Since pulling back from its new 18-month high at 131.39 early this month, EUR/JPY has spent the past three weeks exhibiting the potential pattern of a new bearish trend, complete with lower highs and lower lows, as well as sharp drops interspersed with relatively weaker pullback rallies. Currently trading within one of those relatively weak pullback rallies, EUR/JPY could be poised to extend its recent breakdown, especially if the euro’s latest stumble and yen’s recent strength resume as expected.

Last week, the euro extended its recent pullback against other currencies after the release of minutes from July’s European Central Bank policy meeting, in which concerns were expressed over the possibility of the common currency “overshooting.” At the same time, elevated geopolitical risk conditions in recent weeks have also boosted the Japanese yen, which typically sees increased demand during times of heightened risk aversion.

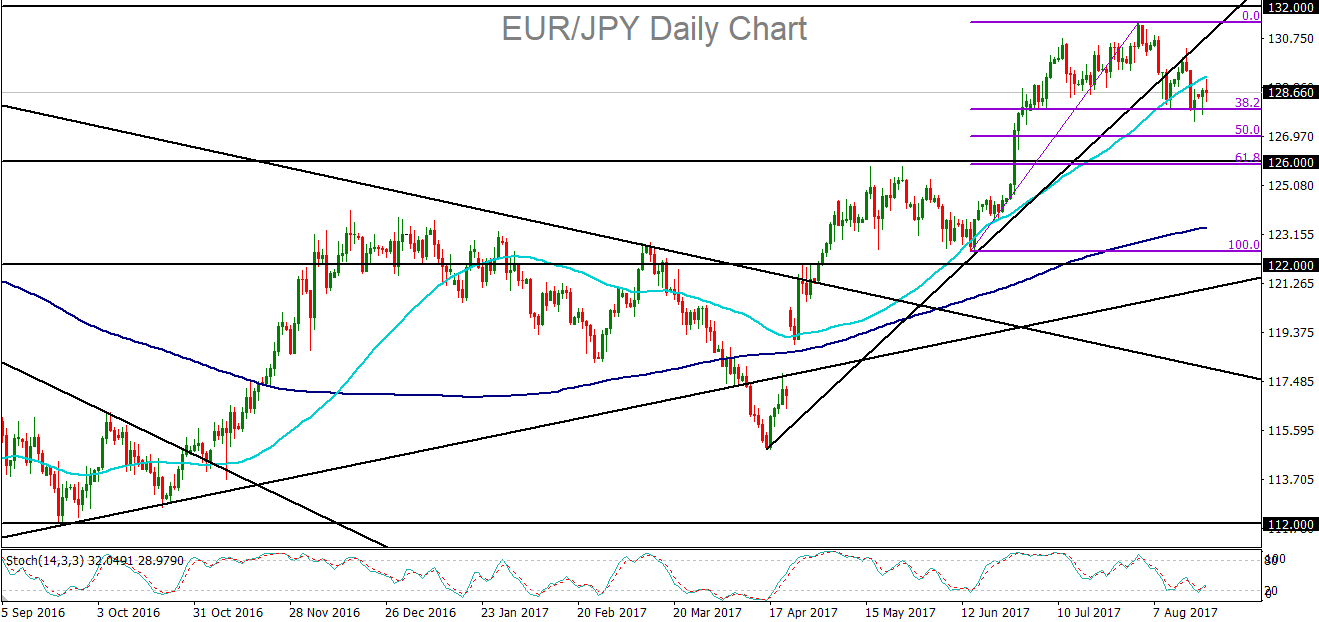

Combined, these dynamics have helped to shift the trend in a bearish manner for the previously rallying EUR/JPY currency pair. Less than two weeks ago, EUR/JPY made a tentative breakdown below a key uptrend line representing the sharp 4-month bullish trend that launched from the April 115.00-area lows. After the trendline breakdown, price rebounded to re-test the underside of the trendline before falling once again after the ECB release.

Most recently, the currency pair has once again risen weakly in a modest pullback rally, forming yet another possible bearish flag pattern, and could be poised to break down to lower lows in line with the prevailing bearish turn in the trend. Now sitting just above a key 38.2% Fibonacci retracement level, a breakdown below this support could pressure EUR/JPY to target the next major downside objective at the key 126.00 support level, which also represents a major 61.8% Fibonacci retracement.