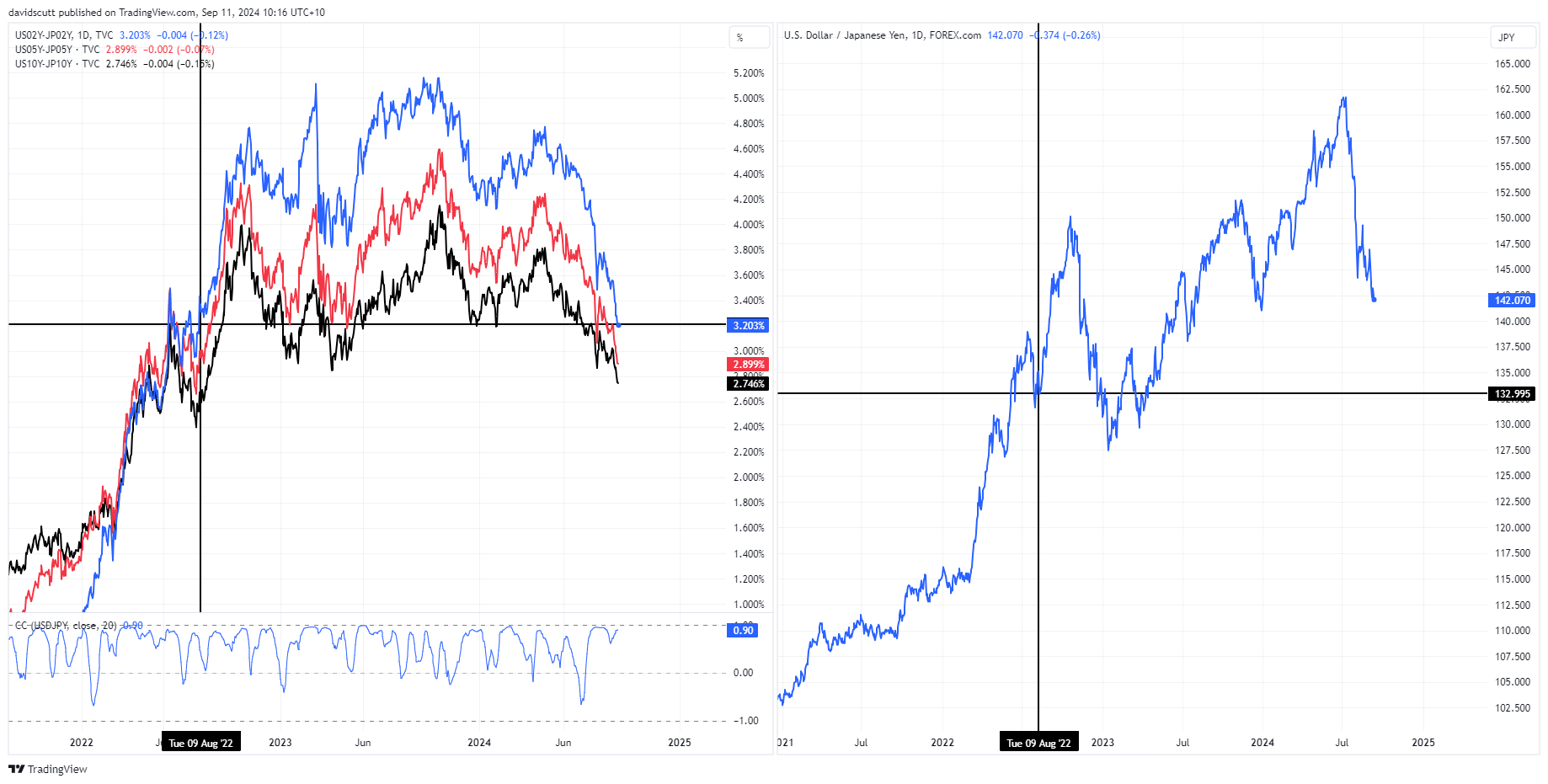

- Yield spreads between US and Japanese 2, 5 and 10-year debt fall to fresh cyclical lows

