- GBP/USD hit the highest level of 2024 on Friday

- UK events calendar is light this week, leaving US economic data and technical to drive direction

- US CPI and PPI are key events to watch

- GBP/USD has not fared well when overbought on RSI in recent times

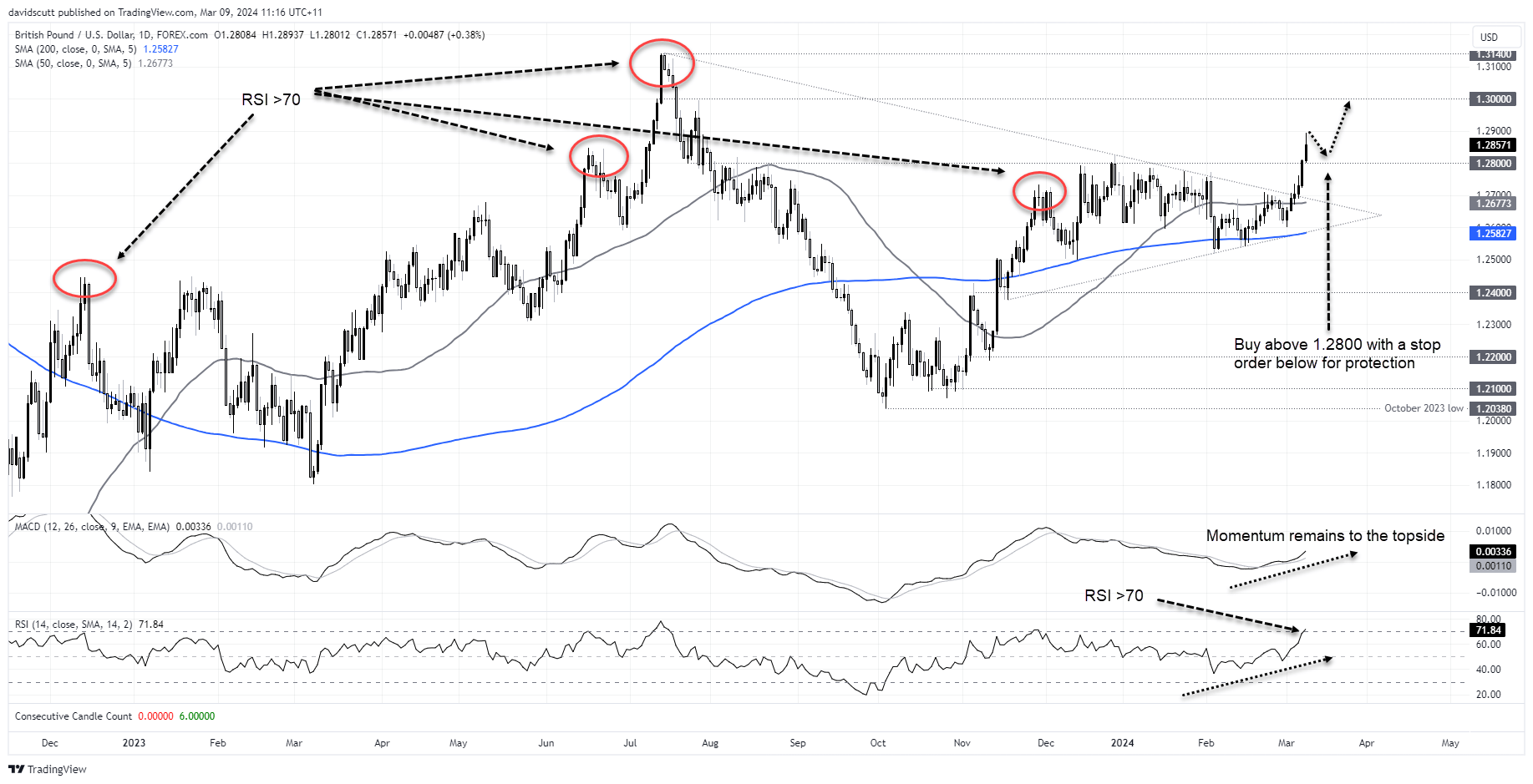

Having hit fresh 2024 highs after breaking downtrend resistance with force, the question for GBP/USD this week is whether the move can extend further, bringing a potential retest of the July 2023 highs onto the radar?

