Asian Indices:

- Australia's ASX 200 index fell by -5 points (-0.07%) and currently trades at 7,476.70

- Japan's Nikkei 225 index has fallen by -58.65 points (-0.21%) and currently trades at 27,374.75

- Hong Kong's Hang Seng index has fallen by -251.46 points (-1.14%) and currently trades at 21,818.27

- China's A50 Index has fallen by -142.96 points (-1.02%) and currently trades at 13,922.19

UK and Europe:

- UK's FTSE 100 futures are currently down -21 points (-0.27%), the cash market is currently estimated to open at 7,763.87

- Euro STOXX 50 futures are currently down -17 points (-0.41%), the cash market is currently estimated to open at 4,141.63

- Germany's DAX futures are currently down -65 points (-0.43%), the cash market is currently estimated to open at 15,061.08

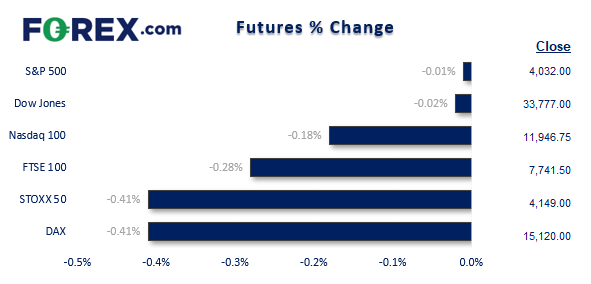

US Futures:

- DJI futures are currently down -3 points (-0.01%)

- S&P 500 futures are currently down -22.75 points (-0.19%)

- Nasdaq 100 futures are currently down 0 points (0%)

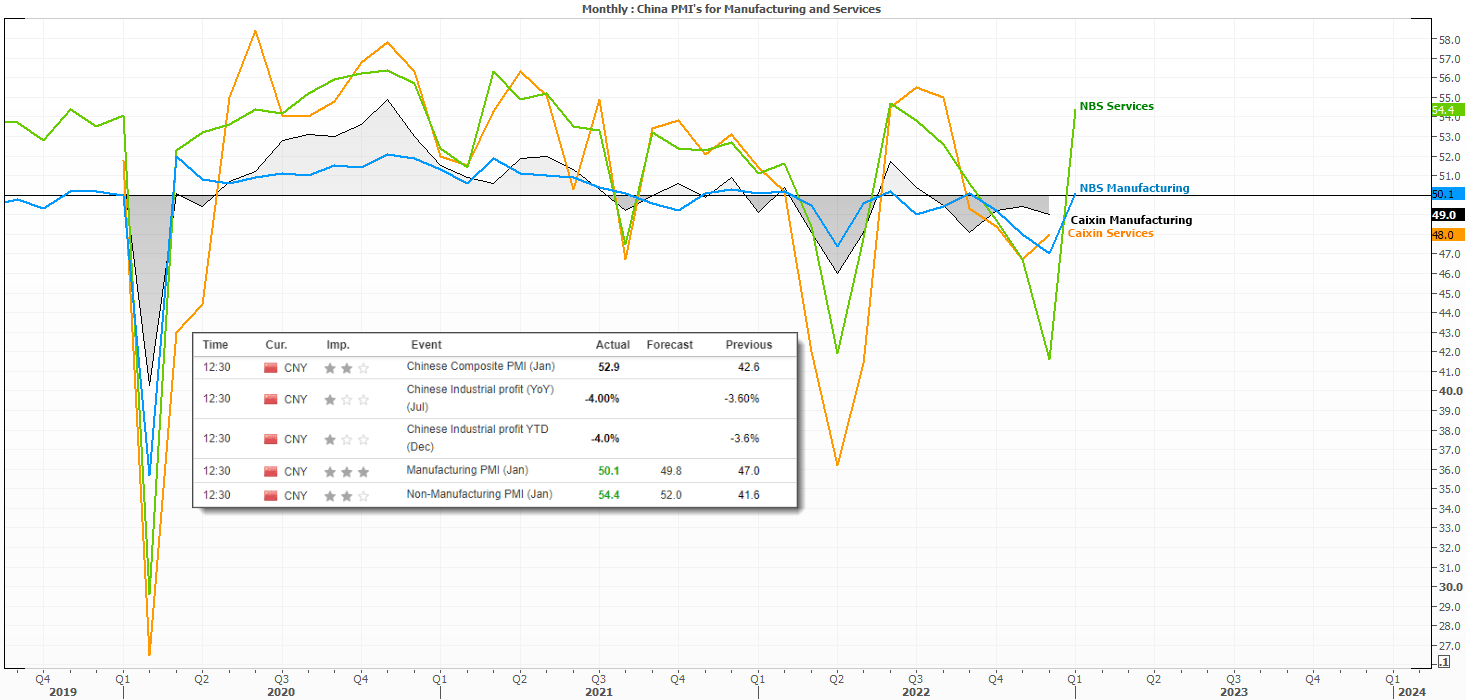

- China’s PMI beat expectations and expanded, which could give global growth prospects a boost as China continues to reopen

