Key takeaways

- The RBA held their cash rate at 4.1%, wrongfooting bets of a 25bp hike and sending AUD pairs lower.

- Inflation remains “too high” and “further tightening may be required” according to the statement

- This suggests that the pause doesn’t necessarily mean the peak

- RBA’s cash rate remains relatively low and further hike/s seem more likely given strong employment figures, expectations for higher wages and relatively high levels of inflation

- The ASX 200 rose to an 8-day high whilst AUD pairs were broadly lower

- AUD/USD remains stuck between 0.6600 – 0.6680 (for now)

- Potential swing-trade long for GBP/AUD

The RBA held interest rates at 4.1% after surprising markets with two 25bp hikes heading into today’s meeting. Whilst a pause may come as a relief to some, I doubt we’re at the peak rate although we may not be far off. But I think there’s an argument to make to just get the job done already. At 4.1% the RBA’s cash rate remains at very low rates compared to their peers, yet they pause whilst simultaneously acknowledging that ‘inflation is still too high’ and wages are expected to rise. I think the UK is a great example of what can come if you try to tread on monetary-policy eggshells when inflation is involved, who have been forced to hike by 50bp so soon after considering a pause. Sure, the UK’s problems are different to that of Australia, but (relatively) lower rates also allows the potential for inflation expectations to rise – especially if Australia continues to post such strong employment figures alongside relatively high inflation rates.

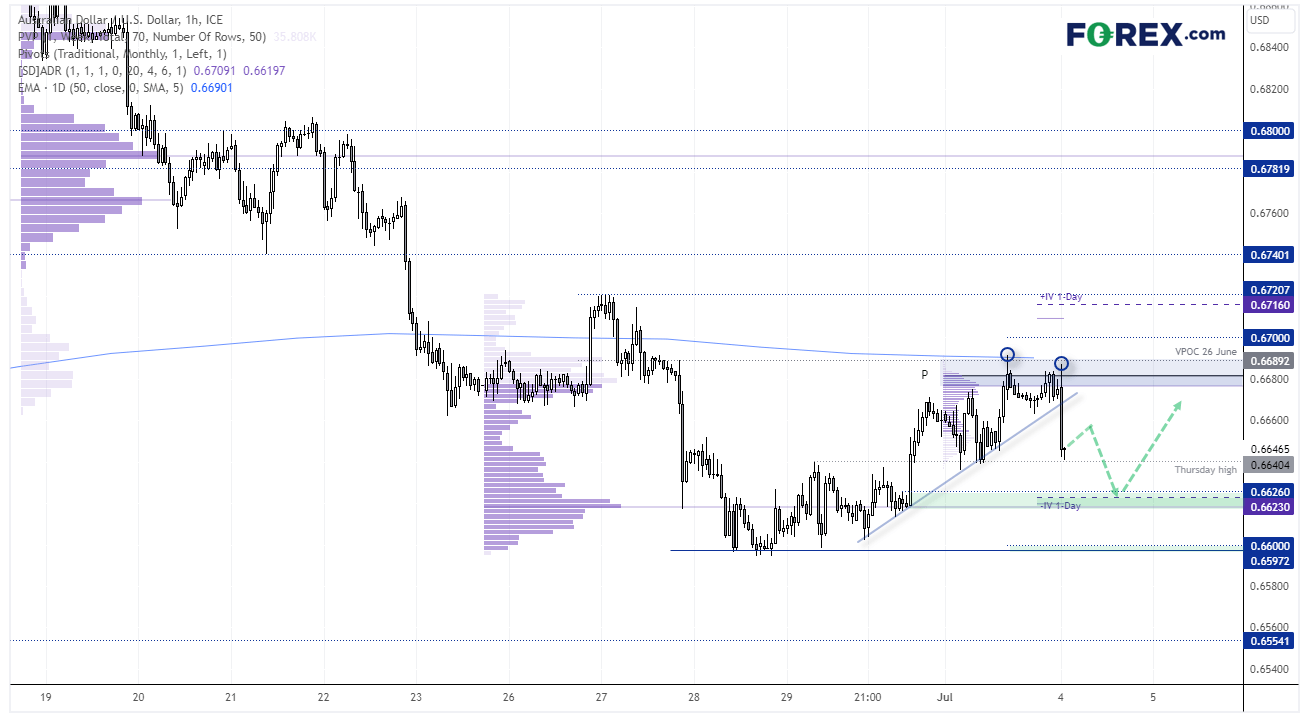

AUD/USD 1-hour chart:

The RBA’s pause meant our bullish bias outlined in today’s Asian Open report did not go has hoped. A double top formed around the 50-day EMA ahead of the announcement, before momentum turned lower and broke a bullish trendline on the 1-hour chart. Support has been found (once again) around Thursday’s high, so perhaps we’ll see a minor bounce before its next leg lower towards the 0.6620 support zone (near the 1-day implied volatility band).

Whilst the RBA paused it was not a dovish statement, so I suspect the downside could be limited unless we see US data strengthen through the week (with another ISM report and several employment figures including Nonfarm Payroll on the roster).

It seems for now AUD/USD is caught between 0.6700 – 0.6680, and we’d prefer to seek intraday swing trades between these levels as opposed to remaining with the bullish bias we’d warmed to on the daily chart (for now).

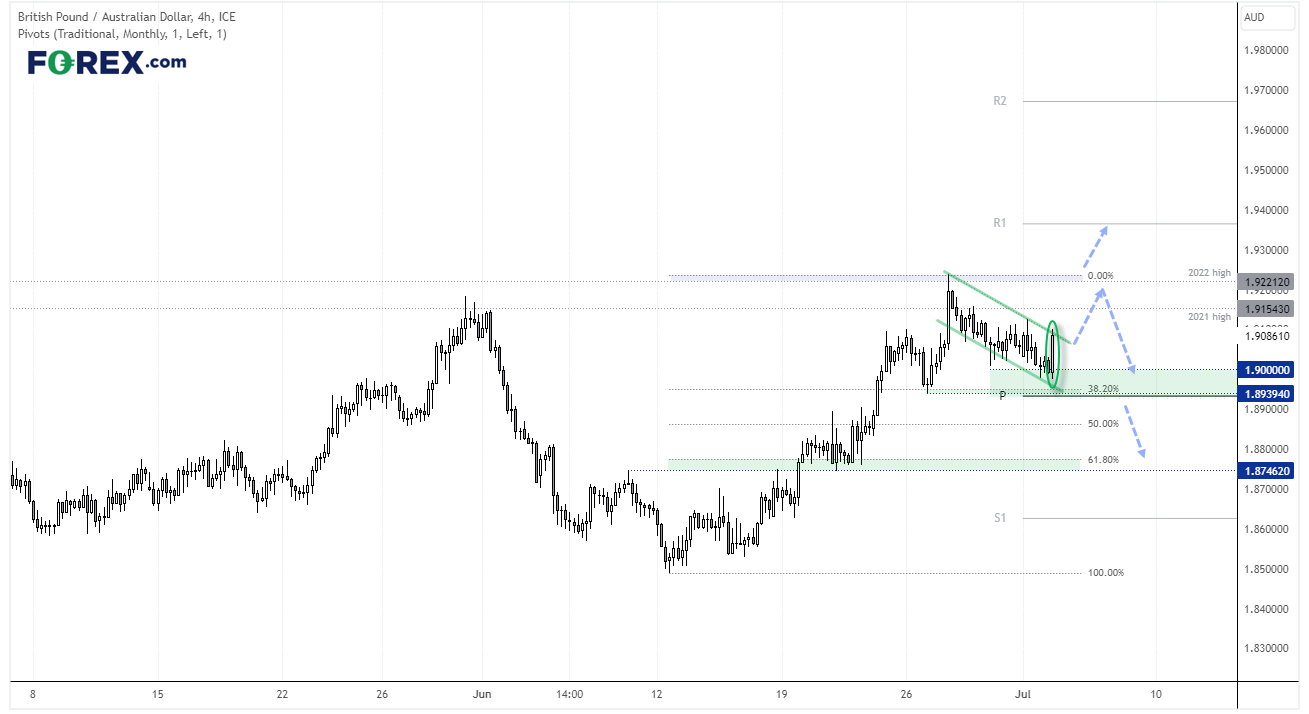

GBP/AUD 1-hour chart:

GBP/AUD may be another AUD pair to watch given the BOE’s higher interest rates (and level of hawkishness for future policy). The 4-hour candle is on track for a bullish engulfing bar, although resistance has been met at the resistance level of a potential bull flat. But with demand around the 1.0900 level, it could be one to watch for a breakout – even if only to retest the 2022 high. However, a break above this level clears the skies for the cross, whilst a break below 1.8900 brings support around 1.8750 into focus.

