- Gold moves increasingly driven by US dollar, rates movements

- US dollar, Fed rates expectations highly sensitive to US labour market data

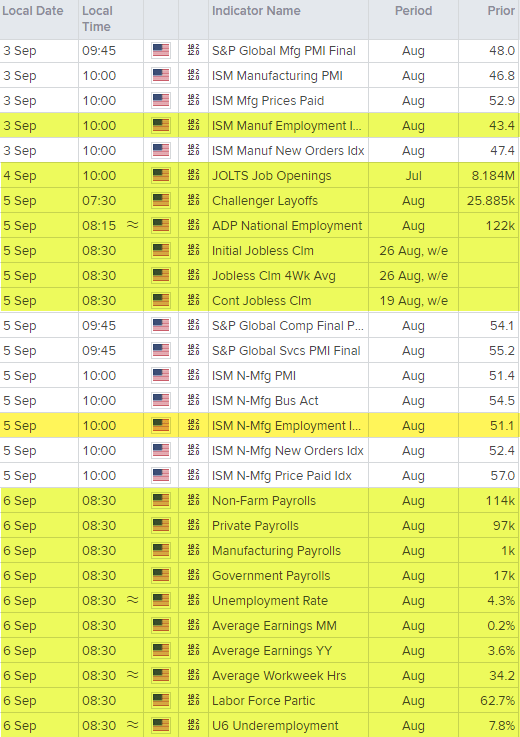

- Nonfarm payrolls, ADP Employment, JOLTS, ISM services data released next week

- Markets continue to price more than 100bps of Fed rate cuts in 2024

Overview

The US dollar and interest rates are back in the driving seat for the gold price, reverting to the long-standing trend after briefly disconnecting earlier this year. Given USD and rates are being driven by speculation over what the Fed may do with rates over the next year, which is largely being determined by labour market data, it means any new information on that front carries the potential to spark big moves in bullion.

