Oil attempts to recover from yesterday’s brutal selloff

- Oil fell over 5% on demand worries

- Gasoline inventories posted the largest build in almost two years

- Oil found support at 83.50

Oil prices are attempting a rebound after falling over 5% in the previous session, wiping out all of September's gains.

Concerns over the macroeconomic outlook and, therefore the demand outlook, as well as a stronger U.S. dollar and the largest builds in gasoline inventories in almost two years, sent oil prices tumbling lower towards $84 a barrel.

The oil market brushed off the OPEC+ meeting's more upbeat outlook towards demand and the prospect of tight supply as the group made no changes to the oil output policy, and Saudi Arabia confirmed it would continue its voluntary cut of 1,000,000 barrels per day until the end of 2023.

The recent rally across the summer in crude oil prices has been on the narrative of tighter supply and the resilient global economy. However, recent U.S. data has shown some signs of the economy cooling which is unnerving the oil market.

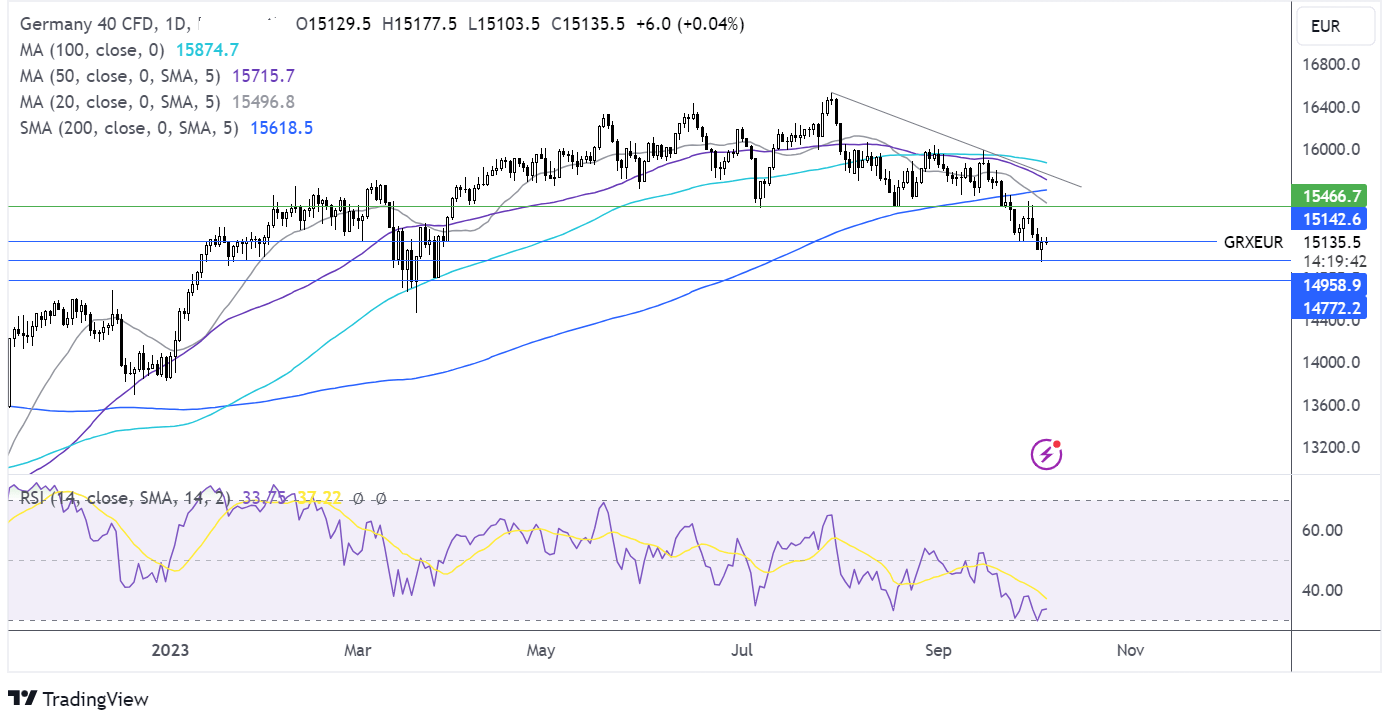

Oil forecast – technical analysis

Oil has fallen sharply across the week, down 7%. The price broke below the 20 sma, the multi-month rising trendline, and the 50 sma before finding support at 83.50, the April high.

Sellers will need to break below 83.50 in order to extend losses towards 82.00, the early April and mid-August high.

Any recovery must rise above the 50 sma at 84.85, which is also the August high. Above here, the rising trendline resistance comes into play at 85.50.

Dax rises as the market mood improves

- Wall Street closed higher after bond yields eased

- German exports fell by more than expected

- DAX tests resistance at 15000

The DAX and its European peers are set to open slightly higher on Thursday, helped by an upbeat finish on Wall Street the day before as the recent surge in the bond yields eased.

