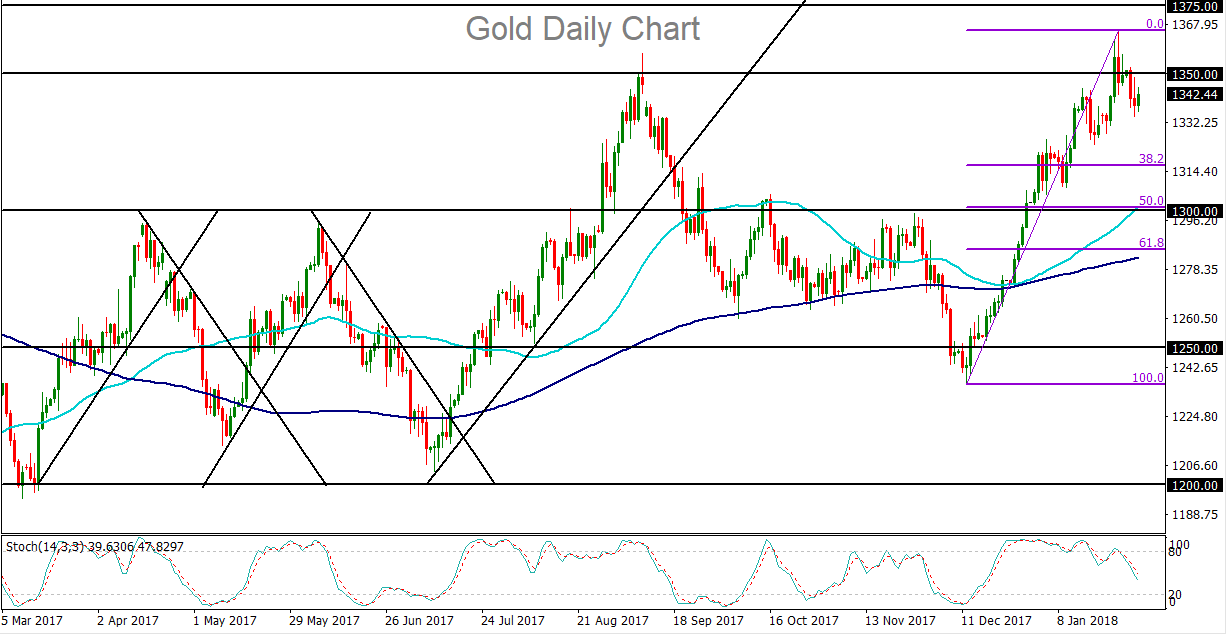

The primary driver of rallying gold prices since mid-December has clearly been a plunging US dollar. During the past month-and-a-half, the sharp rise in the price of gold from its mid-December low around $1236 up to its new long-term high around $1365 that was just reached last week, has tracked the equally sharp plunge for the US dollar index during the same period.

Strong bearish sentiment that has continued to weigh heavily on the US dollar has been a key market theme in recent weeks and months. This has helped to prop-up the dollar-denominated precious metal even in the relative absence of safe-haven demand, and despite the specter of rising interest rates that have the strong potential to diminish the appeal of non-yielding gold.

With US Treasury yields fluctuating around multi-year highs, and expectations that the Federal Reserve will likely raise interest rates at least three times this year, and possibly four, rising interest rates could be a factor that halts the gold rally in its tracks.

On Wednesday, markets were preparing for the highly anticipated Federal Reserve rate decision. Though no interest rate hike is expected at this time, market expectations ahead of the Fed meeting, the last one to be chaired by Janet Yellen before Jerome Powell takes the helm, have been leaning towards the hawkish side. Signs of a strengthening US economy, increased government spending, and rising inflation expectations have contributed to this hawkish anticipation. Even if the Fed turns out not to be as hawkish as expected, however, the stage has already been set for potentially steady interest rate increases going forward that will have a high likelihood of weighing on gold prices.

Since the noted long-term high around $1365 last week, gold has pulled back significantly, and is likely to continue doing so if interest rate expectations continue to remain elevated as indicated by bond yields and the Fed’s monetary policy outlook. In that event, a continued fall for gold prices should open a path back down towards the next key short-term target to the downside around the $1300 support level.