Stock market snapshot as of [12/12/2019 3:20 pm]

- Trade matters, or at least the lack of fresh bad news on them, have eclipsed the ECB’s first policy update under president Christine Lagarde. Risk assets are also maintaining a post-Fed updraft. After a brief dip into the red during the ECB’s press conference, European stock markets have resumed a positive tilt and Wall Street also drifted back higher after futures faded a threatened decline

- To be sure, the ECB didn’t offer much that was concrete to react to. The statement was largely identical to the prior one. The year’s inflation forecast edged down to 1.1%; 2020’s edged up to 1.2%. 2019’s growth outlook is unchanged; 2020’s dips to 1% from 1.1%

- The euro did perk up a tad on Lagarde’s press conference comment on signs of an underlying inflation revival, but short-term rate markets were deadpan. Neither dove nor hawk, Lagarde is a self-described “owl”. She confirmed that an ECB strategic review will begin in January

- The FOMC policy statement was similarly uneventful. The most notable takeaways from the Fed events include that policy makers are more resolute in leaving policy alone for all of 2020, amid a “favourable” outlook despite risks. Also, that chair Jerome Powell is considering expanding “not QE” short-term asset buying to include coupon-bearing securities

- Friday, when results of Britain’s general election will be known, still looks to be the day when cross-asset volatility may be most in evidence (though it is most likely to be visible in sterling)

- The pound is making a show of reacting to the rather disparate final polls published whilst mandatory reporting restrictions apply. The Tories will either secure a slightly smaller 44% vote share vs. Labour’s a-bit-higher 33%, or as little as 41% vs. 36%, depending on which poll proves to be accurate, if any

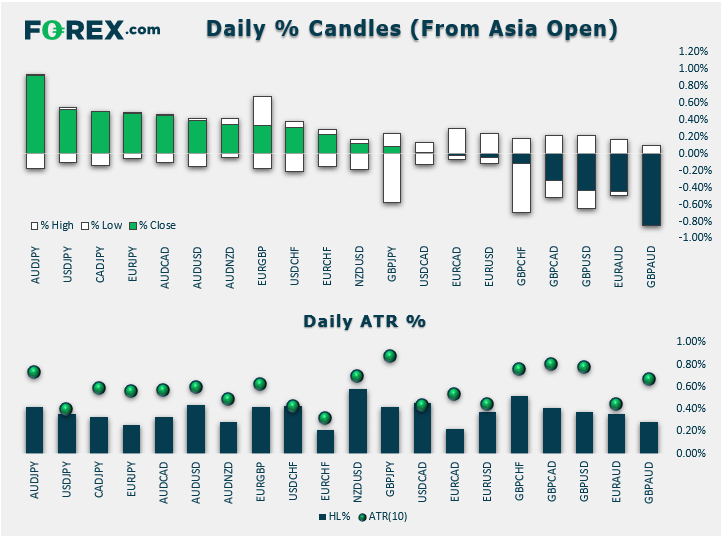

FX snapshot as of [12/12/2019 3:24 pm]

View our guide on how to interpret the FX Dashboard

FX markets and gold

- GBP/USD swept liquidity out from probable stops near this week’s earlier $1.3215 highs. The rate than marked a fresh near 9-month top at $1.3228 before retreating to as low as $1.3115 and then drifting to $1.3174

- Short-term options trading is tight and active. Premiums are elevated with a bias favouring puts. Price action is entirely consistent with that assessment. As such, there’s little point in reading much into price moves before the first hint of an election outcome emerges from early ‘exit polls’ soon after 10 pm GMT

- Elsewhere, the dollar remains under light pressure, though erased an Asia-session decline. 10-year Treasury yields were up 8 basis points to about 1.87% after falling 5bp a day ago

- Aussie was reportedly supported by exporters. AUD/USD is close to its 200-day average as the possible 15th December tariff rise looms. The risk that it could go through and clear some stops isn’t easy to call

- The SNB’s reiterated intervention threat hasn’t exactly echoed. USD/CHF was last at 0.98620. The new winter low is 0.98088

Latest market news

Today 02:05 PM

Today 11:59 AM