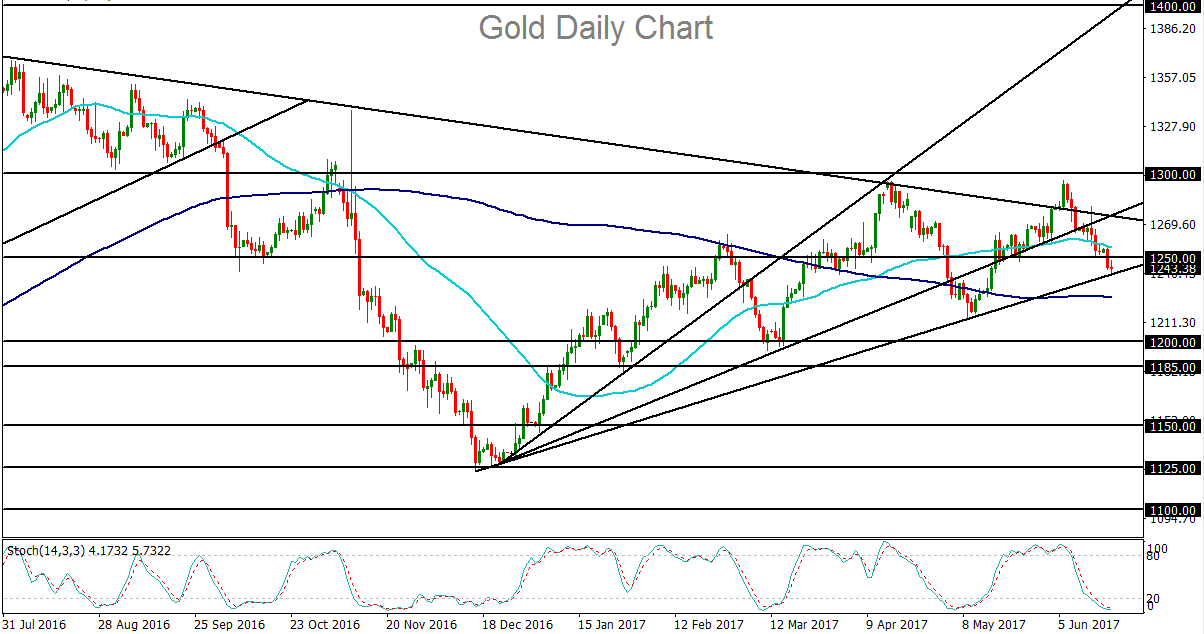

The price of gold has been heavily pressured for the past two weeks as commodity prices have generally slumped, the Federal Reserve has signaled more rate hikes, the US dollar has staged a significant relief rebound, and persistent risk appetite in the markets has decreased demand for safety assets like gold. This confluence of factors weighing on the precious metal has pushed price down to a key uptrend support line extending back to the December lows.

As a non-yielding, dollar-denominated, safe-haven instrument, gold has understandably fallen under the weight of current market dynamics, resulting in the sharp pullback since early June. This pullback brought price down from a failed approach/re-test of the key $1300 price area to its current breakdown below the $1250 previous support level. Despite this pullback, however, the general year-to-date uptrend is still intact – for the time being. This would likely change if a breakdown below the noted uptrend line occurs.

With sustained Fed hawkishness propping up further rate hike expectations, the dollar remains well-supported while gold remains pressured. Additionally, as complacent equity markets continue to fluctuate in progressively loftier record-high territory, gold demand could continue to suffer in the absence of any major risk concerns. Within this current market environment, the price of gold has the potential to break down further. In the event of such a breakdown below the noted trend line support, the next major downside target is around the $1215 price area, which represents May’s lows, followed by the key $1200 psychological support level.

As a non-yielding, dollar-denominated, safe-haven instrument, gold has understandably fallen under the weight of current market dynamics, resulting in the sharp pullback since early June. This pullback brought price down from a failed approach/re-test of the key $1300 price area to its current breakdown below the $1250 previous support level. Despite this pullback, however, the general year-to-date uptrend is still intact – for the time being. This would likely change if a breakdown below the noted uptrend line occurs.

With sustained Fed hawkishness propping up further rate hike expectations, the dollar remains well-supported while gold remains pressured. Additionally, as complacent equity markets continue to fluctuate in progressively loftier record-high territory, gold demand could continue to suffer in the absence of any major risk concerns. Within this current market environment, the price of gold has the potential to break down further. In the event of such a breakdown below the noted trend line support, the next major downside target is around the $1215 price area, which represents May’s lows, followed by the key $1200 psychological support level.

Latest market news

Today 02:05 PM