The EUR/GBP managed to bounce back relatively sharply just before the end of last month after receding Brexit fears had exerted strong downward pressure on the cross throughout the month of April. The recovery may have been driven by lingering ‘Brexit’ concerns and recent weakness in UK data, including last week’s Purchasing Managers’ Indices (PMI) which fell across all the three major sectors of the UK economy as caution prevailed ahead of the UK-EU referendum on June 23.

The weakness in UK data has continued at the start of this week. On Monday, the Halifax April House Price Index (HPI) showed a surprisingly large 0.8% month-over-month drop after rising by a downwardly revised 2.2% in March as investors rushed to beat the rise in stamp duty on buy-to-let properties. Today, fresh data has revealed that the UK’s trade deficit widened to an eight-year high of £13.3 billion in the first quarter. Britain’s goods deficit with the European Union was the widest on record in Q1 as the rise in imports (2.3%) more than outpaced the exports increase (1.6%). But despite the overall poor first quarter, March was actually a better month for UK trade as the deficit in goods and services narrowed more than expected. The closely-watched goods trade deficit also narrowed, to £11.2 billion from a downwardly revised deficit of £11.4bn the month before (initially £12bn).

Clearly, Britain relies on imports from the European Union and if it were to actually leave the EU, the costs of inward shipments could rise in the short to medium term which may be passed on to the consumer. Likewise, it could increase the cost for European exporters, chief among them being Germany where there is not only a trade surplus but one which has swelled to a record high in March.

But industrial production in Germany slumped 1.3% in the same month even if – as we found out yesterday – factory orders surged by a much larger than expected 1.9%. The corresponding industrial data from the UK will be released tomorrow and is expected to show a 0.7% month-over-month increase, due mainly to an expected rise of 0.4% in manufacturing production. But for the pound, (Super) Thursday will arguably be the most important day this week for the Bank of England will publish its latest quarterly Inflation Report then and BoE Governor Mark Carney will be speaking at the press conference. Friday will be a particularly important day for the euro because that is when we will have the German and Eurozone first quarter GDP estimates.

