While the Federal Reserve has grabbed all the headlines for raising interest rates lately, its neighbor to the north has actually been just as aggressive in tightening policy over the last year. The Bank of Canada has raised its benchmark interest rate three times since the start of last July, and if economists are correct, another hike is likely at Wednesday’s meeting.

The Canadian economy continues to show steady improvement, with recent data confirming the underlying strength. While the most recent GDP print showed just 0.3% growth quarter-over-quarter (1.3% year-over-year), the country’s inflation rate has held above the central bank’s 2% objective for the last four months. After a disappointing 7.5k decline in employment in Canada’s May jobs report, the June release showed a stellar 31.8k rise in total jobs, well above the 22.3k increase expected.

Recent market movements are perhaps the most important factor auguring for a hike. Since the BOC’s last hike in January, the Canadian dollar has fallen by more than 700 pips against the US dollar, its most important trading partner. Meanwhile, the price of oil, Canada’s most important export, has surged nearly 17% in the last three weeks to tag a nearly 4-year high. Fears of frothy housing prices in major metropolitan areas like Toronto and Vancouver provide another reason for Stephen Poloz and company to

Market watchers have taken note of the recent bullish news: the market-implied odds of a rate hike have risen to above 80% as of writing, and a recent survey by Bloomberg showed that 14 of the 18 economists queried expected a rate hike. At this point, it may be more destabilizing for the BOC not to raise rates!

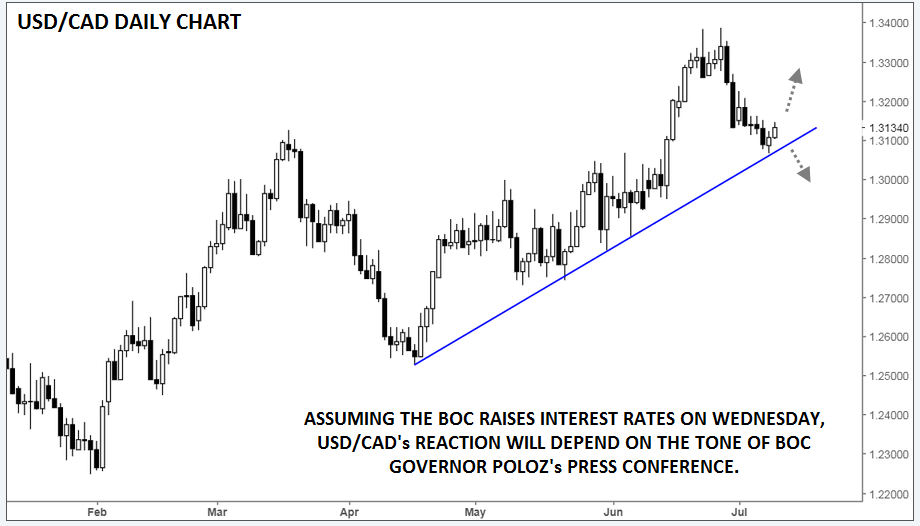

Assuming the central bank raises interest rates as anticipated, the focus may quickly turn to the future, namely the probability of another interest rate increase this year. Markets are currently pricing 50/50 odds of another hike this year, but that probability will almost certainly shift based on the tone of Poloz’s press conference.

If the BOC Governor downplays the risks of trade tensions with the US (including the potential for a collapse of NAFTA) and focuses on the strong domestic economy, USD/CAD could break its bullish trend line to test the key psychological barrier at 1.30. On the other hand, a more tepid economic assessment could lead to loonie weakness (even if the central bank raises rates), with USD/CAD bulls turning their eyes back toward the late June highs above 1.33.

Source: TradingView, FOREX.com