- Fed chair Jerome Powell says the US is back on a ‘disinflation path’

- Greater chance of near-term rate cuts improves odds of delivering a soft landing

- Market volumes likely to drop substantially ahead of US Independence Day

- NZD/USD may see some upside given the current environment

Signs pointing to NZD/USD upside?

Having broken downtrend resistance after logging another failure below the 200-day moving average, NZD/USD may see upside in the near-term as trading volumes thin out ahead of US Independence Day holiday.

With Jerome Powell reigniting Fed rate cut hopes on Tuesday by suggesting the United States was back on a disinflation path after some hot inflation prints earlier in the year, it’s difficult to see risk appetite faltering dramatically in the absence of an unexpected negative event, pointing to a rare window for high beta currency names such as the Kiwi to strengthen.

Disinflation focus shifts event risk

While there are major risk events to navigate over the remainder of the week, including the ISM non-manufacturing PMI later today and non-farm payrolls on Friday, with the focus now back on disinflation, it would have to take some incredibly strong data to make a meaningful mark on interest rates markets, especially given continued signs of faltering momentum in the US economy.

The Atlanta Fed’s GDPNowcast model continues to signal slowing growth the more information on the June quarter that comes in, mirroring the trend seen in the first three months of the year. Now, like then, the Nowcast points to the level of growth consistent with a slowdown in hiring rather than upside risk for inflation.

Source: Atlanta Fed

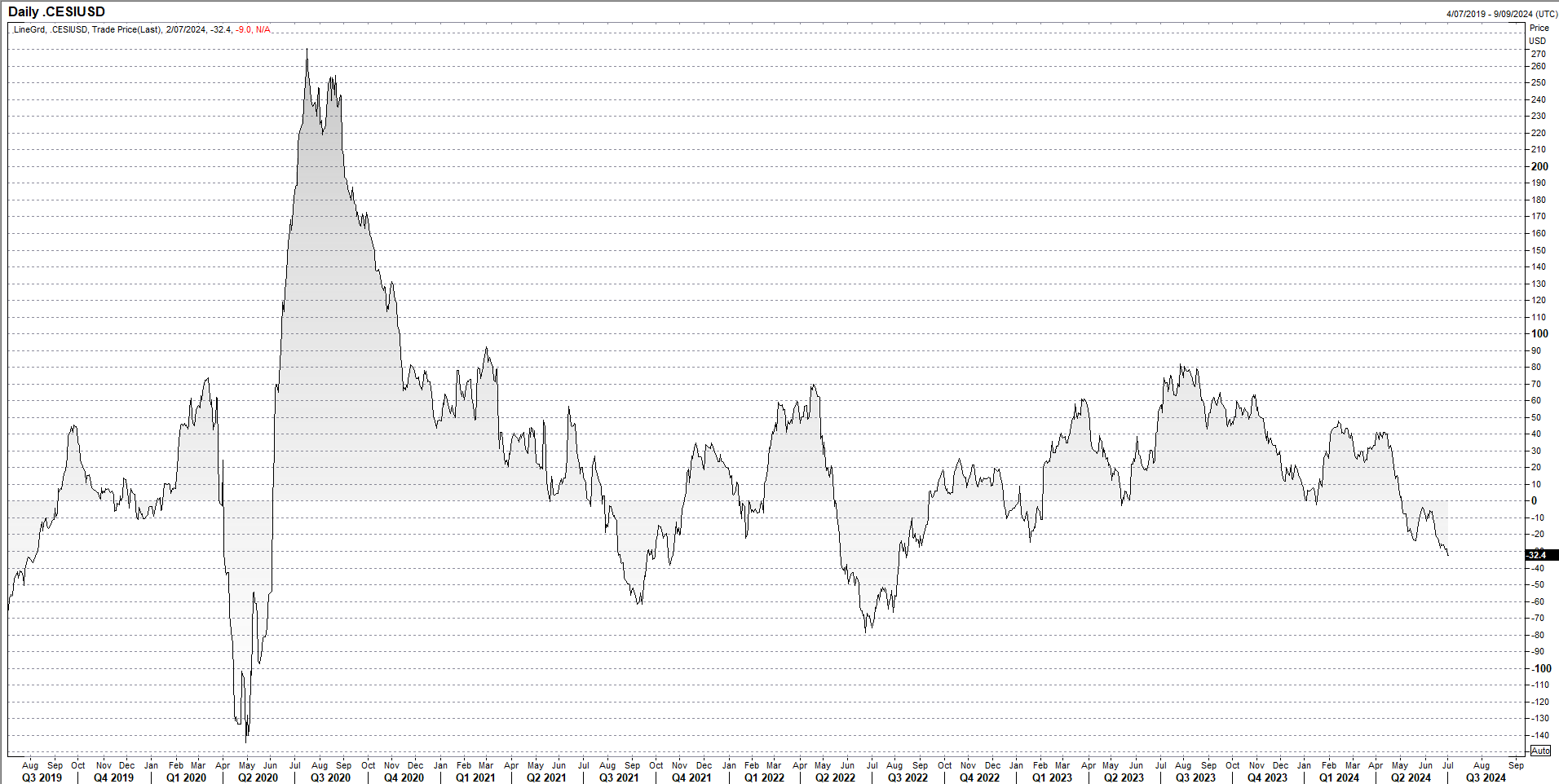

The signal is similar to Citi’s US economic surprise index which continues to move further into negative territory, indicating the proportion of downside surprises is not only higher than upside surprises but increasing in magnitude.

