The market's two leading cryptocurrencies have reclaimed most of the ground lost after two sharp selloffs in September. The first one was after Bitcoin became legal tender in El Salvador and after Chinese authorities banned cryptocurrencies.

In some ways, China's banning of cryptocurrencies that sparked the sell-down in Bitcoin to the recent $39,573 low likely marked the end of China's ability to influence the crypto market.

As we noted in an interview with Forkast news straight after the event, "China's role disrupting crypto markets has about run its course."

The tentative rally from the $39,573 low accelerated following comments last Friday from Fed Chairman Jerome Powell that he has "no intention" of following China's lead and banning cryptocurrencies. In many ways providing the greenlight for continued innovation and development of blockchain technology.

Adding fuel to the rally, a report released overnight by Bank of America noted digital assets were "too large to ignore" and that "that there could be more opportunity than sceptics expect."

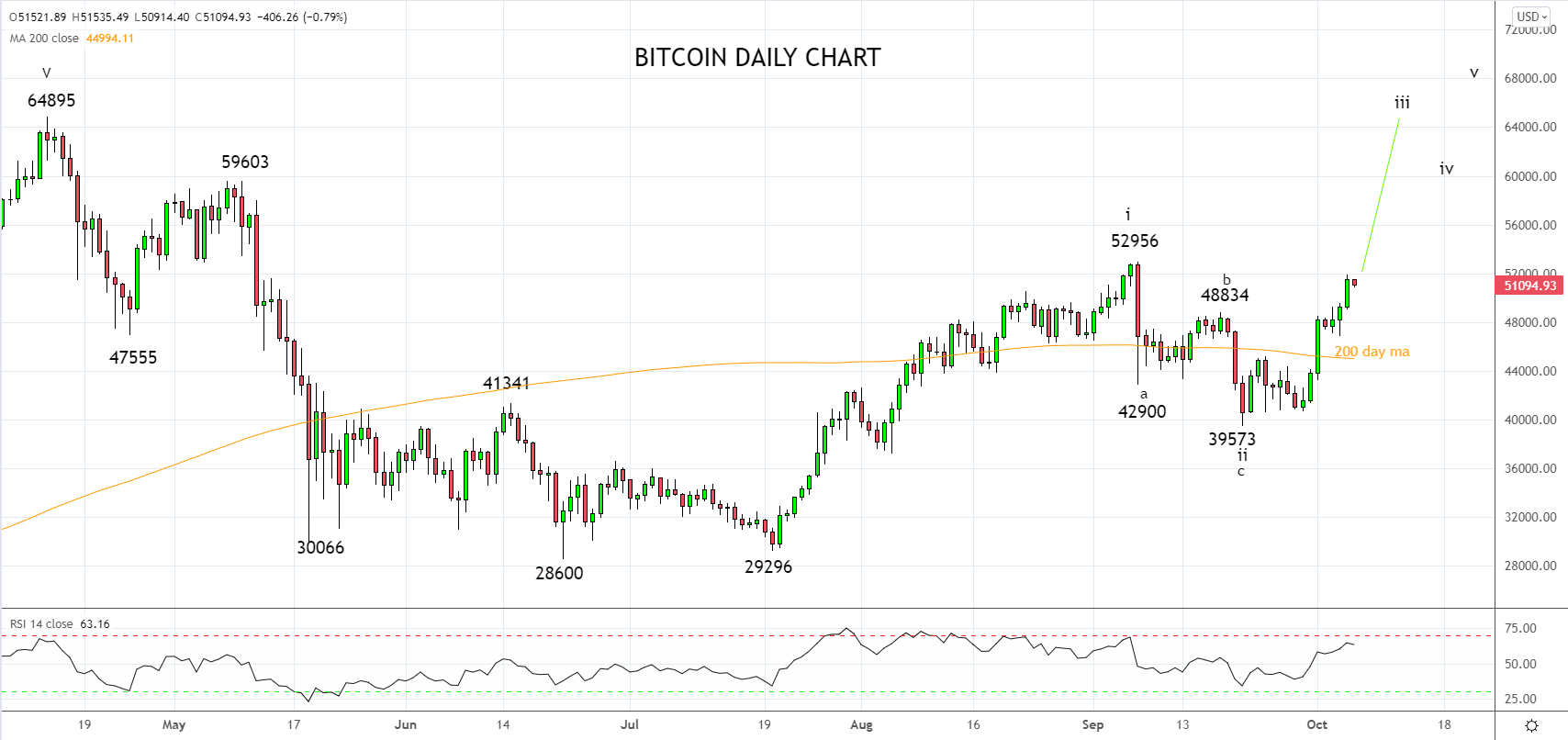

Technically the view is Bitcoin has completed a three-wave corrective pullback from the $52,956 high at the recent $39,573 low.

Providing Bitcoin remains above the 200-day ma near $45,000, the view is the uptrend has resumed, and the expectation is for a retest and break of the $52,956 high at a minimum. Beyond here, there is scope for a retest of the year-to-date highs near $65,000 into year-end.

Likewise, for Ethereum. The view is Ethereum completed a three-wave corrective pullback from the $4025 high at the recent $2650 low that picked up trendline support from the March 2020, $88.20 low.

Providing Ethereum remains above support at $3100, the view is the uptrend has resumed, and the expectation is for a retest and break of the $4025 high at a minimum. Beyond here, there is scope for a test of the all-time $4380 high into year-end.

Source Tradingview. The figures stated areas of October 6th, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation