- New Zealand’s Q2 jobs report beat across the board

- Unemployment came in under expectation while participation, employment and wages beat

- Underlying detail was not as strong with alarming weakness among young Kiwis

- RBNZ meets to discuss rates next week, a rate cut is possible

- NZD/USD capped below .5985, NZD/JPY

New Zealand’s jobs report beat across the board in Q2 with unemployment undershooting forecasts while wages growth, employment, participation and wages growth topped expectations. However, the details were not as impressive as the headline figures, keeping the prospect of an August rate cut from the Reserve Bank of New Zealand in play.

NZD/USD and NZD/JPY are trading modestly higher following the data, although gains are being capped by ongoing nervousness in markets after what happened over the past week.

Jobs report details

Looking at the details, unemployment ticked up two tenths to 4.6%, the highest level since December 2020. However, that was a tenth below the median economist forecast. Employment growth impressed, rising 0.4% compared to expectations for a decline of 0.2%. The detail was not as strong with full time employment declining 0.1% while the part time workforce rose 1.9%. Hours worked declined 1.2%.

Contributing to the lift in unemployment, labour force participation increased two-tenths to 71.7%, reversing the trend seen since the middle of 2023.

Underutilisation, which includes unemployed and underemployed workers, increased at a faster pace than unemployment, rising six tenths to 11.8%. Tarnishing the report further, youth unemployment spiked, jumping over five percentage points to 20.7% for 15 to 19-year-olds and more than two percentage points for 20 to 24-year-olds to 8%.

That’s a sign the economy is not growing faster enough to absorb new labour force entrants, boosting the need for growth to accelerate to above-trend levels.

Despite more Kiwis either in or looking for work, private sector wages grew more than expected, lifting 0.9% over the quarter. Markets were looking for a smaller increase of 0.8%, the same level seen in Q1. From a year earlier, wages excluding overtime rose 3.6%, a tenth ahead of forecast but down on the 3.8% pace reported previously.

Implications for RBNZ

Two-year New Zealand interest rate swaps rose around 7bps on the back of the data, implying a slight reduction in the amount of easing expected from the RBNZ in the coming rate cutting cycle. Most Kiwi mortgages are priced off two-year swaps, making this rate a powerful one when it comes to monetary policy transmission.

As a reminder, the RBNZ has a single policy mandate of low and stable inflation, not a dual mandate like the RBA and Federal Reserve to also target full employment.

When the RBNZ last met in June, it said that while policy will need to remain restrictive, the “extent of this restraint will be tempered over time consistent with the expected decline in inflation pressures.” Today’s report provides mixed messages on this front, although lead indicators such as higher participation and underutilisation suggest risks for wages growth, and therefore inflation, remain to the downside.

Heading into next Wednesday's RBNZ meeting, markets see the prospect of a 25 basis point rate cut as a coin flip.

