Headline consumer prices rose by 1.3%, higher than the 1% expected by economists taking the annual inflation rate to 3.5%. The trimmed mean or core inflation (the RBA’s preferred gauge of inflation) rose by 1%, taking the annual rate to 2.6% y/y, its highest level since Q3 2008.

Notably, the annual rate of core inflation is now above the mid-point of the RBA’s target 2-3% band for the first time since mid-2014, an indication inflation is sustainably higher.

As expected, the rise in inflation was driven by the rising costs of new dwelling construction and a rise in petrol prices, which together accounted for almost half of the quarterly increase in CPI.

While some of the rise in inflation was related to Covid disruptions, the higher starting point means that should the RBA see wages inflation growth accelerate as expected by the middle of the year, a rate hike in the second half of 2022 is becoming increasingly likely. More so given last week's robust employment data that saw the unemployment rate fall to 4.2%.

The prospect of higher interest rates boosted the AUDUSD from .7150 pre the data up to a high of .7175. However, with risk assets including the ASX200 and US equity futures trading heavily during the session, there has been little in the way of follow-through buying.

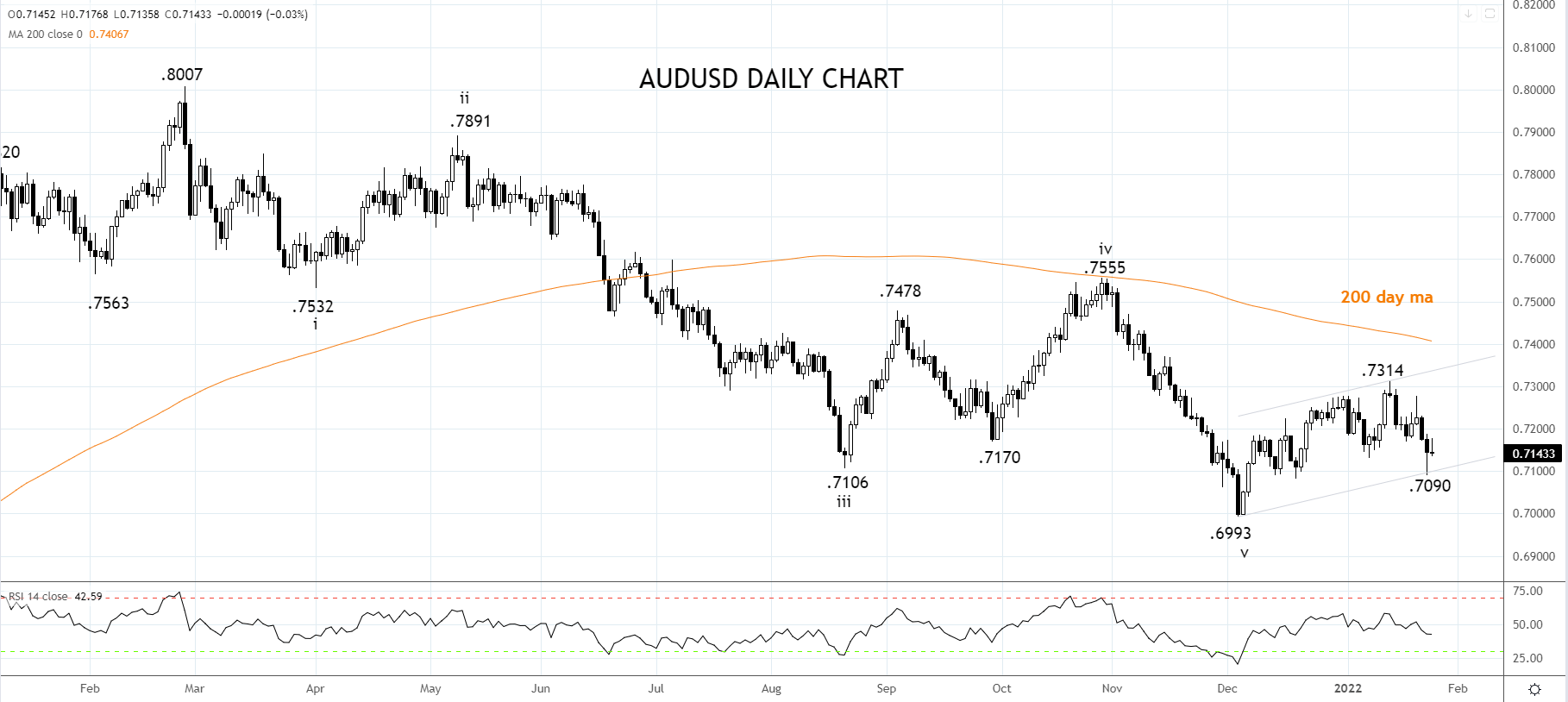

Technically the preferred view is that the AUDUSD has completed a medium-term low at .6993 and can continue to grind higher within the trend channel below in the coming weeks towards .7400c.

Source Tradingview. The figures stated areas of January 25th, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.