- Sterling fell across the board early on Monday due in part to key manufacturing data from the UK that fell short of expectations. The UK’s manufacturing PMI for March came in at 54.2, which still represents an expansion, but fell below expectations for 55.1 and slightly below the previous month’s result.

- Since Wednesday of last week, however, when Article 50 formally launched the process of separation (Brexit) between the UK and European Union, the pound has been surging. This sterling strength was pronounced against the euro, prompting a sharp drop for the EUR/GBP currency pair.

- This seemingly counterintuitive move in the wake of Article 50 can be attributed in part to the fact that Brexit-driven pressure on the pound had already been well priced-in to the UK’s currency, and the official triggering of the separation process had become little more than a formality.

- Also, now that the triggering of Article 50 had finally occurred after many months of anticipation, there were clearly no catastrophic consequences last week, and short positions had been unwinding. It should be noted, however, that the entire process of separation will likely take years, and trade negotiations between the now-separate entities could go on for quite some time. This could introduce additional risks to the UK and sterling that are not currently being reflected in the pound.

- Aside from these potential uncertainties stemming from the ongoing Brexit negotiations, though, there is a perception that risk considerations have now shifted from the UK back to the European Union. With the launch of Article 50 now out of the way, the future of the EU and euro are increasingly put into question, especially with the upcoming French presidential election threatening the integrity of both the EU bloc and the euro shared currency. The prospect of such a staunch anti-EU candidate as Marine Le Pen potentially leading France and pushing for a “Frexit,” is indeed enough to place a great deal of pressure on the euro.

- This euro pressure was helped further along last week by the European Central Bank, which essentially denied that it would be ending its easy monetary policy any time soon.

- If currency concerns indeed continue to shift from the pound to the euro, a EUR/GBP breakdown would be a likely result.

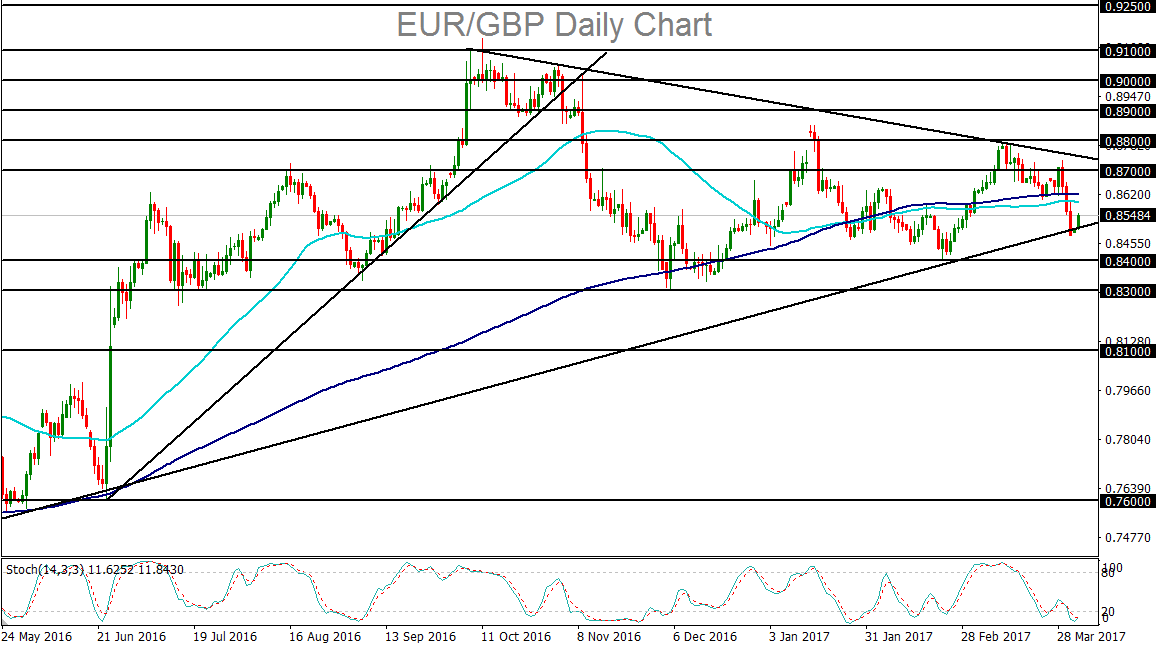

- From a technical perspective, EUR/GBP has just bounced off a major uptrend support line that extends back to the late-2015 lows. Subsequently, with any true breakdown below this trend line amid further pressure on the euro against a rebounding pound, EUR/GBP could be pushed down in the near-term towards its next major bearish targets at the 0.8400 and 0.8300 support levels.

Latest market news

Today 02:05 PM

Today 11:59 AM

Yesterday 11:06 PM