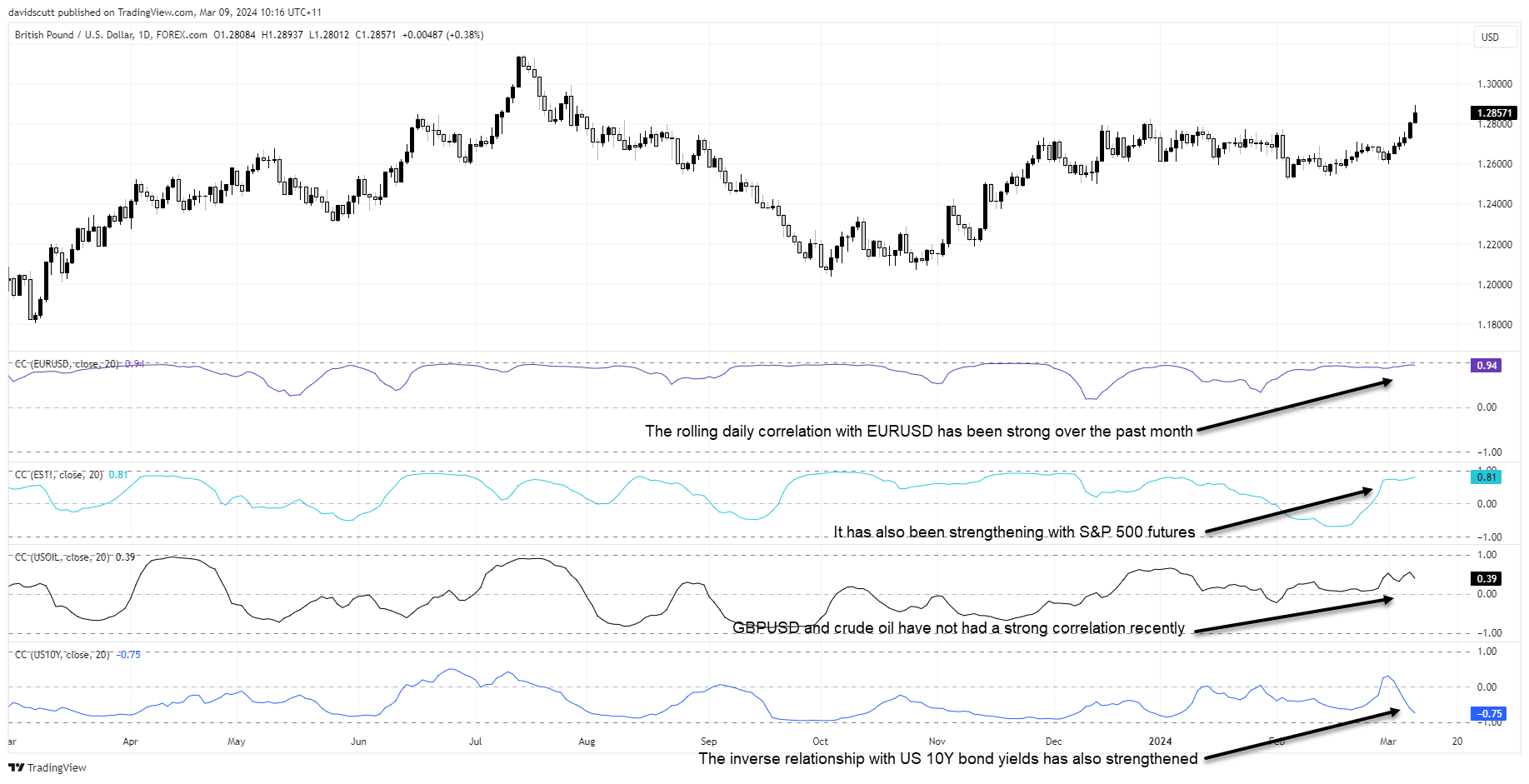

With little on the UK events calendar to speak of, movements in GBP/USD are likely to be influenced by US data along with technicals. Based on correlation analysis, the performance of US stocks and 10-year bond yields, and EUR/USD, may determine whether the rally sinks of swims.

