- New Zealand labour data for Q3 was soft

- Forward indicators on wage growth deteriorated

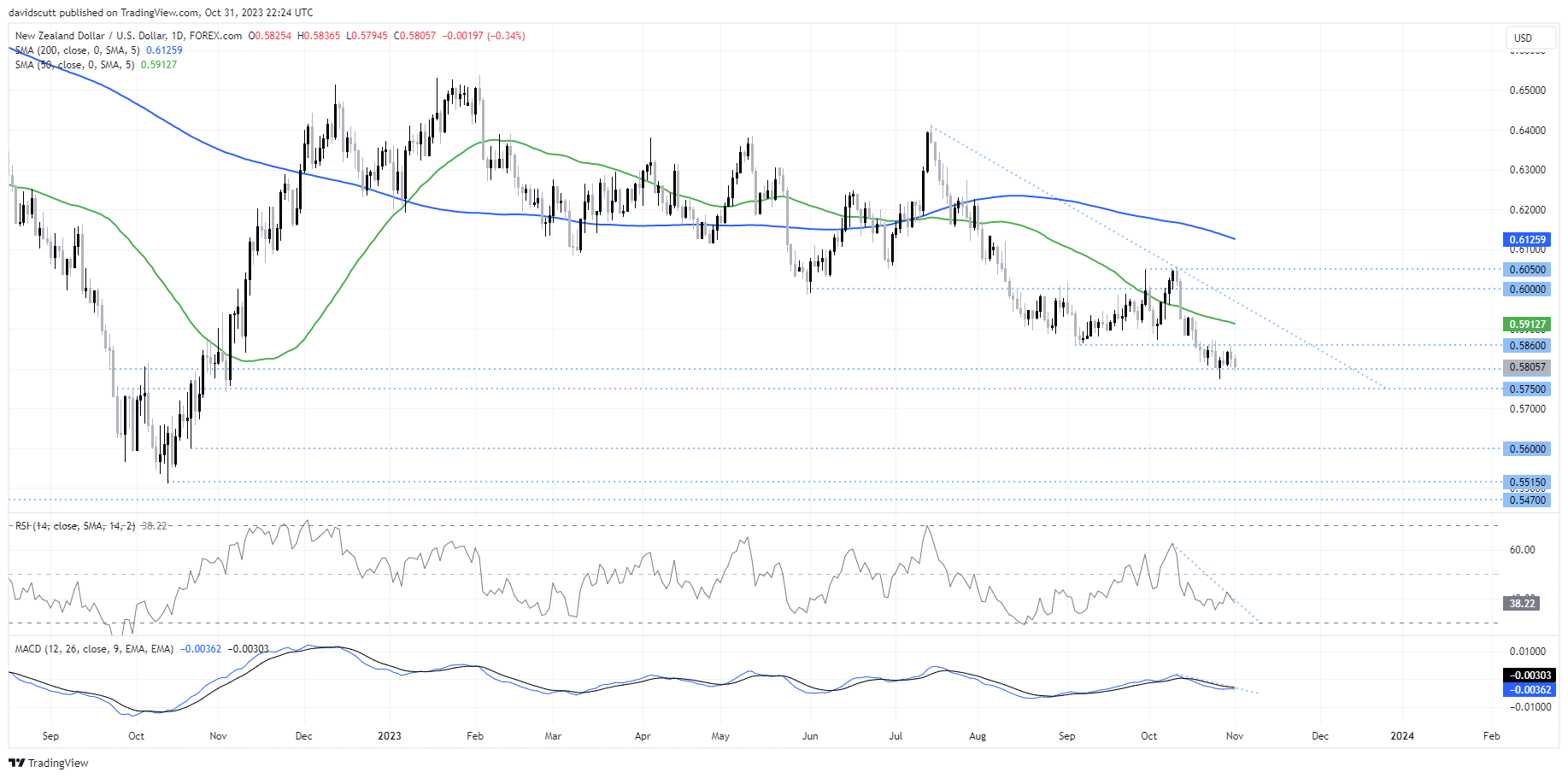

- NZD/USD remains near 2023 lows

NZD/USD is falling in the wake of a soft New Zealand employment report, reinforcing the view that when the Reserve bank of New Zealand (RBNZ) next moves interest rates, it’s far more likely to be a cut than hike.

NZD/USD hit by soft jobs report

Employment grew 0.2%, half the pace expected, while private sector wages ex overtime undershot forecasts by two-tenths, rising 0.8%. While unemployment held steady at 3.9%, that largely reflected disappointing labour force participation which came in a 0.5 percentage points below forecast at 72%.

While wage growth remains strong, lead indicators continue to soften with the nation’s underutilisation rate jumping to 10.4%, up 0.5 percentage points on three months earlier. It’s now increased by a full percentage point over the past 12 month, reflecting sluggish economic conditions and the reopening of New Zealand’s international border.

Outlook for wages weakening

Underutilisation combines unemployment and underemployment to provide a broader indication as to the degree of labour market slack that exists. It typically has an inverse relationship to wage pressures, pointing to softer wage outcomes looking ahead.

“A loosening in the labour market is key in tackling inflation,” said Mary Jo Vergara, Senior Economist at Kiwi Bank. “The RBNZ should take comfort in today's employment data coming in softer than their expectations. And as such, is further evidence that no more rate hikes are needed. Monetary policy is working.”

While today’s report bolsters the case for the RBNZ to be on hold for the foreseeable future, that’s not exactly news to markets, meaning external factors are playing a far greater role in determining fluctuations in NZD/USD.

NZD/USD technical setup

Looking at the daily, NZD/USD continues to attract bids from .5800 and offers from .5860, a range it’s been stuck on for the past fortnight. With the USD looking strong right now thanks to robust domestic economic data and weakness in the Japanese yen following the BOJ interest rate decision on Tuesday, the pair has every excuse to move lower in the near-term. However, if we don’t see downside in this type of environment, it’s a strong signal on where the medium-term directional risks may lie.

Below the current range, a successful break of .5750 may open a push towards .5600. On the topside, the pair has a done a bit of work around .5950 previously but there’s no major visible resistance until you get back to .6000. For now, RSI and MACD suggest momentum remains to the downside, although the latter looks like it may crossover the signal line in the near-future.

-- Written by David Scutt

Follow David on Twitter @scutty