Aside from the 2.2% fall in the September quarter, which was bang on expectations and a function of lockdowns in NSW and Vic, the survey showed a sizeable lift in future investment spending plans.

Firm’s spending intentions for the 2021/2022 year increased by 8.6% to $138.6bn from $127.7 bn. The lift in spending intentions bodes well for a strong recovery in GDP after the inevitable lockdown induced September quarter decline, due to be released next Wednesday.

More economic rays of sunshine are expected from Australian retail sales data for October to be released at 11.30 am tomorrow.

Following a 1.3% gain in September, the first increase since May as lockdown took hold over parts of the country, another strong number for October is expected tomorrow.

The market is looking for a 2.5% gain, and this print is likely to be followed by an even stronger lift in November, reflecting the full re-opening in NSW, Victoria, and the ACT.

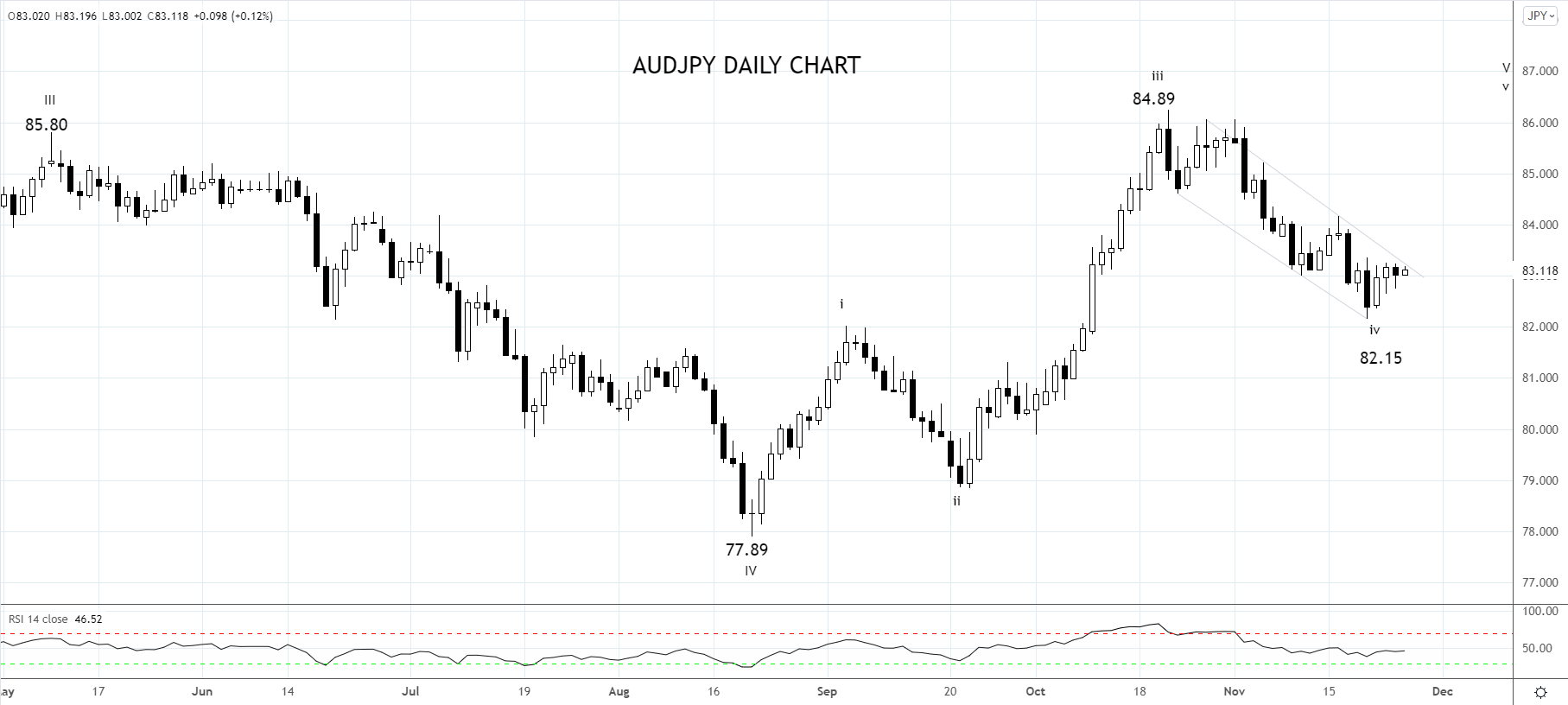

Strong Australian data is unlikely to derail the powerful downtrend for the AUDUSD, so we prefer expressing the expected better retail sales data via AUDJPY.

If AUDJPY can break above downtrend resistance and this week’s highs 83.30/40ish, consider going long the cross looking for the rally to extend towards initial resistance 84.25/50ish before 85.00.

The stop loss should be placed initially below the recent 82.15 swing low, looking to trail it higher, presuming the rally takes hold as expected.

Source Tradingview. The figures stated areas of November 25th, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.