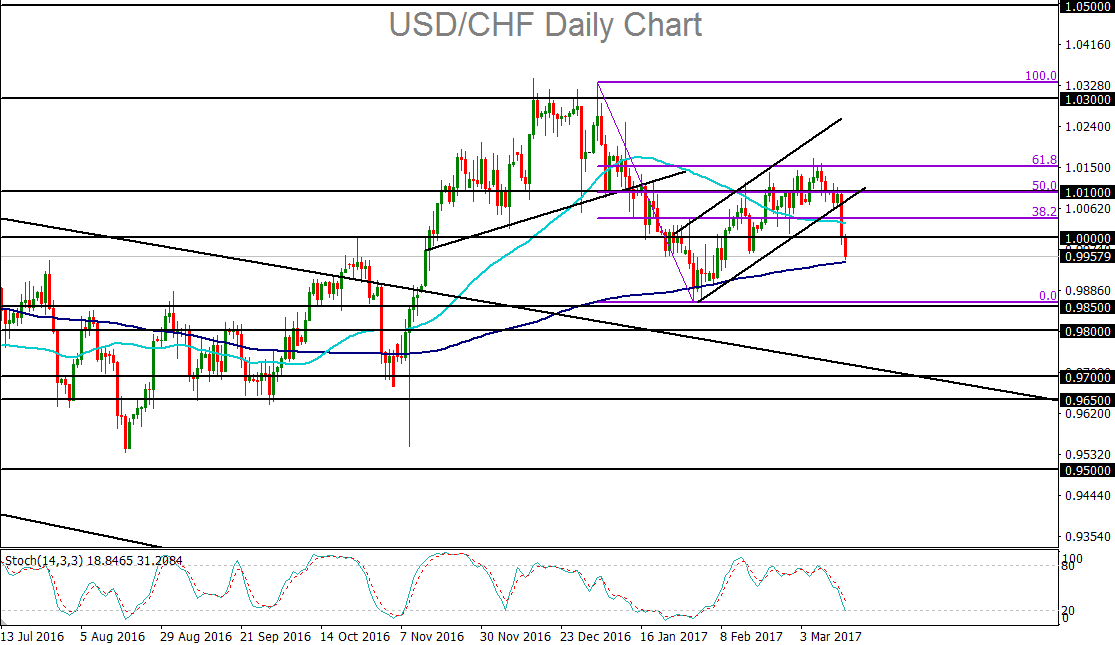

- USD/CHF broke down sharply below a rising trend channel and returned to parity (1.0000) on Wednesday. This occurred after the US Federal Reserve raised interest rates by a quarter point to 0.75-1.00% but issued an unexpectedly dovish outlook, which led to a steep plunge for the US dollar.

- This Fed-driven dovish sentiment continued into Thursday as the dollar remained pressured, helping push USD/CHF to break cleanly below parity and reach back down to its 200-day moving average.

- Aside from the Bank of Japan and Bank of England, Thursday also featured the Swiss National Bank’s (SNB) monetary policy assessment and Libor rate. The central bank kept the target range unchanged at -1.25% to -0.25%, with a midpoint at -0.75%, as expected. In its assessment, the SNB again asserted that "the Swiss franc is still significantly overvalued. The negative interest rate and the SNB’s willingness to intervene in the foreign exchange market are intended to make Swiss franc investments less attractive."

- The fall of USD/CHF has been swift and dramatic since the Fed’s Wednesday announcement, and perhaps somewhat overdone. After all, projections for the path of Fed rate hikes are essentially the same as they were in December, and could very well accelerate at any time in reaction to expected fiscal policies and inflation pressures. Therefore, it remains unlikely at this point that a new bearish trend has begun for the dollar.

- As long as the US economy continues to show the steady improvements that have been acknowledged by the Fed, and the Trump Administration continues to work towards further economic growth and fiscal spending, the dollar should continue to be supported despite the current short-term stumble.

- Having dropped below parity to hit its 200-day moving average, USD/CHF has reached down to a critical support juncture. The 200-day moving average last served as a strong support factor in January and February, when price bottomed out around 0.9850. If this moving average is unable to act as support this time, a further extension of the current breakdown could once again target that 0.9850 support level in the near-term. However, a strong bounce at or near the moving average should target a recovery towards the 1.0100-1.0150 resistance area to the upside.

Latest market news

Today 02:05 PM

Today 11:59 AM

Yesterday 11:06 PM