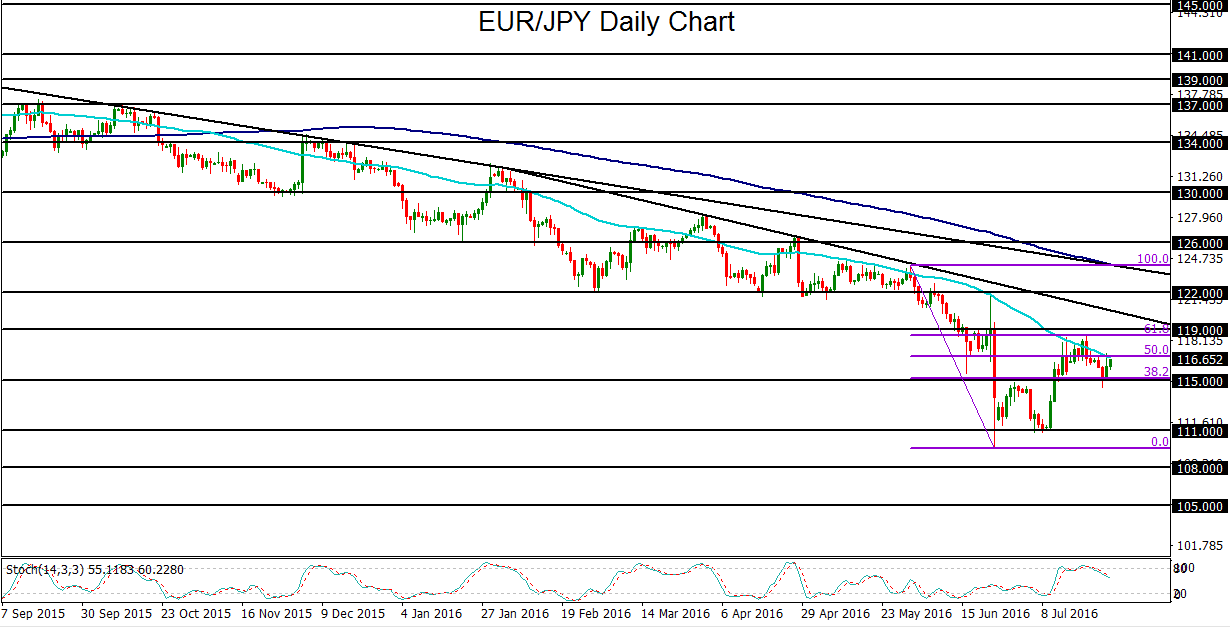

This EUR/JPY downtrend is clearly framed by two key trend lines that have shown an acceleration of the bearish trend this year. Most recently, the currency pair established a post-Brexit multi-year low around 109.50 in late June. This was followed by a rebound within the past three weeks that boosted EUR/JPY up to a key 61.8% Fibonacci retracement level before falling back.

Currently, in the immediate run-up to the BoJ policy statement, the currency pair is bumped up against its 50-day moving average to the upside. To the downside is the major 115.00 support level. Depending on the outcome of the policy statement, any surprise could likely lead to a breakout price move. With less-than-expected stimulus, EUR/JPY could break down below 115.00, which could put it on track to target downside support around 111.00, followed by a potential resumption of the entrenched bearish trend. With more-than-expected stimulus, EUR/JPY could rise above its 50-day moving average, in which case, the next major resistance targets are around the 119.00 level, followed further to the upside by the noted accelerated downtrend line.

On Wednesday, Japanese Prime Minister Shinzo Abe revealed an unexpectedly sizable 28 trillion yen government stimulus package, which placed immediate pressure on the BoJ to follow suit by expanding its stimulus program. The key question weighing now on the global markets, and the yen in particular, is the extent to which the central bank will cooperate with Abe’s aims to boost Japanese economic growth.

Most analysts expect some form of stimulus from the central bank, including possible asset purchases and/or a further interest rate cut, but the uncertainty lies in the magnitude of these actions. This magnitude will likely serve as one of the main drivers of market movement on Friday and into next week for both the Japanese yen and major equity markets. Of course, in the very unlikely event that there is no BoJ action at all, volatility in the markets should be particularly pronounced, potentially leading to a dramatic surge for the yen.

As usual, USD/JPY will be one to watch, as it can serve as a good barometer of yen movement. Another key currency pair that should also see high volatility during this event, however, will be EUR/JPY, especially since Friday also brings a solid series of European economic data.

In the event of more comprehensive stimulus than expected from the BoJ on Friday, the yen will likely be pressured to retreat sharply, pushing EUR/JPY to rise and extend its rebound from recent multi-year lows. In the opposite event of a substantially lighter stimulus package that disappoints Abe and other Japanese government officials, the yen could resume its longer-term strengthening, potentially pressuring EUR/JPY to continue its downtrend of the past year.

This EUR/JPY downtrend is clearly framed by two key trend lines that have shown an acceleration of the bearish trend this year. Most recently, the currency pair established a post-Brexit multi-year low around 109.50 in late June. This was followed by a rebound within the past three weeks that boosted EUR/JPY up to a key 61.8% Fibonacci retracement level before falling back.

Currently, in the immediate run-up to the BoJ policy statement, the currency pair is bumped up against its 50-day moving average to the upside. To the downside is the major 115.00 support level. Depending on the outcome of the policy statement, any surprise could likely lead to a breakout price move. With less-than-expected stimulus, EUR/JPY could break down below 115.00, which could put it on track to target downside support around 111.00, followed by a potential resumption of the entrenched bearish trend. With more-than-expected stimulus, EUR/JPY could rise above its 50-day moving average, in which case, the next major resistance targets are around the 119.00 level, followed further to the upside by the noted accelerated downtrend line.

Latest market news

Today 02:05 PM