UK events calendar is light

UK unemployment data and a speech from Bank of England MPC member Catherine Mann on Tuesday are the highlights on what is a relatively light UK event calendar.

Keeping with the focus on inflation, average earnings ex-bonus will receive the bulk of attention, especially with uncertainty on how reliable the ONS unemployment data is under the new methodology. Only a large increase or decrease in employment over the prior three months will likely be enough to move the dial. It’s largely about demand-pull inflation, hence wages and income.

Updated GDP, trade, industrial production and house price data are unlikely to generate volatility.

While Catherine Mann sounded her usual hawkish self when she spoke in February, markets will be on alert for remarks that suggest her stance towards the rates outlook is moving towards most other MPC members.

Fed blackout period begins

From a fundamental perspective, it’s the US events calendar that looms as more likely to move GBP/USD this week.

Before we look at specific US events, it’s important to note the Fed has entered its blackout period prior to the March FOMC meeting, meaning we’ll hear nothing from members until the policy decision is announced. That means if there’s a need to deliver a message to markets that deviates significantly from the current view of 3.5 rate cuts this year, it will come through connected journalists such as the Jon Hilsenrath at the WSJ.

US inflation report the major risk event

In terms of new information that could be that powerful, nothing ranks close to the US February CPI report on Tuesday. After an uncomfortably hot January core CPI print, markets expect a softer number with the median economist forecast looking for an increase of 0.3%. Having spiked in January in each of the prior three years, there’s a sense last month’s hot figure may have been a creation of seasonal distortions that may reverse in February.

Given the flowthrough from strong labour market conditions to some inflation components, the core services ex housing figure – known simply as “supercore” – will again receive plenty of attention.

Two days later, Thursday’s US producer price inflation report could generate volatility given some components are used to forecast how core personal consumption expenditure (PCE) inflation – the Fed’s preferred measure or underlying price pressures – may look when released later in the month.

They are the two big US data releases with New York Fed inflation expectations on Monday, jobless claims and retail sales on Thursday and the University of Michigan consumer inflation expectations survey on Friday the remaining events that could generate volatility.

Aside from data there are long bond auction scheduled in the UK and US, providing a test of demand after the recent pullback in yields. Tuesday brings 10-year auctions of US Treasuries and UK Gilts with a US 30-year bond going off on Wednesday.

GBP/USD influenced by US stocks, long bond yields, EUR/USD

With GBP/USD rolling with a correlation of 0.96 with EUR/USD over the past month on the daily, you may want to keep track of EU events calendar, too. With little first tier data outside of revisions, ECB speeches may be influential should the tone deviate meaningfully from the expected start of the next easing cycle in June.

In terms of other correlations, GBP/USD has seen a strengthening relationship with US S&P 500 futures over the past month on the daily. The inverse relationship with US 10-year bond yields has also grown during this period.

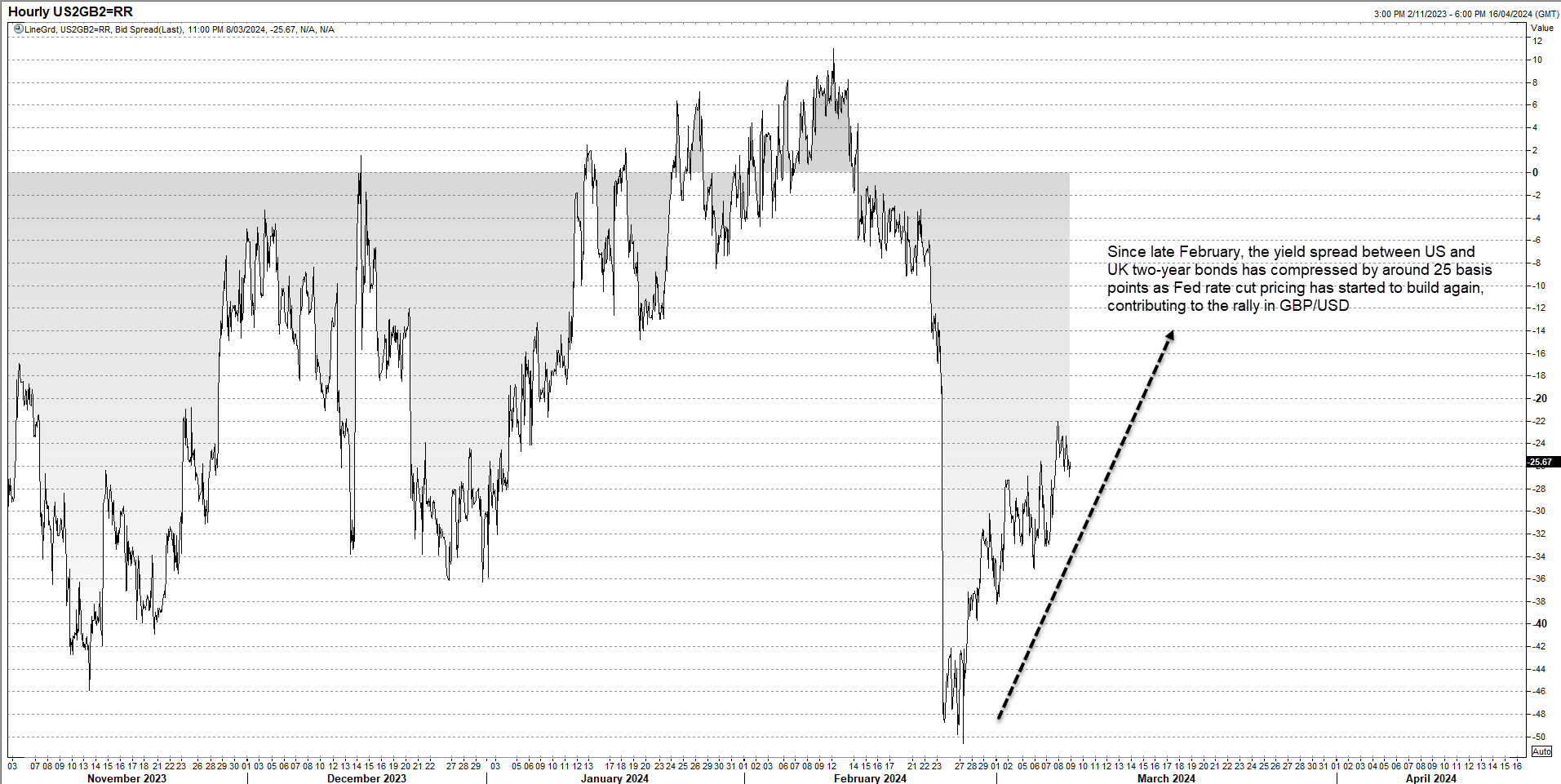

US-UK yield differentials compress

Yield differentials between the US and UK have also started to compress for shorter-dated bonds, helping to fuel GBP strength against the USD. The spread between US and UK two-year yields has narrowed by around 25 basis points since late February as markets swung back to favouring four rate cuts from the Fed this year rather than three.

Source: Refinitiv

GBP/USD technical setup

It was a stunning week for GBP/USD bulls to kick off March with the pair breaking the downtrend dating back to July 2023 before doing away with horizontal resistance at 1.2800 heading into the US non-farm payrolls report on Friday, sending cable to the highest level of the year.

While a bullish move with momentum continuing to build to the upside, it has seen GBP/USD move into overbought territory on daily RSI, providing a warning that a near-term pullback/consolidation may be on the cards. I’ve circled on the chart other periods recently where GBP/USD has been overbought to highlight it has often coincided with short-term tops.

Given that tendency but with momentum still pushing higher, I’m inclined to buy dips towards 1.2800 this week, positioning for a potential move back towards 1.3000 or higher. A sustained push below 1.2800 would signal a false break and change the bullish bias for GBP/USD we’re seeing right now.

Unless we receive a hot US CPI or PPI report next week, the perceived probability of sustained reversal appears low.

-- Written by David Scutt

Follow David on Twitter @scutty