- According to official data from NBS, the services PMI rose 54.4 compared with 52 forecast, and manufacturing squeezed in a slight expansion of 50.1 compared with the 48.2 forecast

- AUD was the weakest major overnight after (much) weaker than expected retail sales reveals December is producing increasingly disappointing numbers

- Despite this, oil prices have continued lower and reached out initial downside target mentioned in yesterday’s European report, which now brings trend support on the daily chart into focus

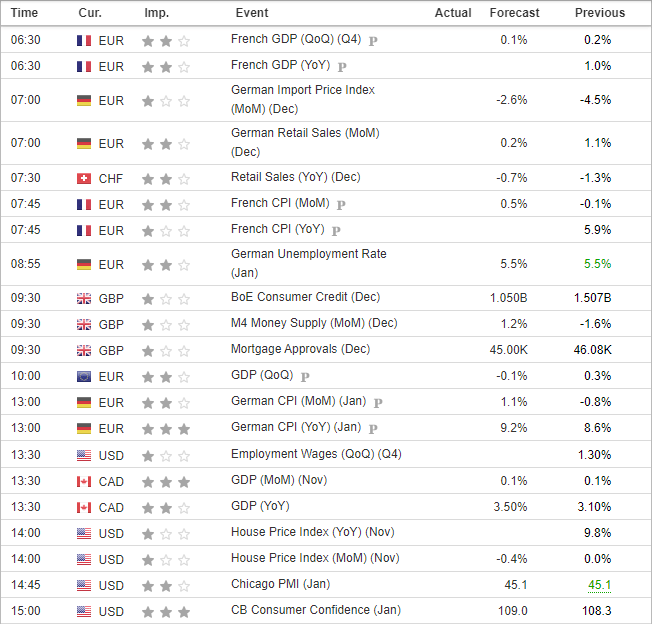

- There’s quite a few data points for Europe including GDP and inflation for France and Germany, although none of it is considered ‘top tier’

- So we could be in for a low volatility session like yesterday, given we’re fast approaching the FOMC meeting which tends to stifle volatility anyway

- With that said, implied volatility is creeping higher for FX majors as traders attempt to hedge their risk on the options market

- Equity sentiment remains caution ahead of the FOMC meeting tomorrow, with index futures markets pointing to a weak open and looking past stronger data from China

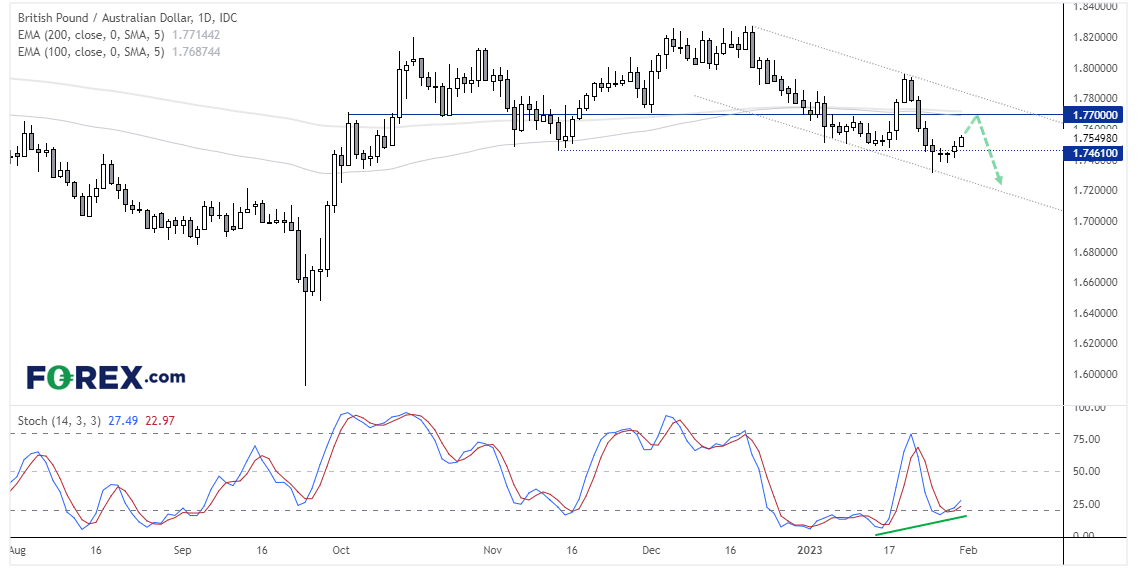

GBP/AUD daily chart:

GBP/AUD trades within a bearish channel on the daily chart, but appears to be within a countertrend move.

Weak retail sales has helped GBB/AUD recover back above the November low, having already printed a long bullish hammer with a couple of small inside candles (DOJI’s) to show bears were losing steam. A buy signal has been generated on the stochastic oscillator, which also produced a bullish divergence relative to the two recent price action lows. Given GBP/AUD has the ability to generate decent swings, then we like the pair for a potential long setup over the near-term.

Bulls could seek a move towards 1.7700 near the 100 and 200-day EMA’s on the daily chart, or seek bullish continuation patterns on the 1 or 4-hours charts to increase the potential reward to risk ratio.

Economic events up next (Times in GMT)