- Based purely on yield differentials, USD/JPY looks expensive

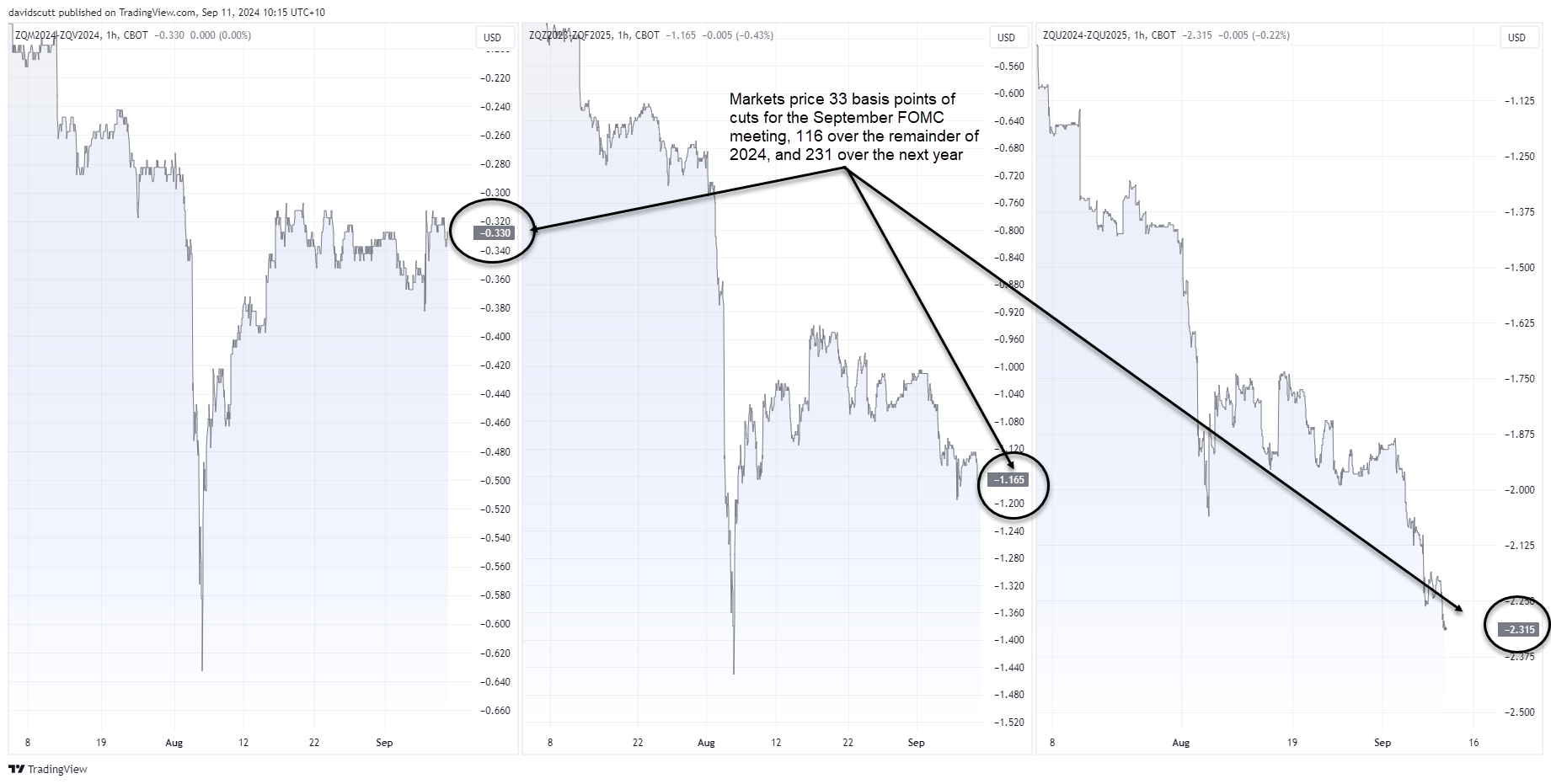

- Markets price in nine Fed rate cuts over the next year, returning to levels the Fed believe are neutral for unemployment and inflation

- If the need to stimulate the economy grows, the Fed may cut even more aggressively

