Thursday US cash market close:

- The Dow Jones Industrial rose 87.06 points (0.25%) to close at 34,583.57

- The S&P 500 index rose 19.06 points (2.51%) to close at 34,058.75

- The Nasdaq 100 index rose 32.925 points (0.23%) to close at 14,531.81

Asian futures:

- Australia's ASX 200 futures are down 0 points (-0.64%), the cash market is currently estimated to open at 7,442.80

- Japan's Nikkei 225 futures are up 130 points (0.48%), the cash market is currently estimated to open at 27,018.57

- Hong Kong's Hang Seng futures are down -62 points (-0.28%), the cash market is currently estimated to open at 21,746.98

- China's A50 Index futures are up 5 points (0.04%), the cash market is currently estimated to open at 13,856.08

Initial jobless claims in the US fell to a 53-year low of 166 last week, meaning an already tight labour market is getting tighter. Worker shortages help to partly explain the decent print, although it should be factored in that the calculation for seasonality has been altered.

Bullish outside days formed on the Dow Jones and S&P 500, with the latter holding above 4455 support. 54% of the S&P’s stocks advanced, which is not exactly a compelling day for bulls, although 8 of its 11 sectors posted gains led by healthcare and energy.

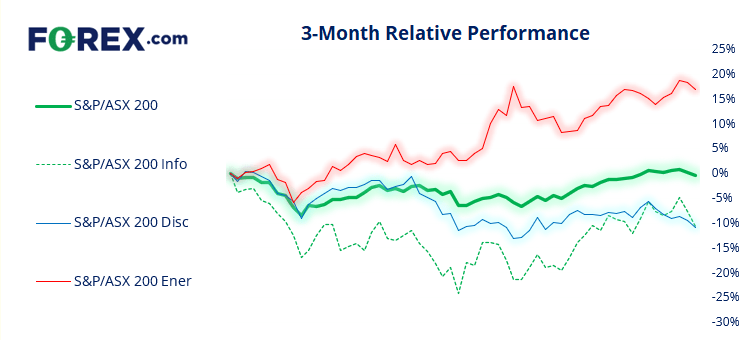

ASX 200:

The ASX 200 has held up relatively well the past few days and it could be argued a pullback was due, given it rallied into 7500 in a relatively straight line. The daily trend structure is bullish overall and can afford a pullback to 7360 but, given the positive lead from Wall Street, we’re more interested in seeking evidence of a swing low today.

ASX 200: 7442.8 (-0.63%), 07 April 2022

- Consumer Stap (0.55%) was the strongest sector and Info Tech (-3.42%) was the weakest

- 8 out of the 11 sectors closed lower

- 7 out of the 11 sectors outperformed the index

- 130 (65.00%) stocks advanced, 54 (27.00%) stocks declined

Outperformers:

- +11.9% - Magellan Financial Group Ltd (MFG.AX)

- +9.68% - GQG Partners Inc (GQG.AX)

- +4.88% - Zimplats Holdings Ltd (ZIM.AX)

Underperformers:

- -6.67% - Liontown Resources Ltd (LTR.AX)

- -6.55% - WiseTech Global Ltd (WTC.AX)

- -6.36% - Novonix Ltd (NVX.AX)

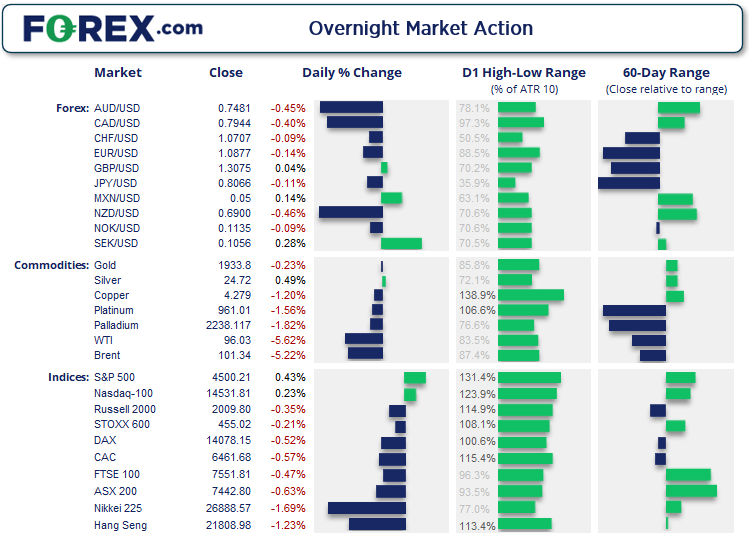

USD is the strongest currency this week

The US dollar has now rallied for six consecutive days, the euro has fallen for six, the Swiss franc and Japanese yen five. And all because the Fed have hammered home a point we thought was already generally accepted; the Fed will be raising rates aggressively and begin trimming their balance sheet. Looking at the US dollar index, 6 bullish closes are quite rare and we are now headed for 100. So there is the potential for mean reversion, one side of this weekend or the other.

Potential bull flag on GBP/AUD

A potential bull flag is forming on the GBP/AUD hourly chart. The daily pivot point sits at 1.7455 and the 23.6% Fibonacci retracement 1.7432, making it a potential support zone. If successful, the flag projects a target around 1.7750 but we’re happy to focus on more conservative targets ahead of the weekend. The daily R1 and R2 sit at 1.7530 and 1.7585, and with the weekly R1 pivot just above swing highs then 1.7600 is a feasible target potentially in the European or US session.

WTI reaches target yet key support holds (for now)

WTI reached our lower target of 94.0 yesterday after respecting the upper bounce of our resistance zone near 99.0. Prices have now since recouped around half of yesterday’s losses over the past four hours and, given the significance of support around 94.0, we’re happy to retain a flat view heading into the weekend as prices are now trapped between the key levels of 94 – 99. Should a big event trigger a break of either of those key levels, our bias would switch to the relevant direction. Otherwise, traders could consider range trading strategies (short into resistance, long around support) until that range breaks.

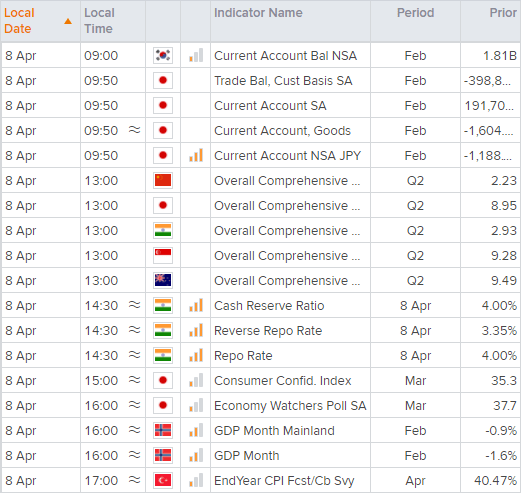

Up Next (Times in AEST)

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.