Dollar, rates driving gold movements

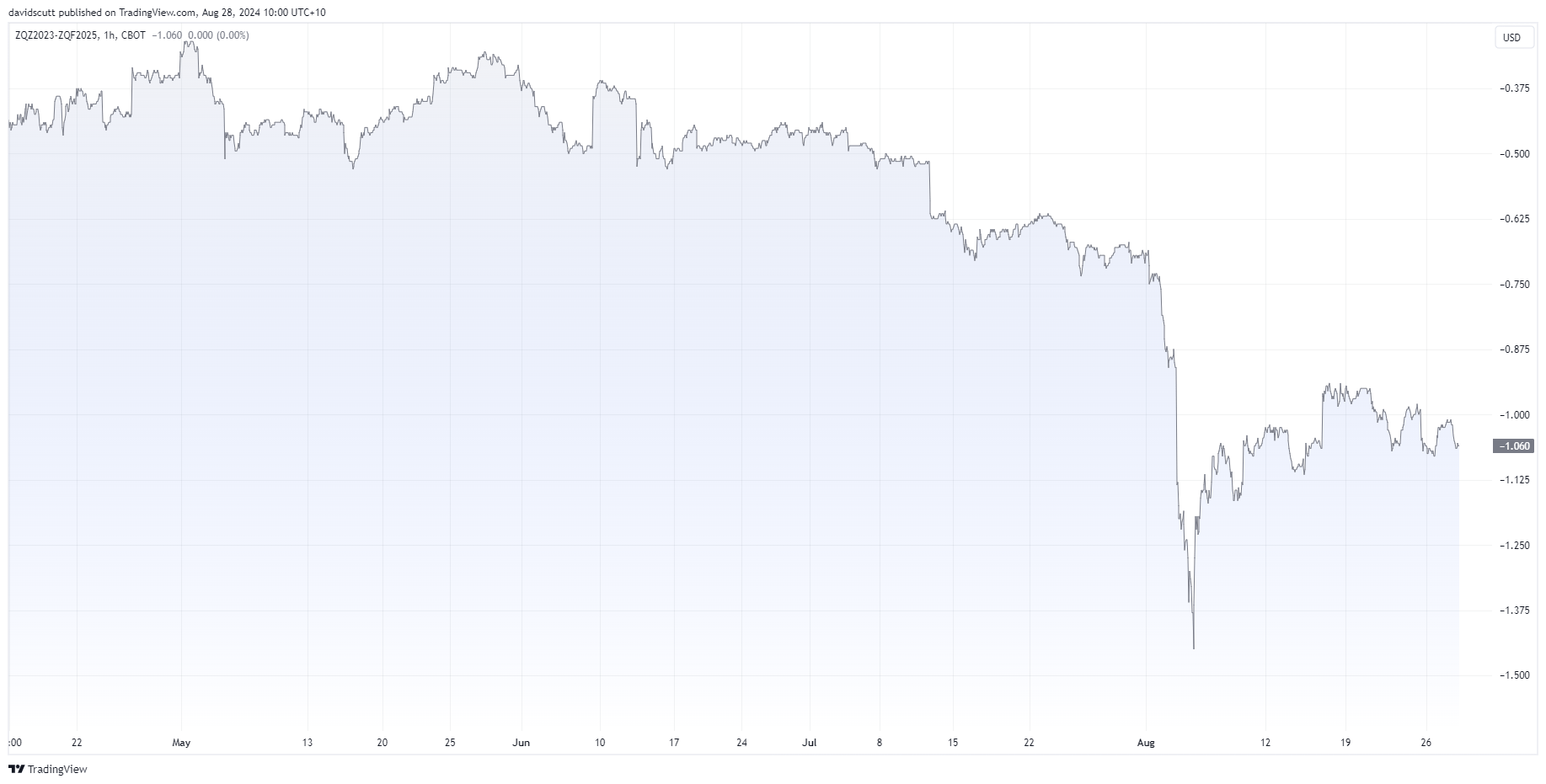

This chart looks at the rolling 60-day daily correlation between gold with a number of variables from FX and interest rate markets, designed to represent the relationship between them over the past quarter.

After disconnecting briefly earlier this year, perhaps due to central bank purchases and heightened geopolitical tensions in the Middle East, gold’s traditional drivers are back dominating proceedings.

Whether you’re looking at the US dollar index (DXY, Fed funds future curve over the remainder of 2024, short or long-dated Treasury yields or benchmark 10-year inflation-adjusted Treasury yields, gold’s movements have become increasingly negatively correlated, indicating that as they have dropped, gold has popped.

And they are being driven by US jobs data

As the dollar and rates expectations are now likely to be heavily influenced by US labour market data after Fed chair Jerome Powell left little doubt that it’s now the main determinant of future monetary policy decisions, it means anyone looking for entry or exit points for gold trades need to be highly attentive to data that could really move the dial.

While this Thursday’s weekly jobless claims series will be treated as one of the most important releases in recent times given a dearth of labour market data this week, the week following is laden with far more important information, headlined by August non-farm payrolls.

I’ve highlighted the figures that may shake the gold market up with all times US eastern daylight.

Source: Refinitiv

Markets price 100bps of Fed rate cuts in 2024

With markets pricing in just over 100 basis points worth of rate cuts from the Fed this year, which would still leave policy in restrictive territory, any signs of further weakening could place further downward pressure on the US dollar and Treasury yields, likely boosting gold unless accompanied by a ramping up of US recession fears. But if the data remains resilient, there’s every chance rate cut bets could be curtailed, likely resulting in the opposite market response.