A cooler-than-expected US private payroll report on Wednesday saw investors rein in expectations of another rate hike by the Fed this year.

Here in Europe, the German trade balance showed that exports and imports fell by more than expected. German exports dropped -1.2% MoM in August, worse than the 0.4% forecast. The data suggests that trade is no longer a strong growth driver for the German economy. Imports fell 0.4%, defying expectations of a 0.5% rise.

The data comes after mixed data from the eurozone in the previous session, where retail sales fell by 1.2% MoM in August, more than expected, pointing to weak consumer demand as inflation remains high. Meanwhile, the composite PMI, also released on Wednesday, pointed to the eurozone economy most likely contracting in the third quarter putting a recession in the second half of the year as very likely.

Looking ahead, ECB speakers will be in focus and could influence sentiment with any comments regarding the outlook for the economy inflation and the future path of interest rates.

In the US session, jobless claims will be under the spotlight and are expected to rise to 210K, up from 205K. The data comes ahead of tomorrow's key non-farm payroll data.

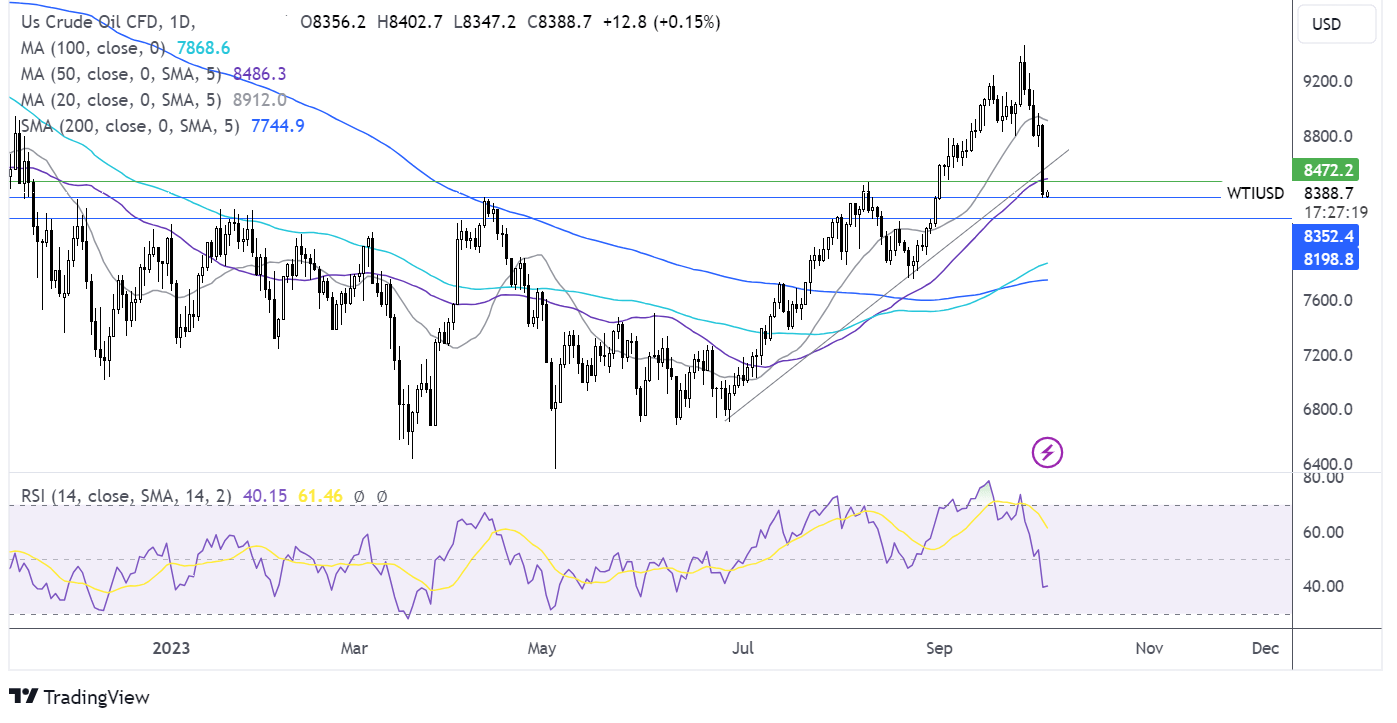

DAX forecast – technical analysis

The DAX has been trending lower, dropping from a peak of 16500 at the end of July to a low of 14945 yesterday.

The price has picked up from the 14945 level. However, the 20 sma crossing over the 200 sma and the RSI below 50 support further downside. Sellers will need to break below 14945 to extend the selloff towards 14775 the March 24 low.

Buyers could be encouraged bny the long lower wick on yesterday’s candle suggesting there was little appetite from sellers at the lower levels. Buyers are testing resistance at 15000 the psychological level, with a rise above here bringing 15465 the August low into focus.