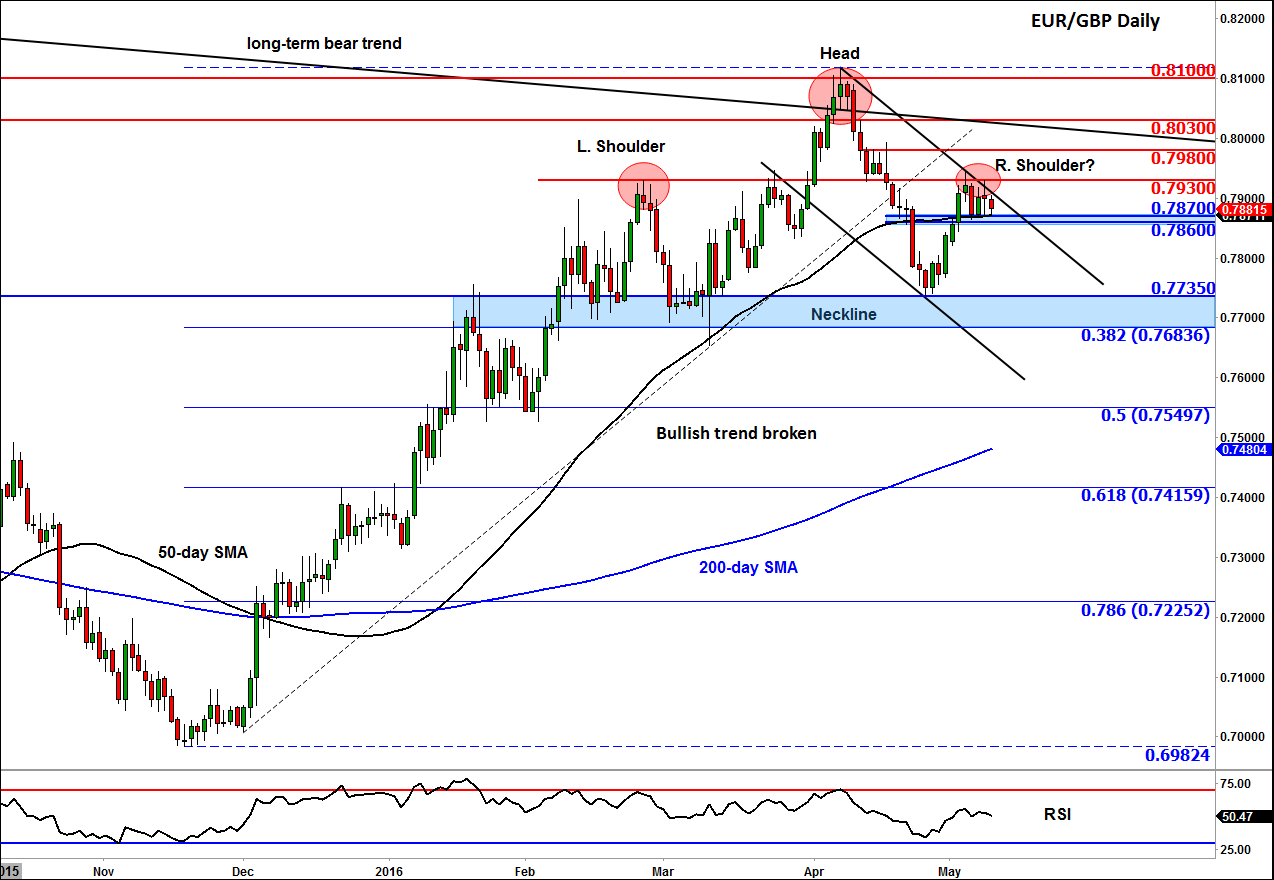

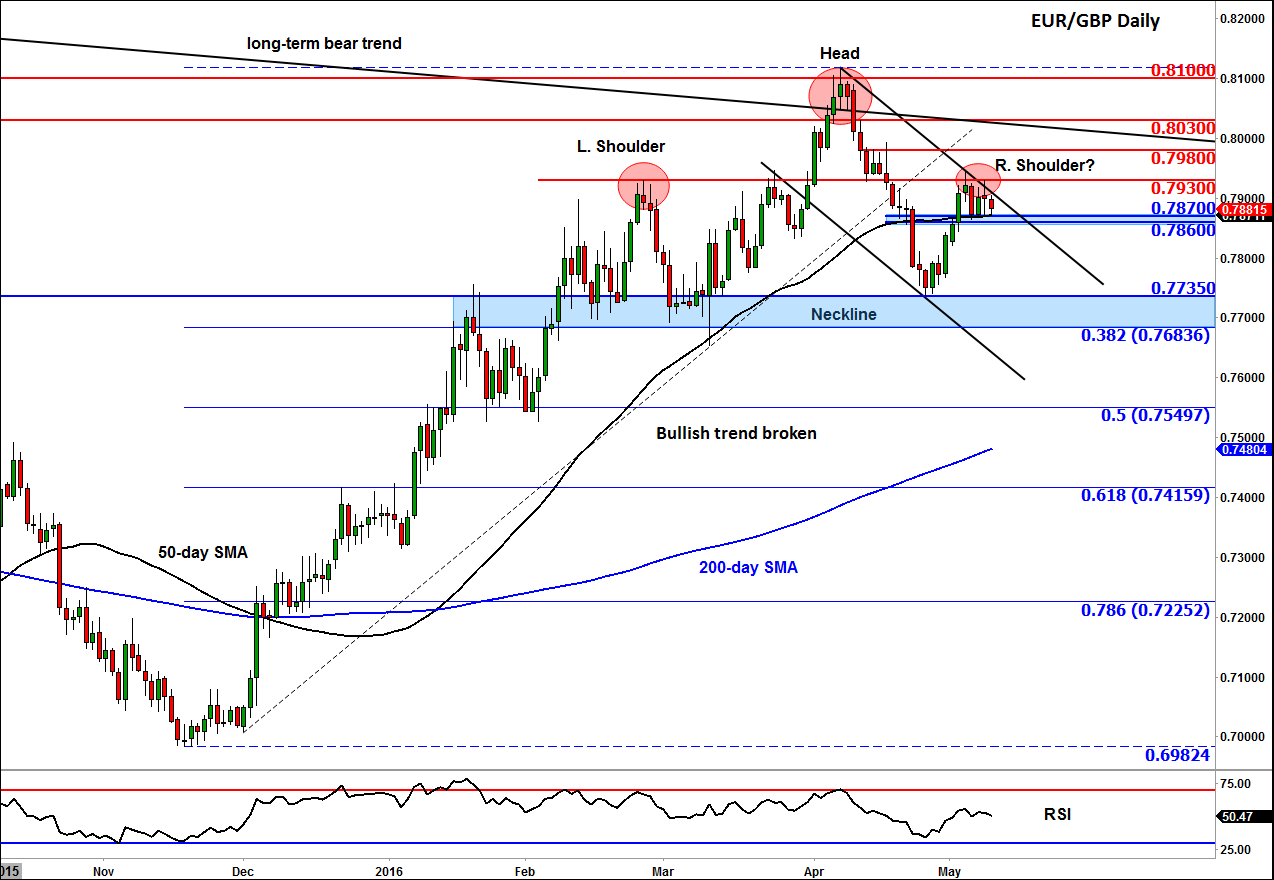

Clearly then, this could be a key week for the EUR/GBP. The recent recovery in this pair seems to be stalling once again which is good news for those who think that Brexit odds are still overstated. The cross has reached a potential turning point around 0.7930 area which had been a key resistance-turned-support level in the past. If the EUR/GBP drops significantly from this level then it will form the right shoulder of a potential ‘Head and Shoulders’ reversal pattern with the neckline being at 0.7735. For this potential pattern to develop, the sellers will first need to push price below short-term support and the 50-day moving average around 0.7860/70, an area which has offered decent support in recent days.

Conversely, a rally above 0.7930 would invalidate this potentially bearish outcome. But in this scenario, price will then face further key resistance levels ahead which means the potential gains could be limited. In our view, the most import area of resistance is around 0.8030-0.8100 where previous highs meet a long-term bearish trend line and a couple of Fibonacci levels.