Source: Refinitiv

While there is a risk this could be signaling a more substantive growth slowdown that could generate headwinds for riskier cyclical assets such as the Kiwi, until those fears are backed up by hard data, the soft-landing narrative may provide a risk-positive backdrop for NZD/USD.

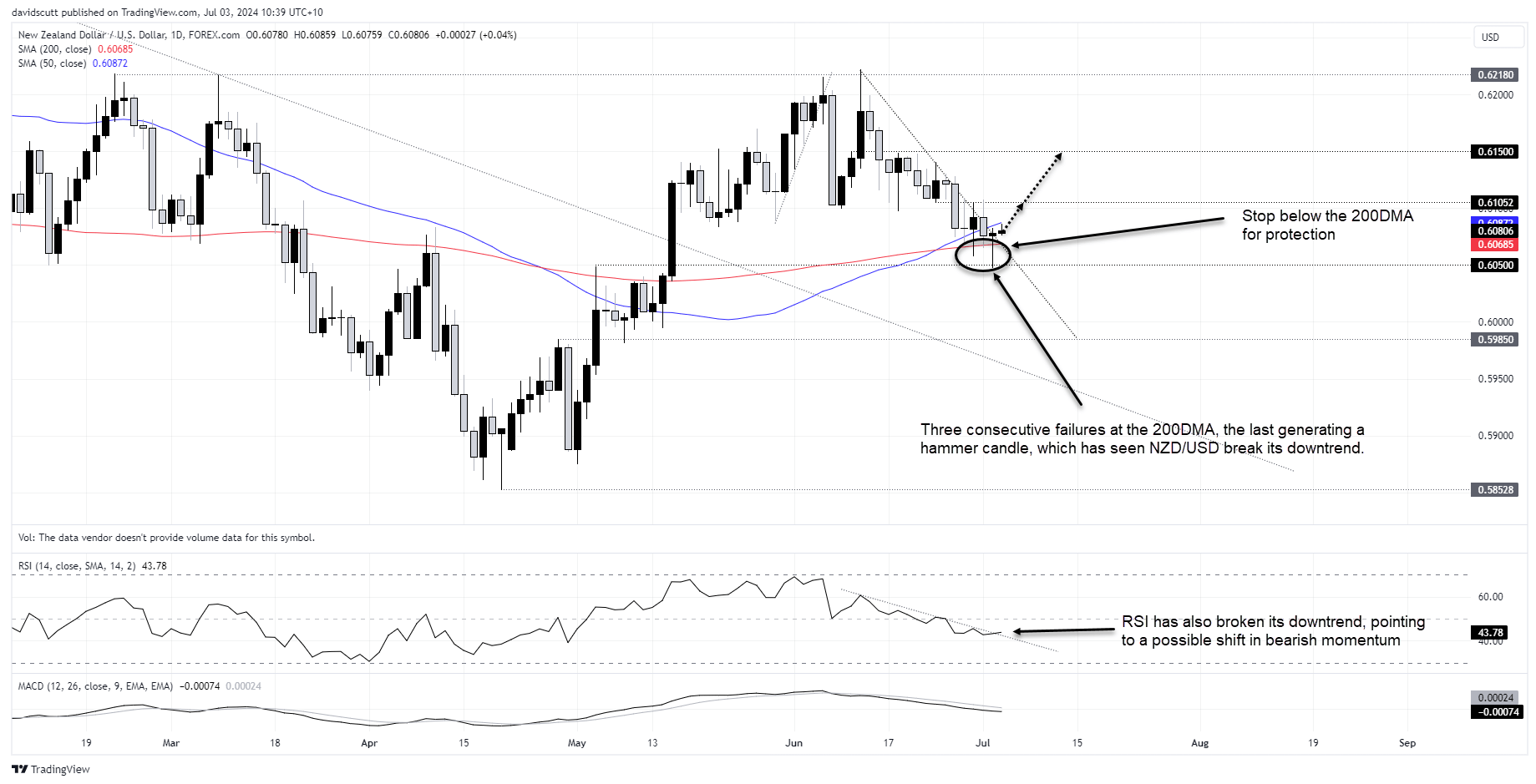

NZD/USD attempting to put in a bottom

Looking at NZD/USD on the daily, you can see Tuesday’s hammer candle that formed after reversing hard from horizontal support at .6050, making it three consecutive tests or failures to break and hold below the 50-day moving average.

The inability to close below this level, combined with the break of the downtrend in price and RSI dating back to June 12, points to a potential shift in directional risks. And with thinning market volumes before the July 4 holiday in the US, the price action combined with a improving backdrop for risk could see NZD/USD go on a run higher.

For those considering taking on the long trade, you could buy around these levels with a stop below the 200-day moving average for protection, targeting a push back to resistance .6150. Between entry and target, the 50-day moving average and minor horizontal resistance at .61052 are two levels to watch. If they were to be broken, considering raising your stop loss order to provide a free hit on upside.

-- Written by David Scutt

Follow David on Twitter @scutty