On Tuesday, with markets all but certain that the Federal Reserve will raise interest rates by at least 25 basis points on Wednesday at the conclusion of its heavily anticipated FOMC meeting, the US dollar index continued to be bid up above the key 94.00 price level. This surge for the greenback extends the rebound that has been in place for the past two weeks as anticipation of higher interest rates from the Fed and US tax reform from Congress have given a much-needed boost to the dollar.

As noted, a 25-basis-point rate hike, which would be the third this year, is widely expected by the markets. Of course, in the unlikely event that the Fed defies expectations by failing to raise rates on Wednesday, the dollar is likely to take a rapid and sustained plunge. Assuming, however, that there is indeed the expected rate hike, the Fed’s policy wording and outlook will be of critical importance for expectations into next year. Markets will be looking primarily for any clues as to the future path of monetary policy that may be gleaned from the Fed’s statement, press conference, and economic projections (which will include the “dot-plot” outlook for future interest rate changes by Fed officials).

Due to the anticipation of impending US tax cuts, this outlook may potentially skew more towards the hawkish side, as tax reform could compel the Fed to tighten monetary policy somewhat more aggressively into 2018. In this event, the dollar could receive a further boost.

Tuesday saw the release of US Producer Price Index (PPI) inflation data, which came out as expected at +0.4%. However, the core PPI reading (excluding food and energy), was higher than expected at +0.3% against a prior consensus of +0.2%. Prior to the FOMC decision on Wednesday, the key US Consumer Price Index (CPI) inflation data will be released. November CPI is expected at +0.4% and core CPI (excluding food and energy) is expected at +0.2%.

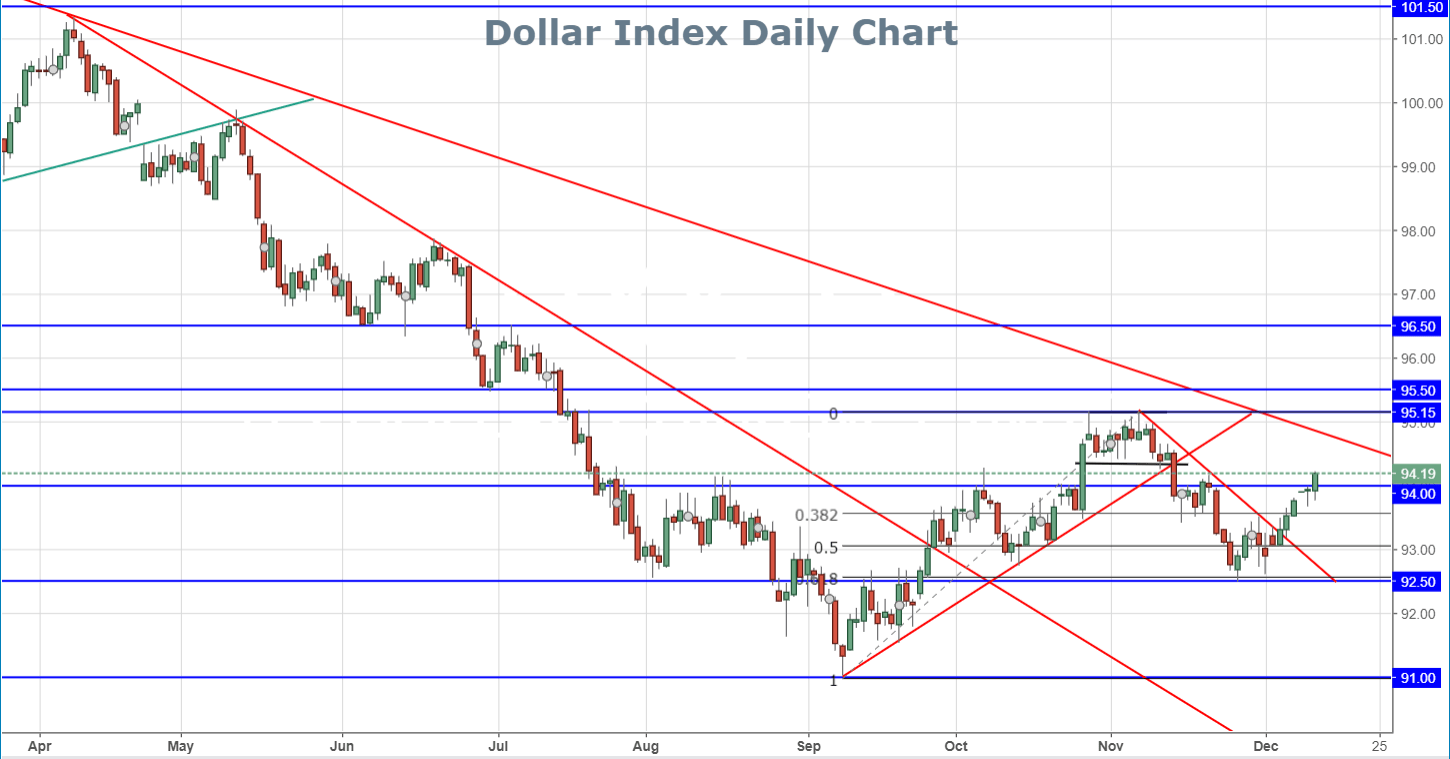

As noted, the dollar has been well-supported in the run-up to the Fed’s December decision on Wednesday. Tuesday saw the US dollar index, a key benchmark measuring the strength of the dollar against its major rivals, rise to hit a new 4-week high above the key 94.00 level at one point during the trading day. This surge follows two weeks of a rebound and rally from the 92.50 support area (which was also around the 61.8% Fibonacci retracement level of the previous September-November bullish run). The dollar’s short-term direction is now highly dependent on the Fed’s outlook on Wednesday. In the event of a more hawkish outlook by the Fed, which could likely be the case, any sustained move for the dollar index above the noted 94.00 price area should then open a path towards the 95.15 November highs.