Earlier today, we talked about the recent strength of the euro in the context of EUR/USD, but the moves in EUR/GBP since the start of December have been even more impressive. Since bottoming near the .7000 handle in late November, the normally quiet pair has tacked on over 800 pips to hit a 1-year high above .7800.

From a fundamental perspective, the huge rally in EUR/GBP shows an often overlooked truism: it’s not the absolute monetary policy decisions and outlooks that drive currencies, but how they evolve relative to expectations. No one would argue that the European Central Bank (ECB) is in a more dovish posture than its peer across the English Channel, but what’s driven the EUR/GBP surge is how traders’ views about Eurozone and UK monetary policy have evolved.

Namely, everyone "knew" tha the ECB would remain in easing mode throughout this year, likely expanding its quantitative easing program in the process, and while it took longer than expected after the half-hearted tweaks in the December meeting, the ECB is now on track to fulfill those expectations. The far more dramatic shift has been in expectations for the BOE. Up until the last few months, many traders and analysts expected that they’d be one step behind the Fed in raising rates aggressively this year. With the slowdown in the UK economy and onset of global market volatility however, traders have now pushed out expectations for BOE tightening all the way to late 2017!

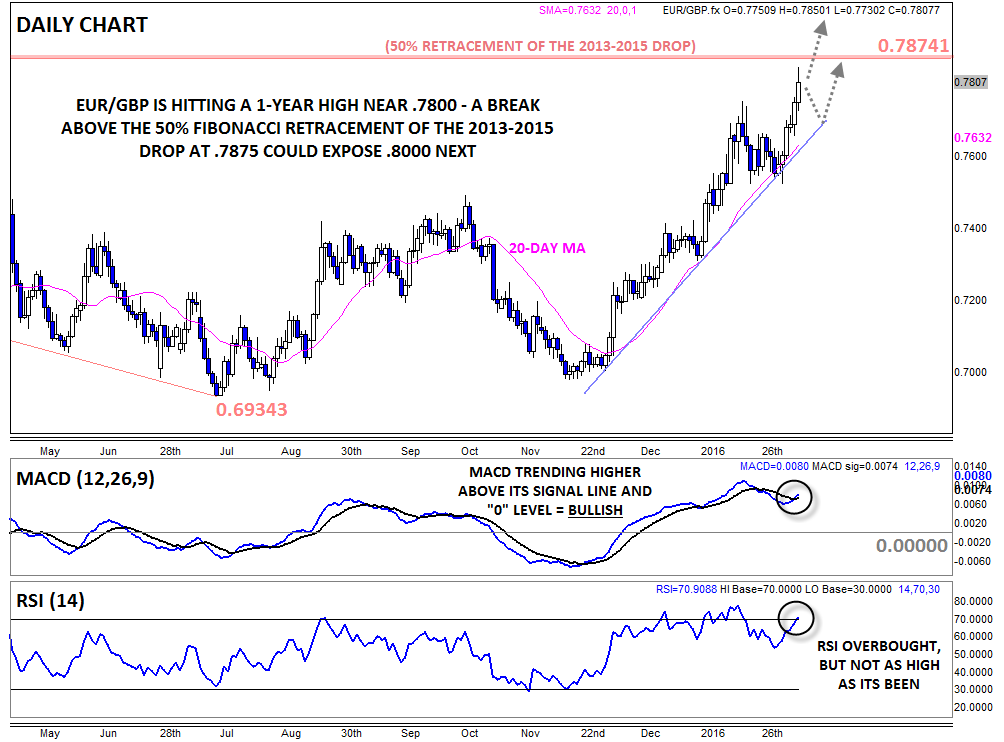

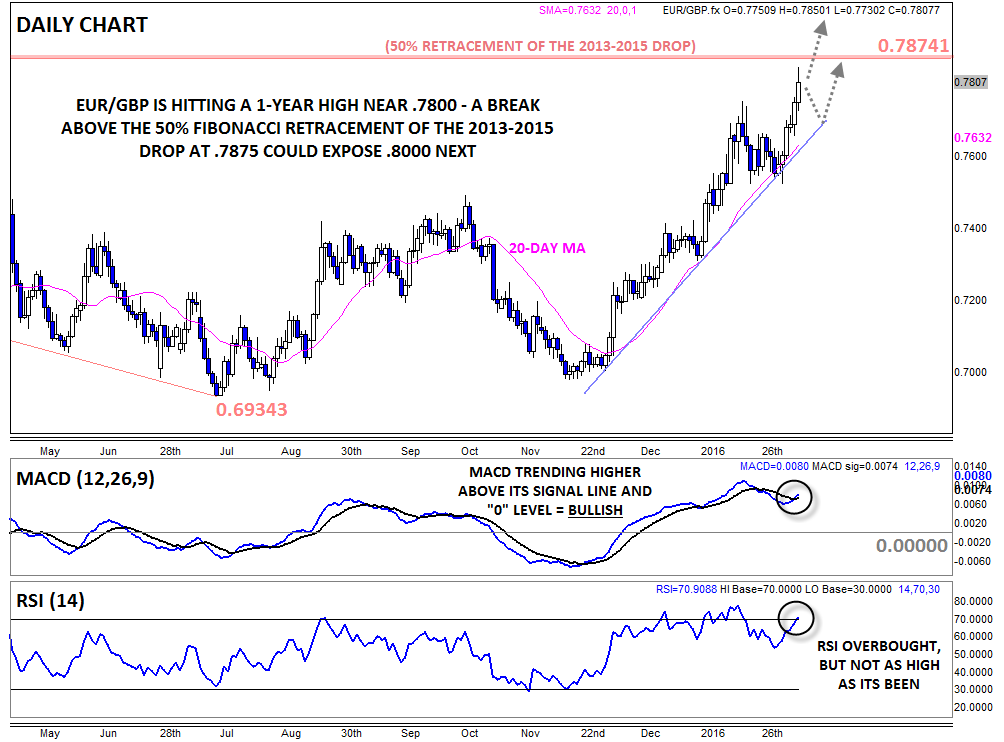

Technical view: EUR/GBP

Not surprisingly, the dramatic extension of the implied timeline for BOE tightening has driven EUR/GBP sharply higher, and based on the chart, this trend coul stretch further. As we go to press, EUR/GBP has broken conclusively above the 38.2% Fibonacci retracement of the entire 2013-2015 drop (not shown), and bulls may now turn their eyes toward the 50% retracement at .7875 next.

If that level breaks, a continuation up toward the .8000 level could be seen next. The secondary indicators bolster the case for further gains, with the MACD trending higher above its signal line and the "0" level, and though the RSI is in overbought territory, it’s been meaningfully twice in the last two months alone, so it hardly signals an immediate reversal. Only a break back below the 20-day MA and bullish trend line support (currently in the .7650 zone) would erase the near-term bullish bias.

@MWellerFX and @FOREXcom)

@MWellerFX and @FOREXcom)

@MWellerFX and

@MWellerFX and