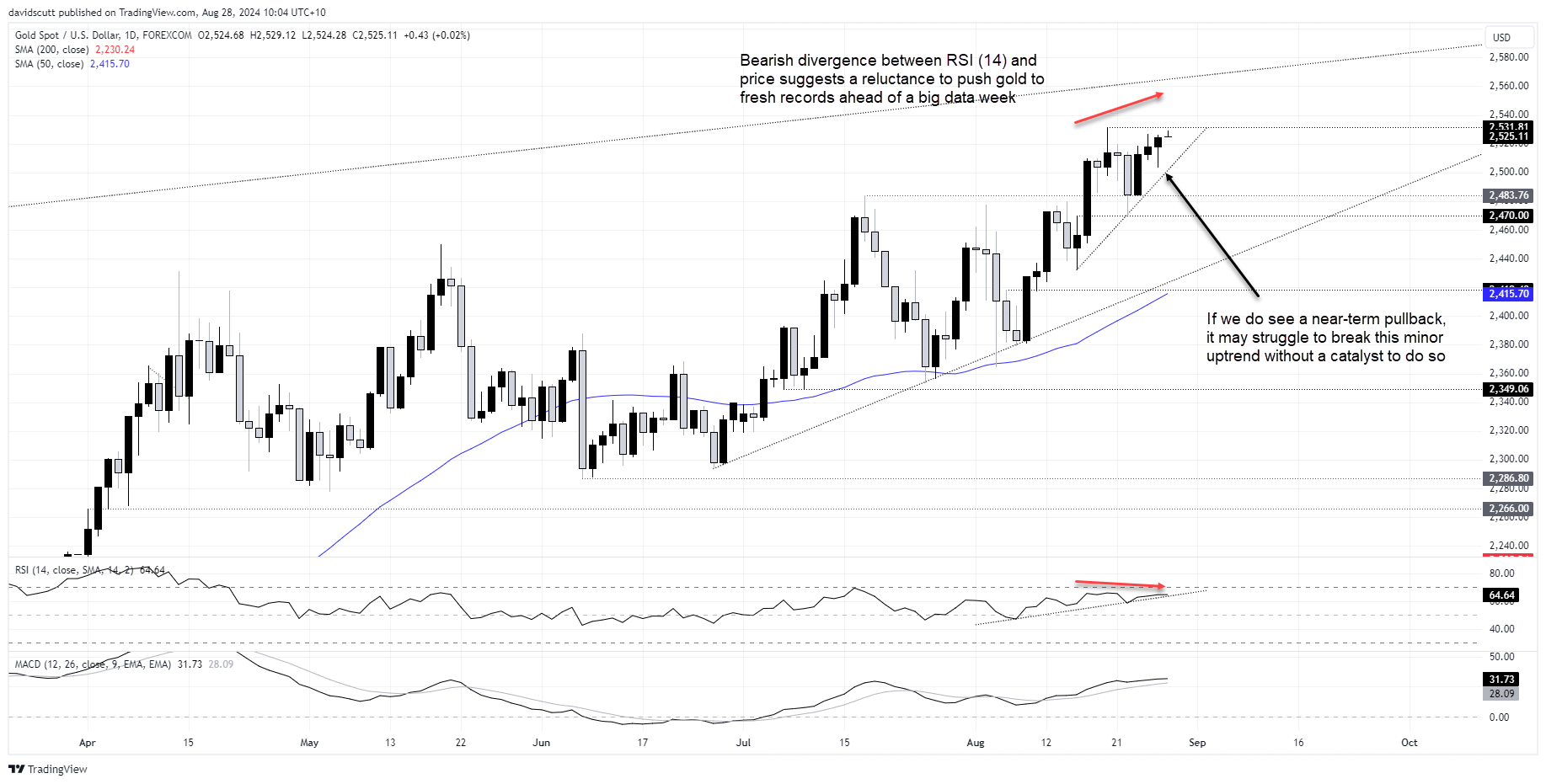

Gold coiling beneath record highs

Looking at gold on the daily chart, Tuesday brought a record close, leaving the price just below the intraday record of $2531.81 set on August 6. The bullish reversal following Jerome Powell’s speech last Friday has set the tone for this week, delivering back-to-back gains.

While MACD and RSI (14) continue to trend higher, making gold a buy-on-dips play in the near-term, there may a degree of reluctance to break above the former highs ahead of jobless claims on Thursday. Bearish divergence between RSI (14) and price suggests there’s waning momentum behind this latest thrust higher, complementing that view.

If we do see a pullback, it’s unlikely to go past the minor uptrend located around $2500 without a major catalyst to do spark it. Nvidia’s earnings could do it, but it has a track record for delivering upside surprises recently, not downside that could spark a major risk-off episode.

If we see the price break above the current record highs and hold there, the price may have a look at a trendline dating back to early 2021 that’s located around $2567. Beyond, big figures have often had a gravitational effect whenever fresh highs have ben been seen.

-- Written by David Scutt

Follow David on Twitter @scutty