USD/JPY resumed its plunge on Tuesday as the dollar continued its recent slide on lowered Fed rate hike expectations and the yen rose despite news that the Japanese government had approved a hefty fiscal stimulus package worth 13.5 trillion yen.

Since last week’s FOMC meeting, the US dollar has been significantly pressured, suffering from the market’s realization that a rate hike in the next few months is both extremely uncertain and increasingly improbable. This lowered likelihood was reinforced on Friday when Advance GDP data came out much worse than expected at 1.2% versus prior expectations of 2.6%.

Meanwhile, the Japanese yen strengthened last week when the Bank of Japan (BoJ) disappointed investors and failed to cooperate with Japanese Prime Minister Shinzo Abe’s aggressive fiscal stimulus proposal by refraining from pushing further into negative interest rate territory or increasing its bond-purchase program. This weak response on the part of the BoJ led to an immediate surge for the Japanese currency. Fast-forward to the current week – the noted Japanese government approval of a substantial fiscal stimulus package on Tuesday failed to have the desired effect of weakening the yen largely because Abe’s pre-announced aggressive stimulus measures had already been widely expected and priced-in to the Japanese currency. The yen subsequently continued to surge against its major currency rivals on Tuesday.

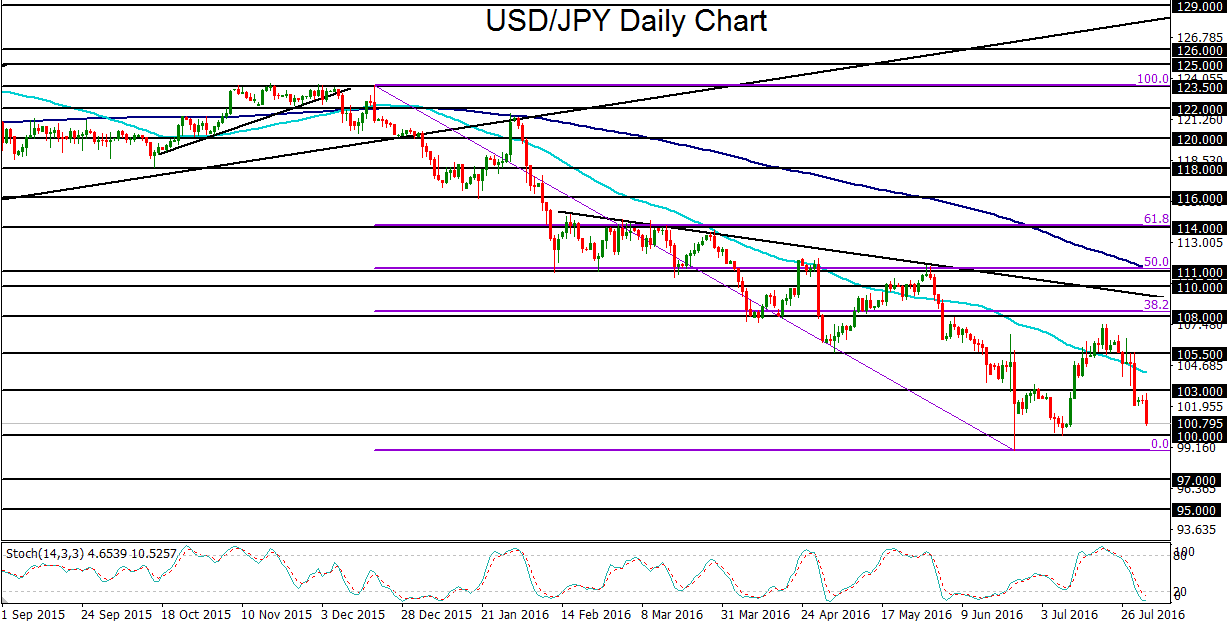

This persistent yen strength, despite ongoing efforts by Japan to weaken its currency, combined with Fed-driven pressure on the US dollar succeeded in pushing down USD/JPY ever closer to its major psychological support level at 100.00. This key price level was temporarily broken in the immediate aftermath of June’s Brexit vote, when the currency pair spiked down to a low around 99.00 before rebounding. Subsequently, the 100.00 level was again revisited in early July before another bounce.

With the current re-approach of 100.00, USD/JPY has once again neared a critical juncture. Any strong breakdown below this level would clearly create further concerns for Japanese officials and revive talk of potential Japan intervention in its currency, which could very well prove again to be ineffective. On any such sustained breakdown below 100.00, major downside support targets continue to reside at the key 97.00 and 95.00 levels.

Since last week’s FOMC meeting, the US dollar has been significantly pressured, suffering from the market’s realization that a rate hike in the next few months is both extremely uncertain and increasingly improbable. This lowered likelihood was reinforced on Friday when Advance GDP data came out much worse than expected at 1.2% versus prior expectations of 2.6%.

Meanwhile, the Japanese yen strengthened last week when the Bank of Japan (BoJ) disappointed investors and failed to cooperate with Japanese Prime Minister Shinzo Abe’s aggressive fiscal stimulus proposal by refraining from pushing further into negative interest rate territory or increasing its bond-purchase program. This weak response on the part of the BoJ led to an immediate surge for the Japanese currency. Fast-forward to the current week – the noted Japanese government approval of a substantial fiscal stimulus package on Tuesday failed to have the desired effect of weakening the yen largely because Abe’s pre-announced aggressive stimulus measures had already been widely expected and priced-in to the Japanese currency. The yen subsequently continued to surge against its major currency rivals on Tuesday.

This persistent yen strength, despite ongoing efforts by Japan to weaken its currency, combined with Fed-driven pressure on the US dollar succeeded in pushing down USD/JPY ever closer to its major psychological support level at 100.00. This key price level was temporarily broken in the immediate aftermath of June’s Brexit vote, when the currency pair spiked down to a low around 99.00 before rebounding. Subsequently, the 100.00 level was again revisited in early July before another bounce.

With the current re-approach of 100.00, USD/JPY has once again neared a critical juncture. Any strong breakdown below this level would clearly create further concerns for Japanese officials and revive talk of potential Japan intervention in its currency, which could very well prove again to be ineffective. On any such sustained breakdown below 100.00, major downside support targets continue to reside at the key 97.00 and 95.00 levels.

Latest market news

Today 11:59 AM

Yesterday 11:06 PM

Yesterday 01:00 PM

November 30, 2024 12:00 PM