- Fed Chair Janet Yellen’s testimony before both chambers of Congress on Tuesday/Wednesday appeared to strike a slightly more hawkish tone, as Yellen stated that it would be “unwise” to delay raising interest rates further.

- When the dust settled, however, dollar traders are not any closer to discerning when or whether a rate hike might occur on the immediate horizon. Though Yellen did note that gradual normalization of monetary policy is warranted given increases in employment and inflation, she also qualified that by acknowledging risks and uncertainties in the economy – including unknowns regarding US fiscal policy.

- Though the US dollar had been given a boost in the days preceding and during Yellen’s testimony, Thursday saw a sharp pullback as continued Fed uncertainty weighed on the greenback.

- At the current time, the Fed Fund futures market continues to see a relatively low 22% probability of a mid-March rate hike. May and June prospects rise considerably higher, but those higher probabilities have arguably already been priced-in to the recently rebounding dollar.

- Speculation over Fed action has long been one of the primary movers of the US dollar against its global currency counterparts. But when the uncertainties surrounding the trade/economic policies of the new and volatile Trump Administration are added to the mix, the dollar is now subject to many different and often opposing factors.

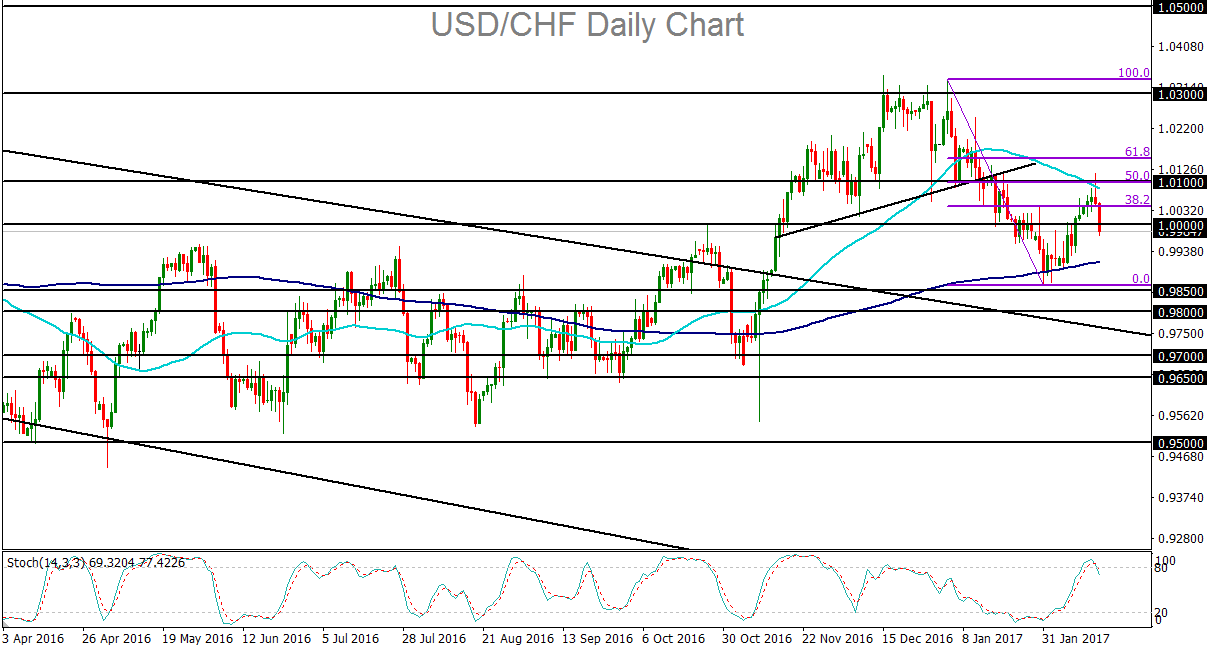

- From a technical perspective, the USD/CHF currency pair dropped back below parity (1.0000) on Thursday as the US dollar pulled back. This drop was initiated a day earlier (Wednesday), after USD/CHF briefly pierced 1.0100 to the upside before forming a “shooting star” bearish reversal candle right around the 50-day moving average and a key 50% Fibonacci retracement level. With any continued short-term downside ahead of the next Fed meeting a month from now, the nearest major bearish target is around the 0.9850 support level, which is the area of the last major low.

Latest market news

Today 02:05 PM

Today 11:59 AM

Yesterday 11:06 PM