Gold prices have been battered relentlessly for more than three weeks as the US dollar has generally been rising in recovery mode from its long-term lows, expectations for a Fed rate hike in December have increased, and markets have failed to be daunted by recent geopolitical risk events and conditions. These three factors have weighed heavily on the dollar-denominated, non-yielding, safe-haven asset, pressuring the price of gold well below the $1300 handle. Even further nuclear missile threats from North Korea in recent weeks have been unable to prompt any sustained support for the precious metal. The balance of this week features major economic data releases from the US that are likely to impact gold significantly, whether to extend its slide or possibly spark a relief rally.

Earlier in the week, Monday’s ISM manufacturing PMI release already showed a substantially better reading than expected for September at 60.8 against the prior consensus forecast of 57.9. Wednesday will bring an even more critical release in the ISM non-manufacturing (services) PMI, which is expected to come in at 55.5 for September. Also on Wednesday will be the ADP non-farm private sector employment report, which serves as a precursor to the official non-farm payrolls report released by the US Labor Department. ADP for September is expected to come out at around +151,000 jobs. Fed Chair Janet Yellen will additionally be speaking publicly at a conference on Wednesday, followed by speeches from other key Fed members on Thursday.

On Friday, of course, will be the heavily-anticipated US jobs report featuring the official non-farm payrolls data, wage growth numbers, and the unemployment rate. As it currently stands, due to the negative economic impact on several southern US states from a series of recent hurricanes, expectations for job growth in September are sharply lower than they would otherwise have been. The current consensus forecast stands at a relatively slim 88,000 jobs added. Because these expectations are so low compared to previous months, an upside surprise could be likelier than would normally be the case. Monthly wage growth in the form of average hourly earnings is expected to have risen by 0.3%, and the unemployment rate is expected to have remained steady from the previous month at 4.4%.

As noted, US manufacturing data earlier this week tentatively painted an optimistic picture of the US economy, at least the manufacturing sector. If the impending data later this week continue this momentum, the US dollar is highly likely to receive a further boost in its recovery and gold should be pressured further. Of course, any major disappointments in the data would be likely to prompt a relief rally for gold as the dollar potentially becomes pressured once again.

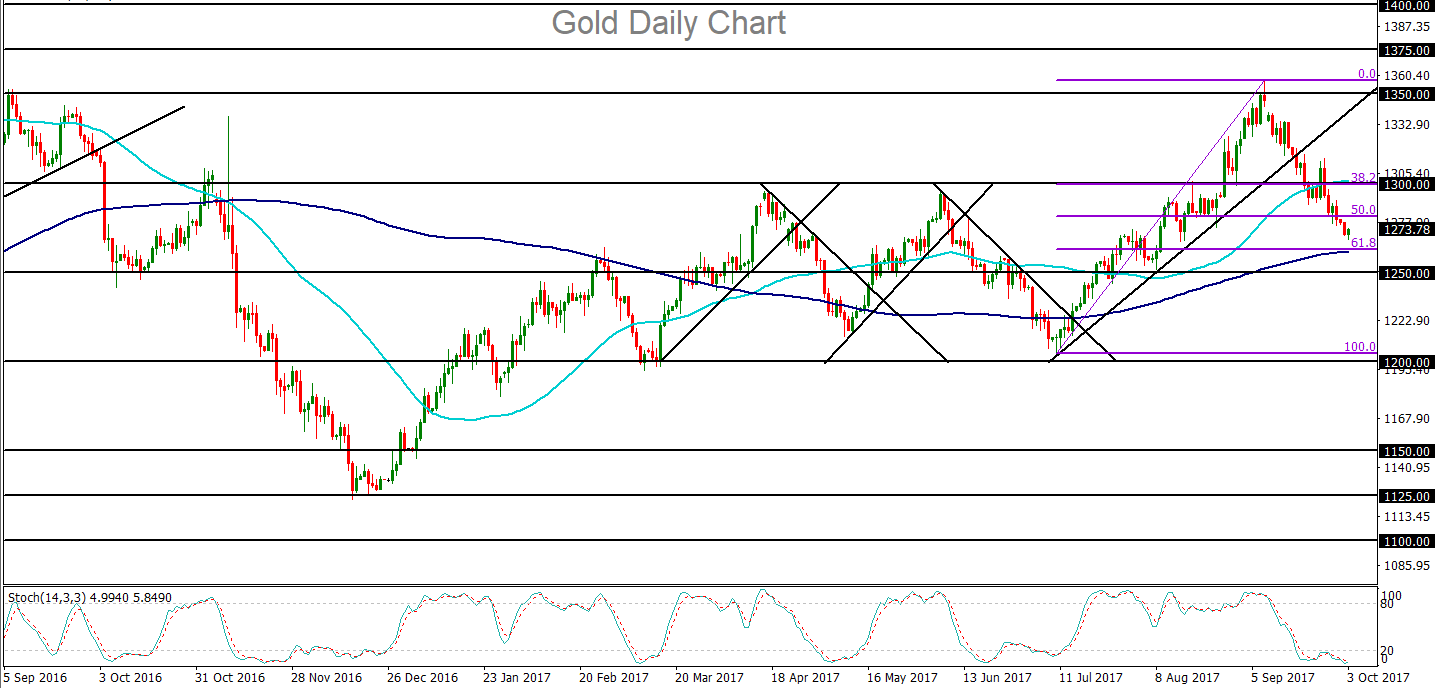

From a technical perspective, the price of gold is showing a clearly bearish chart with recent breakdowns below major support levels, most notably the key $1300 level. Currently, the slide is heading for support at both the 200-day moving average and the 62% Fibonacci retracement of the uptrend from early July to early September. That confluence of support is currently around the $1263 level. Of course, near-term price movement will be driven largely by this week’s US data, along with any surprise geopolitical events that may potentially arise. With better-than-expected data this week, the price of gold could break support and extend its fall towards key targets around $1250 and possibly $1215. Any relief rally for gold on worse-than-expected data will likely lead to a boost back up towards the key $1300 level.