Another day, another round of trade war tweets drawing the attention of traders.

To extend the trade war analogy, this morning’s causality was due to friendly fire. In a series of tweets this morning, US President Trump criticized the iconic American manufacturer Harley Davidson, which has shifted some of its production overseas as a result of increased duties.

The motorcycle company is caught between a rock and a hard place. As a global manufacturer, Harley Davidson was already feeling the squeeze from the recently imposed tariffs on steel and aluminum. Now with other nations viewing it as a swing-state target to strike at Trump’s political support, the company faces tariffs on its overseas sales. To make matters worse, the company’s target market is aging and it has struggled to make inroads with younger consumers.

Regardless of what happens with HOG, it appears that traders still haven’t reached a tipping point when it comes to trade war fears. Switching gears to the FX market, one of the best proxies for global trade concerns, and risk appetite in general, is AUD/JPY. Because the Australian economy relies heavily on exporting raw materials (primarily metals), it would be one of the big losers of an escalated, prolonged trade war. Meanwhile, the yen remains one of the premier “safe haven” currencies that traders buy when they feel worried about global economic growth.

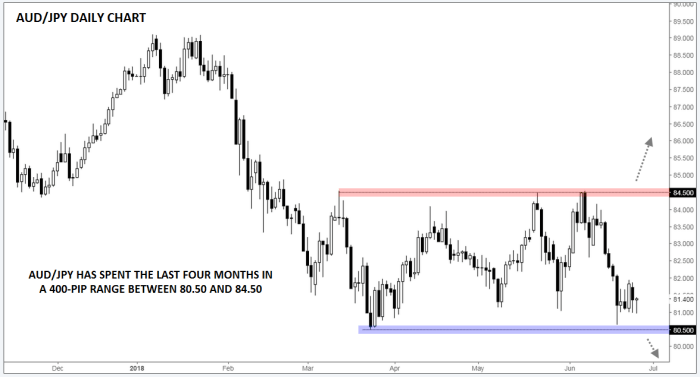

Looking at the chart, AUD/JPY remains trapped within the same 400-pip range that has contained rates for the past four months. The pair continues to see strong support near 80.50, with resistance capping the unit any time it makes a run at 84.50.

If and when the market becomes truly concerned with the budding trade wars having a material impact on global economic growth, we would expect AUD/JPY to slice through 80.50 support, opening the door for a continuation down toward the Q3 2016 support zone near 76.00. Alternatively, if the trade tensions show signs of fading, AUD/JPY could break 84.50 resistance and make a run toward the year-to-date highs up around 89.00 heading into the fall.

Source: TradingView, FOREX.com