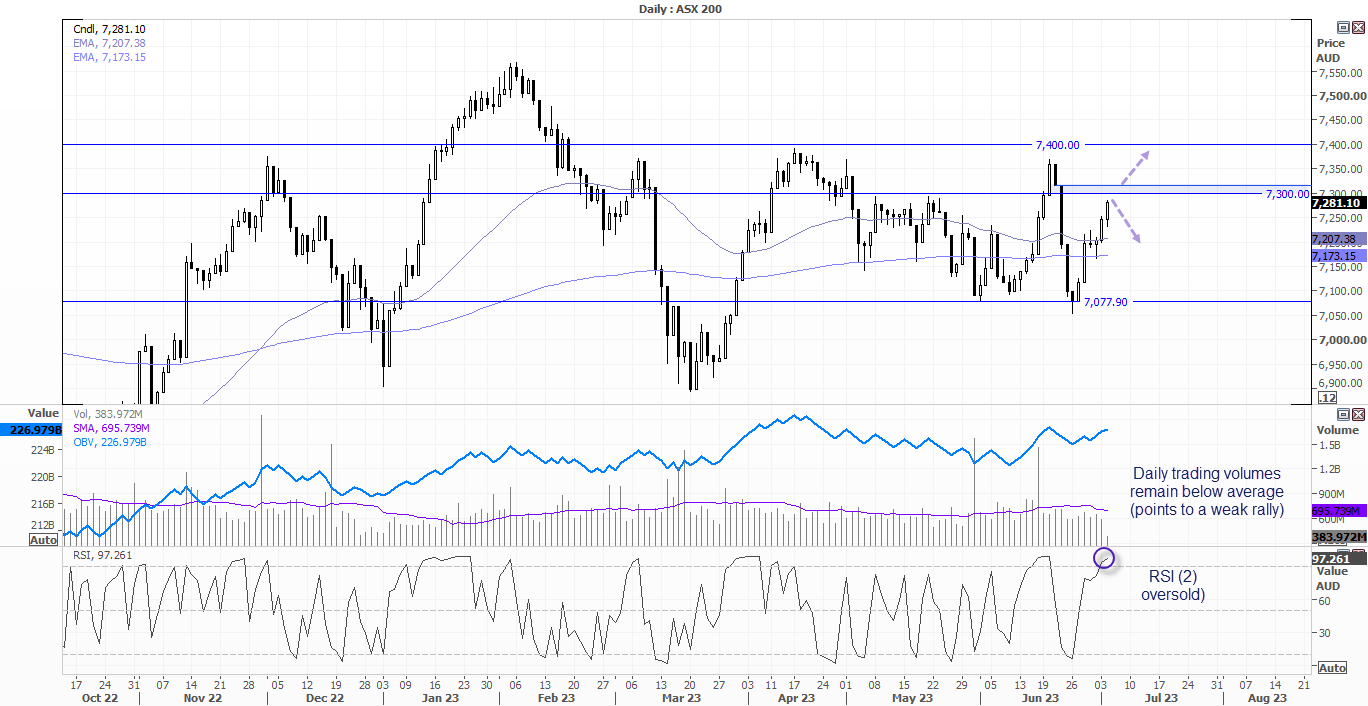

ASX 200 daily chart:

Today’s pause came as a relief to equity bulls, with the ASX 200 rising to an 8-day high. But with a daily range of around 50 points, there remains some caution due to the hawkishness of the RBA’s statement. But whilst today’s pause may not mark the peak, the ASX looks determined to tap 7300 this week. But it may need to look for global sentiment to pick up to hold on to recent gains.

Furthermore, daily trading volumes have remained below their 20-day average for the past couple of weeks which points to a weak rally. And until we see a break above 7400, the ASX risks being knocked form its perch unless buyers up their game.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge