Sterling is bounding higher as Boris Johnson maintains a healthy lead in the polls in the last few days heading towards the elections. The latest data showing voters intentions puts Boris Johnson with a double-digit lead of 11.9 points ahead of Labour’s Jeremy Corbyn.

Traders are looking for the Tories to win by an overall majority. This is being seen to pave the way for Boris Johnson’s Brexit bill to pass quickly through Parliament, enabling the UK to leave the EU early next week with a deal in place. Conservative market friendly policies are also playing a part in boosting sterling. These are favoured over Jeremy Corbyn’s left leaning policies and the uncertainty that he brings to Brexit.

The leaders will be upping their game this week; concerns of a late surge for the Labour party aren’t materialising. A target of $1.35 is quite possible in the near term should a Tory win in the elections and Brexit fall into place.

Dollar eases on trade headlines post stellar NFP

On the other side of the equation, the dollar is easing after surging on Friday post NFP. 266,000 jobs wee created, smashing forecasts of 180,000. The strong labour market has cemented beliefs that the Fed will stay pat on rates in its policy announcement this week.

On the other side of the equation, the dollar is easing after surging on Friday post NFP. 266,000 jobs wee created, smashing forecasts of 180,000. The strong labour market has cemented beliefs that the Fed will stay pat on rates in its policy announcement this week.

Trade headlines continue to impact trading. The dollar is broadly out of favour after President Trump called on the World Bank to stop lending to China, potentially rocking very already very fragile relations ahead of the 15th December deadline.

Level to watch

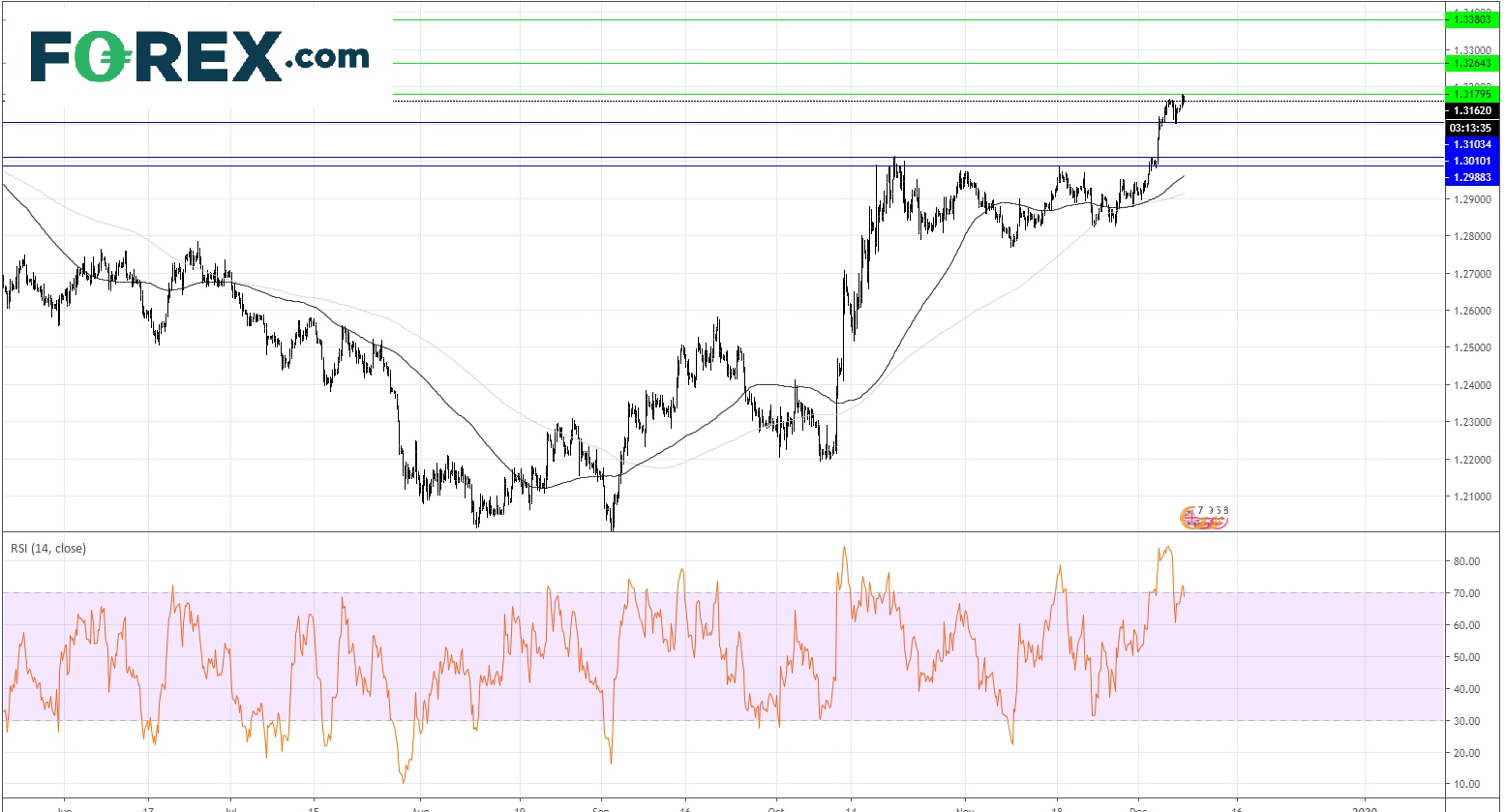

The pound is trading above its 200, 100 and 50 sma, in bullish trading. The RSI has also dropped back below 70 in another strong sign for pound bulls.

Resistance can be seen at $1.3181, prior to $1.3265, from March, before $1.3380, 2019’s high. On the downside support is identified at $1.31 prior to $1.3050 and $1.2985, November’s peak.

Latest market news

Today 02:05 PM

Today 11:59 AM

Yesterday 11:06 PM