Preliminary Japanese GDP data (q/q) for the second quarter was released prior to Monday’s Asian trading session, and the results were a significant disappointment. Gross domestic product for the April-to-June period was reportedly flat against prior consensus expectations of a 0.2% increase. This weak economic data could likely help pressure Prime Minister Shinzo Abe’s government and the Bank of Japan to find additional ways to stimulate the Japanese economy.

Despite the implication that Monday’s pessimistic GDP data may lead to even more stimulus measures than have already been implemented or announced, the Japanese yen was not significantly affected by the economic data release. While the yen should have been pressured considerably by the specter of more stimulus actions and potential interest rate cuts further into negative territory, the perception remains that Japan may be running out of options to help prop up its economy and weaken its currency. Therefore, even a very poor GDP reading was unable to faze the persistently strong yen.

Meanwhile, the US dollar has continued to struggle as bets on a Fed rate hike this year have progressively diminished. Lower expectations of a US rate hike have been prompted by an overwhelming trend of global monetary easing by major central banks, as well as some very recent US data that has shown some unexpected weakness. Last week’s US retail sales, Producer Price Index (a key inflation indicator), and consumer sentiment data all surprised significantly to the downside.

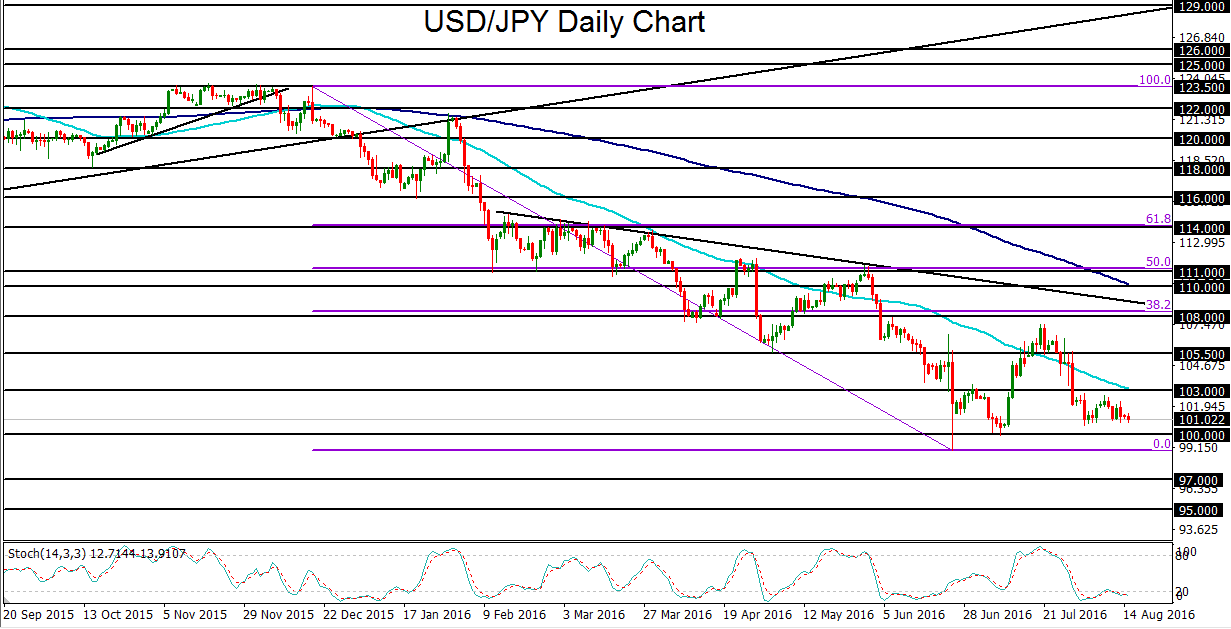

This combination of a very resilient Japanese yen and lagging US dollar has served to pressure USD/JPY back down towards major psychological support around the 100.00 level. As long as markets continue to bet against a Fed rate hike anytime soon and the yen continues to ignore Japan’s efforts to weaken it, USD/JPY could have significantly further to fall. With any breakdown below the noted 100.00 psychological support level, the currency pair could drop down to its post-Brexit low just below 99.00. In turn, a breakdown below that low would confirm a continuation of the long-term downtrend, with the next major downside target around the 97.00 support objective.

Despite the implication that Monday’s pessimistic GDP data may lead to even more stimulus measures than have already been implemented or announced, the Japanese yen was not significantly affected by the economic data release. While the yen should have been pressured considerably by the specter of more stimulus actions and potential interest rate cuts further into negative territory, the perception remains that Japan may be running out of options to help prop up its economy and weaken its currency. Therefore, even a very poor GDP reading was unable to faze the persistently strong yen.

Meanwhile, the US dollar has continued to struggle as bets on a Fed rate hike this year have progressively diminished. Lower expectations of a US rate hike have been prompted by an overwhelming trend of global monetary easing by major central banks, as well as some very recent US data that has shown some unexpected weakness. Last week’s US retail sales, Producer Price Index (a key inflation indicator), and consumer sentiment data all surprised significantly to the downside.

This combination of a very resilient Japanese yen and lagging US dollar has served to pressure USD/JPY back down towards major psychological support around the 100.00 level. As long as markets continue to bet against a Fed rate hike anytime soon and the yen continues to ignore Japan’s efforts to weaken it, USD/JPY could have significantly further to fall. With any breakdown below the noted 100.00 psychological support level, the currency pair could drop down to its post-Brexit low just below 99.00. In turn, a breakdown below that low would confirm a continuation of the long-term downtrend, with the next major downside target around the 97.00 support objective.

Latest market news

Today 02:05 PM