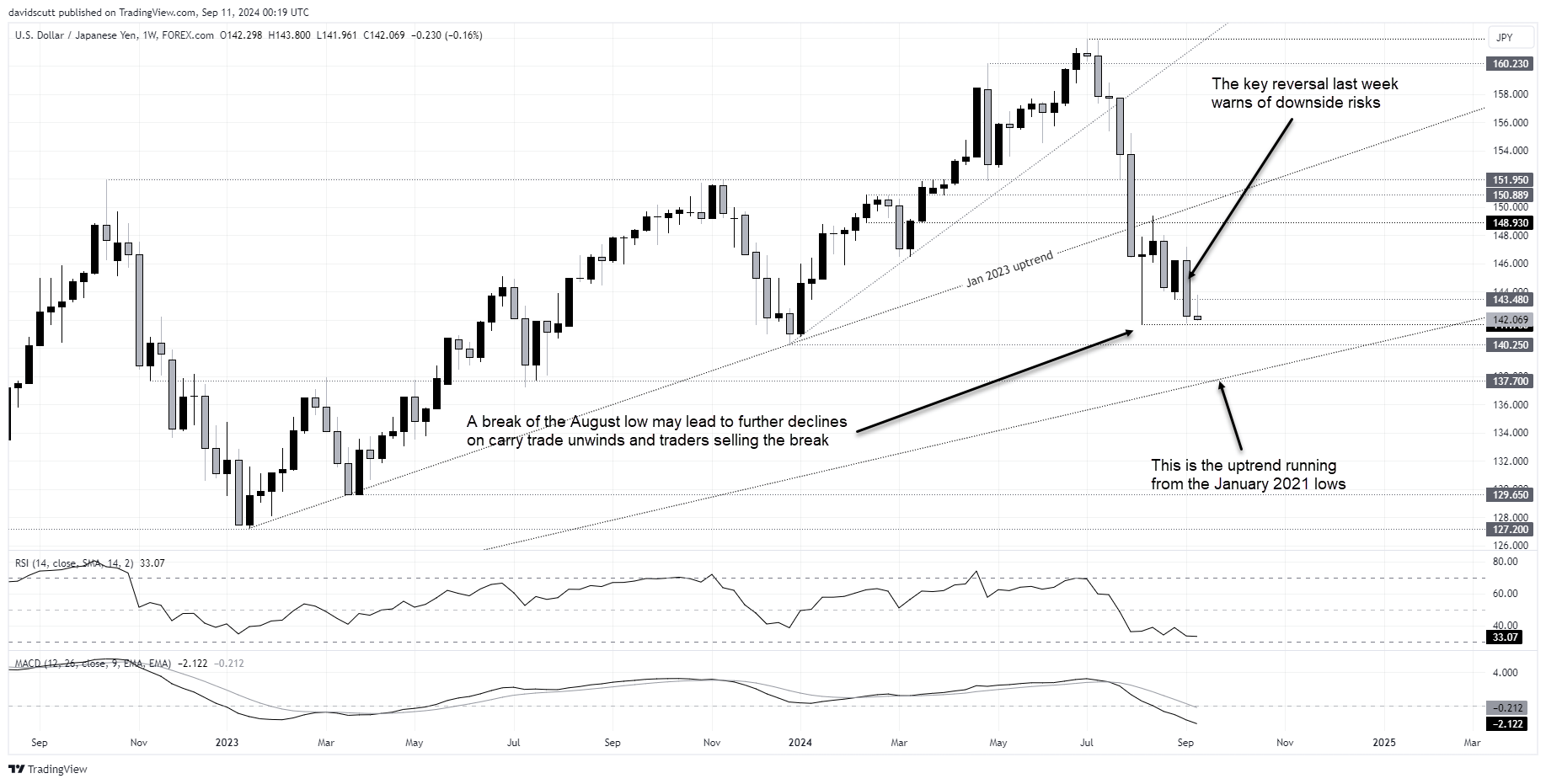

- USD/JPY eyeing 2021 uptrend test

Overview

With yield differentials between the United States and Japan compressing to multi-year lows across multiple tenors, you have to wonder whether it may spark a fresh round of forced carry trade unwinds in USD/JPY as seen in early August?

Because unless we see a significant hawkish shift in the US interest rate outlook akin to that witnessed earlier this year, or an unlikely surge in asset values from already historically elevated levels, it suggests directional risks for USD/JPY remain skewed to the downside.

USD/JPY looks elevated relative to yield spreads

From a purely interest rate differential perspective, USD/JPY looks overvalued at current levels even with the recent unwind from above 160.

The left-hand pane on the chart above shows the spread between US and Japanese 2 (blue), 5 (red) and benchmark 10-year (black) bond yields, revealing that after a further decline on Tuesday, each sits at lows not seen since around August 2022. The bottom pane is the rolling 20-day correlation USD/JPY has had with two-year yield spreads, underlining the strong relationship the two have right now.

To the right, it’s simply the USD/JPY daily chart marked with where the pair was trading around when spreads were last at these levels. Clearly, around 142, the pair remains well above the levels seen back then.

While yield differentials are not the only factor to consider, with trade flows along with asset valuations important, you can’t ignore that the lure of higher interest rates in the United States for those borrowing in yen is starting to wane. That contributed to the large decline in USD/JPY in early August and it could easily do so again as spreads have compressed even further.

Fed pricing aggressive for a reason

Looking quickly at the US interest rate outlook, 33 basis points of cuts are priced into the Fed funds futures curve for September, implying around a one in three chance of a 50 being delivered. Over the remaining three FOMC meetings of 2024, 116.5 basis points are priced. Over the next year which captures eight Fed meetings, 231.5 basis points are expected.

It’s an aggressive profile, no doubt, but even with the amount of rate cuts priced over the next year, it would only get the funds rate back to around the levels where the Fed believes will keep inflation and unemployment steady. While a theoretical level, the read-through is that if the Fed believes the economy needs outright stimulation, it could cut even harder than markets imply.

The Fed is highly unlikely to signal that in its updated dot plot at the September FOMC meeting because it would only act to stoke recession fears, but it will likely signal more rate cuts than the median projection of five out to the end of 2025 provided three months ago. That may help to keep downward pressure on spreads as markets have tended to overstate Fed projections in anticipation of this easing cycle.

USD/JPY breaking bullish uptrend

USD/JPY on the weekly chart looks increasingly shaky for long-term bulls, breaking uptrend after uptrend in recent months, leaving only the January 2021 trendline to go. In between, 141.70 is the first downside level of note, marking the low struck in early August. If it were to go, 140.25, the January 2021 uptrend and 137.70 are the next levels of note. The key reversal candle last week warns of growing downside risks.

If we were to see a bounce, 143.80 may encounter resistance. Last week’s high around 147.20 is another, although it would need a major turnaround in market pricing for the Fed.

-- Written by David Scutt

Follow David on Twitter @scutty