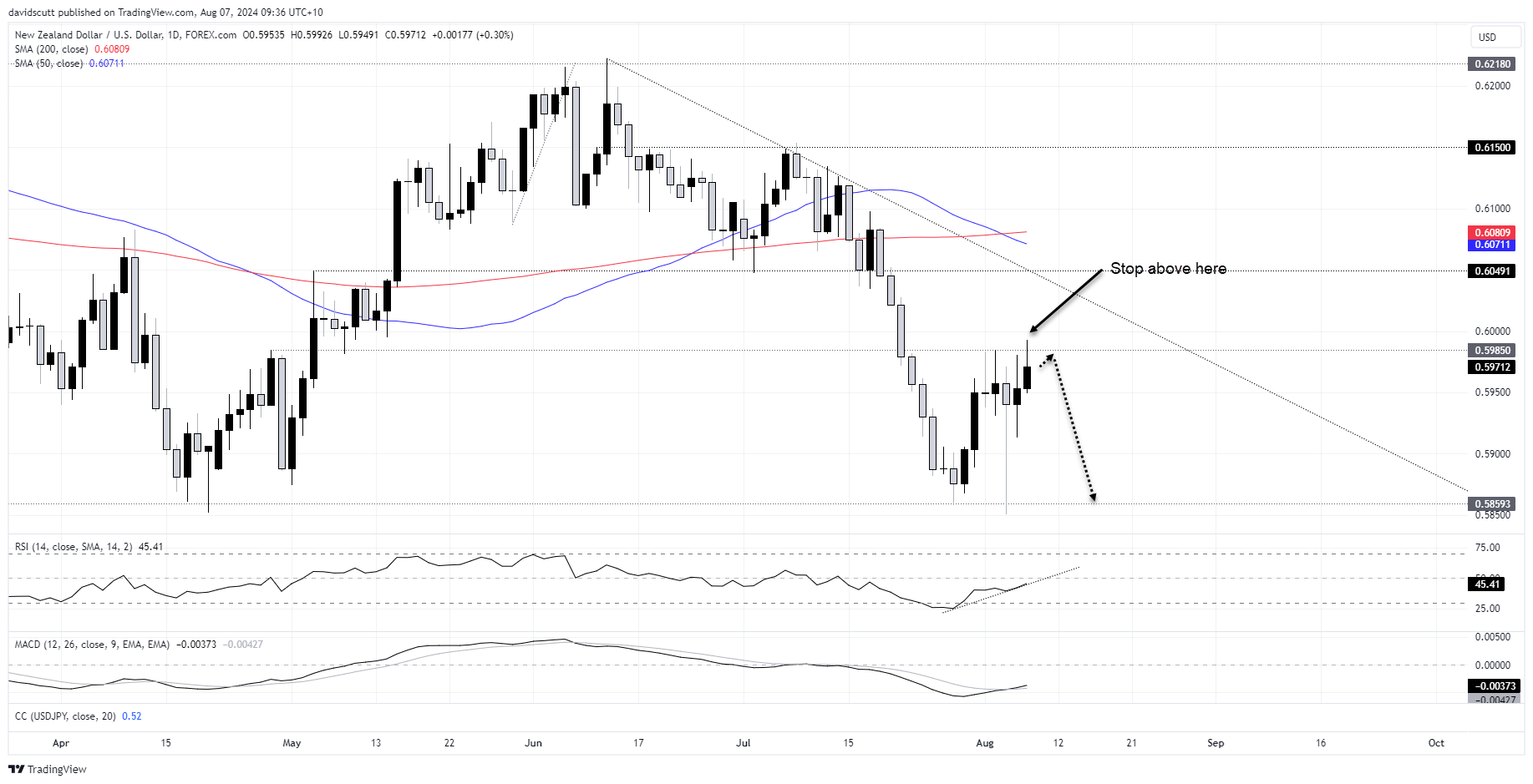

NZD/USD bulls thwarted again at .5985

NZD/USD hit highs not seen since July 22 on the data before reversing, struggling again to hold above resistance at .5985. That’s now four attempts where it has either been thwarted or baulked at breaking above this level. You get the sense these that unless risk appetite can improve beyond what’s already been seen, it may be easier to sell Kiwi than buy in the current environment.

Those considering short setups could sell below .5985 with a stop above today’s high for protection, targeting a move back down to .5983, where the price has been well supported on pullbacks, including earlier this week. Below, there’s not much to speak of until .57736, the lows struck in October 2023.

On the topside, should sellers above .5985 be overrun, .6049 is the next level of note, coinciding with the intersection of the June downtrend and horizontal resistance. For the moment, RSI and MACD are providing mildly bullish signals on momentum.

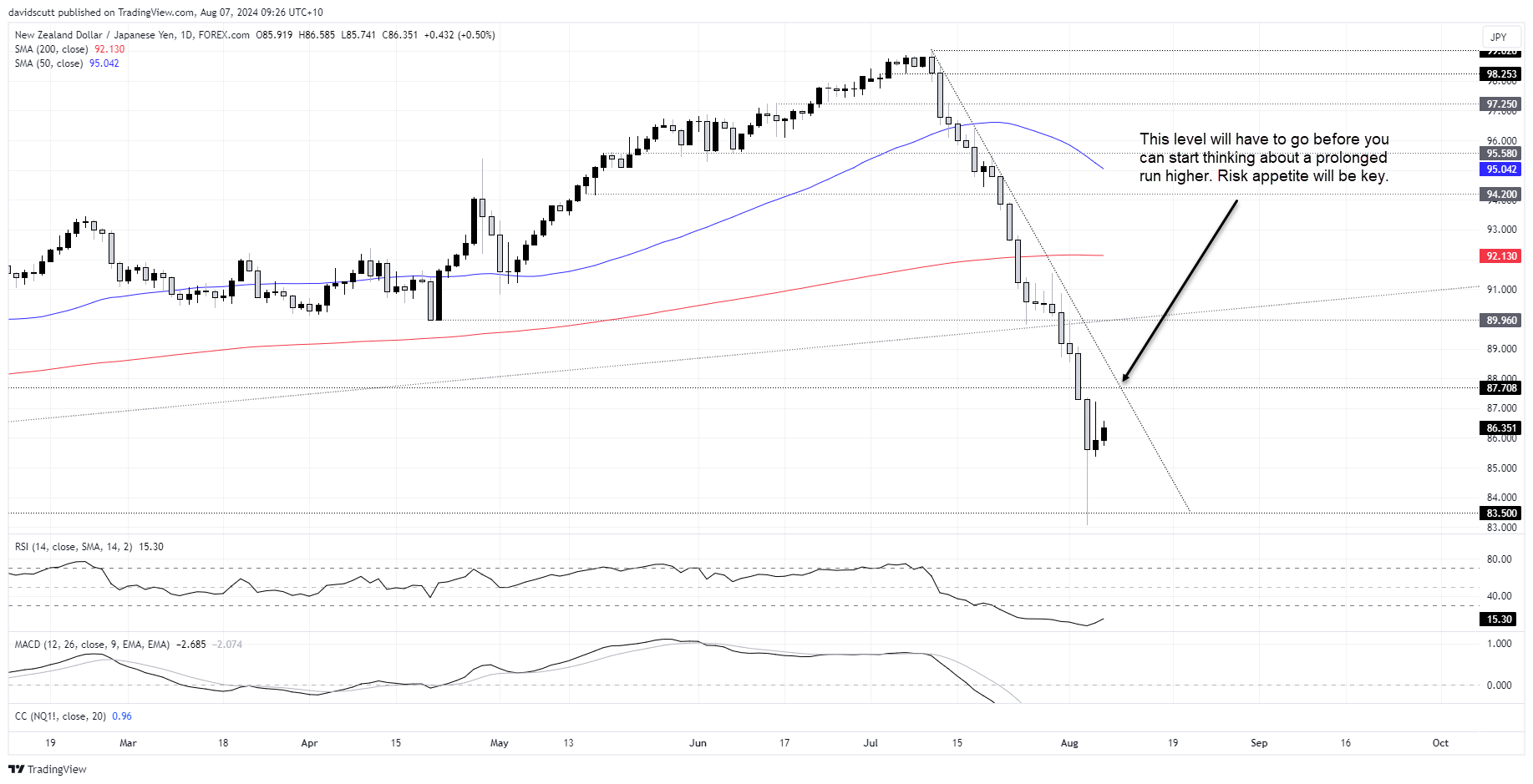

NZD/JPY a pure-play on risk appetite

NZD/JPY managed to bounce on Monday after a torrid run that saw it tumble into oversold territory on RSI (14) rarely seen before. Unlike NZD/USD which is more a play on risk appetite, yield differentials and sentiment towards China, NZD/JPY comes across as a pure play on risk appetite.

Support is located from 83.50 with 80.436 the next level after that. On the topside, the downtrend running from July will need to be broken before thoughts of meaningful upside can be pondered. Should that go, 87.70 and 90 are the levels of note.

-- Written by David Scutt

Follow David on Twitter @scutty