Wednesday US cash market close:

- The Dow Jones Industrial rose 344.23 points (1.01%) to close at 34,564.59

- The S&P 500 index rose 49.14 points (2.51%) to close at 34,058.75

- The Nasdaq 100 index rose 277.05 points (1.99%) to close at 14,217.29

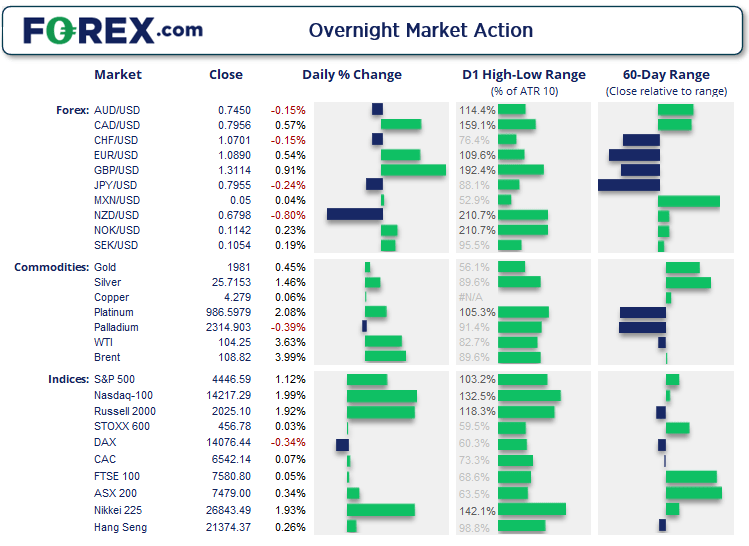

Asian futures:

- Australia's ASX 200 futures are up 12 points (0.16%), the cash market is currently estimated to open at 7,491.00

- Japan's Nikkei 225 futures are up 40 points (0.15%), the cash market is currently estimated to open at 26,883.49

- Hong Kong's Hang Seng futures are up 99 points (0.46%), the cash market is currently estimated to open at 21,473.37

- China's A50 Index futures are up 103 points (0.75%), the cash market is currently estimated to open at 13,925.16

Wall Street broke its bearish streak and printed bullish engulfing candles on the daily chart. Investors looked past the strong inflation data and focussed on earnings season. The Nasdaq was the strongest performer and rose nearly 2%.

Measures of inflation continue to rip higher across the globe. US producer prices hit a record high of 9.2% y/y which paves the way for further costs to be passed onto the consumer and jack of consumer prices. Let’s just say it is no coincidence that corporate profits recently hit a record high. UK inflation data rose to 7%, its highest level since 1992. Producer prices rose to 11.9%, its highest since the GFC. And PPI input prices (and inflationary input of an inflationary input) rose 19.2% y/y, and 5.2% m/m which is its highest on record. The Thomson Reuters commodity index is also trading just shy of an 8-year high and is showing no signs of a market top, having risen over 200% since the March 2020 low.

How CPI impacts forex

Oil prices rallied for a second day with WTI close to reaching our initial 105 target. Concerns of a tight global supply which stem from OPEC’s lower demand forecast, along with likelihood that traders will boycott Russian oil, has continued to support prices.

Silver reached our initial target zone around 26.0 after its sixth consecutive bullish close. As outlined in Tuesday’s video we also week the potential for it to break above 27.0 and continue its impulsive move higher.

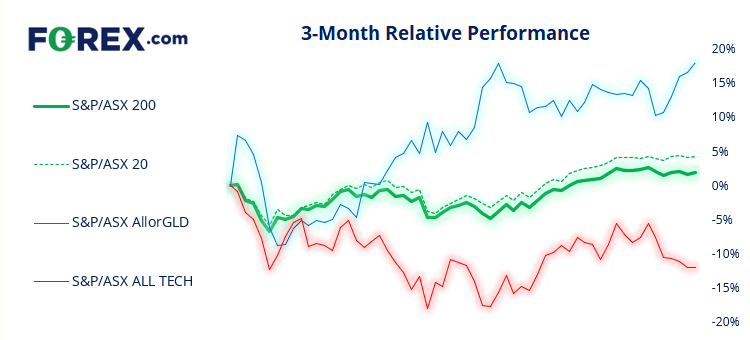

ASX 200:

ASX 200: 7479 (0.34%), 13 April 2022

- Energy (0.98%) was the strongest sector and Real Estate (-0.41%) was the weakest

- 8 out of the 11 sectors closed higher

- 3 out of the 11 sectors closed lower

- 5 out of the 11 sectors outperformed the index

- 130 (65.00%) stocks advanced, 54 (27.00%) stocks declined

Outperformers:

- +12.35% - Core Lithium Ltd (CXO.AX)

- +11.65% - AVZ Minerals Ltd (AVZ.AX)

- +9.78% - Lake Resources NL (LKE.AX)

Underperformers:

- -2.9% - James Hardie Industries PLC (JHX.AX)

- -1.77% - Meridian Energy Ltd (MEZ.AX)

- -1.68% - Summerset Group Holdings Ltd (SNZ.AX)

Hawkish hike from BOC

The Bank of Canada (BOC) followed the RBNZ with a 50-bps hike. This is their most aggressive hike in nearly 22 years and has seen the central bank increase rates by 75-bps over the past two meetings. They also began quantitative tightening (QT) which is where is lets purchased bonds roll off its balance sheet, and a precursor to balance sheet reduction.

BOC governor said they’re concerned that inflation will become “entrenched”. The Canadian dollar traded broadly higher and was further bolstered by rising oil prices. NZD/CAD fell to a 2-month low despite RBNZ’s hawkish meeting.

Potential bullish reversal on GBP/AUD

After two notably bearish months, GBP/AUD is showing signs of a rebound from a key support level (1.7400) it failed to hold below. We can see on the four-hour chart that the market has formed an inverted head and shoulders pattern which projects an approximate target around 1.8000. Take note that the weekly pivot points (blue) will be reset on Tuesday after the public holiday, but prices are currently holding beneath the weekly R1 level. Interim targets sit around 1.7745 (wR2) 1.7800 near the monthly pivot point and 1.7842 swing high.

Elsewhere in currencies the euro turned higher ahead of today’s ECB meeting, which meant EUR/CAD failed to break lower in line with our bias. But it remains a pair to watch to see if it can break key support or instead extend its rally.

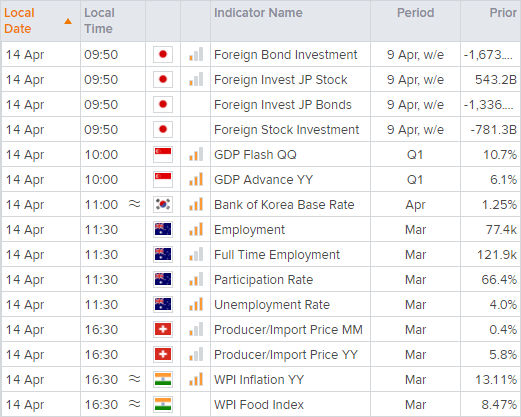

Up Next (Times in AEST)

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.