FX traders were casting a wandering eye ahead toward a long holiday weekend this morning, but the US retail sales report pulled their attention back to their monitors.

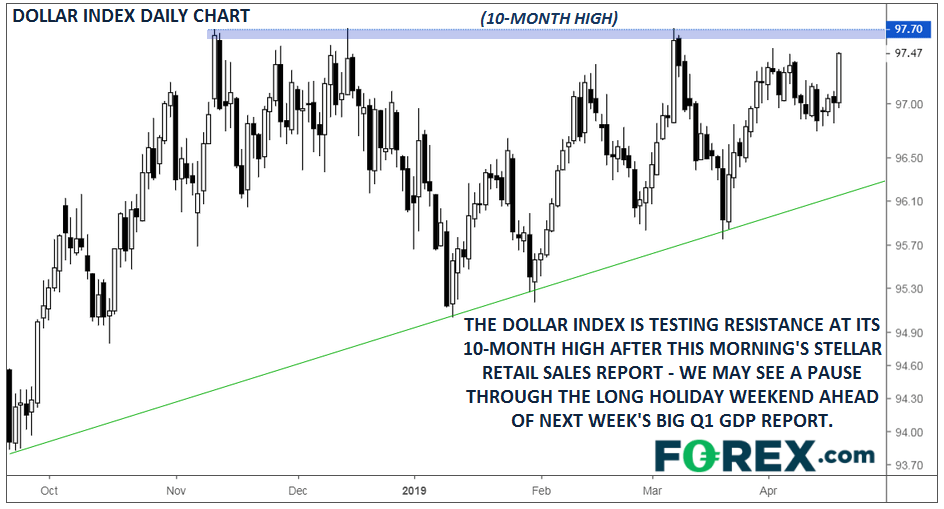

After a disappointing -0.2% m/m reading in February, US retail sales surged 1.6% in March, with “core” sales (ex-automobile purchases) also coming in strong at 1.2% m/m. The stellar reading on the US consumer, combined with disappointing manufacturing data out of Germany and France, has reinforced the “best house in a bad global neighborhood” trade for the US economy and taken the US dollar index up to test key resistance at its 10-month high in the mid-97.00s:

Source: TradingView, FOREX.com

From a technical perspective, the dollar index is showing a large “ascending triangle” pattern, which could foreshadow an explosive rally if the 97.70 barrier is eclipsed. That said, with many financial centers out on holiday tomorrow and on Monday, the lack of newsflow could keep the dollar index contained for now.

Looking ahead to next week, next Friday’s advance Q1 GDP report will be the marquee event. After today’s blowout retail sales report, the Atlanta Fed’s GDPNow model is pointing toward a 2.8% annualized growth rate in Q1; a reading in that range could be the catalyst for a big bullish breakout in the buck next week.