- The US dollar pulled back on Thursday after having rallied strongly for the first half of the week. Prior to this pullback, the dollar had been boosted sharply this week by rebounding US economic data and a corresponding rise in expectations for a June interest rate hike by the Federal Reserve.

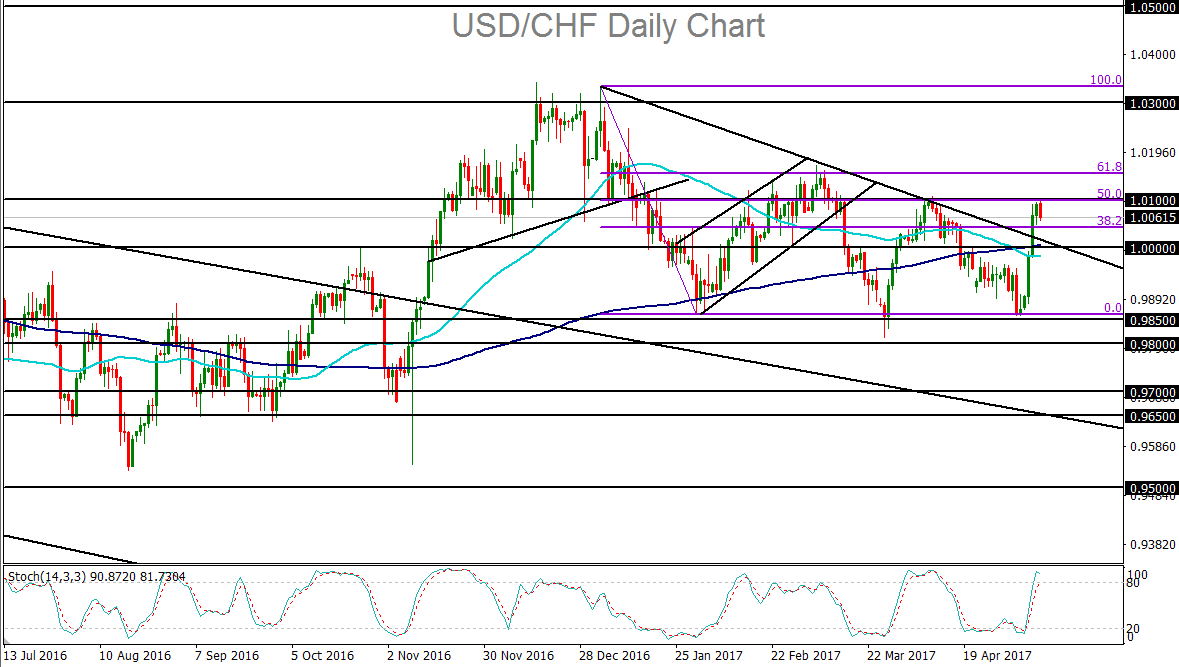

- This dollar strength has helped push USD/CHF up to key resistance at the 1.0100 level, retesting April’s highs, before Thursday’s pullback.

- The Swiss franc continues to carry a generally bearish bias, as the Swiss National Bank (SNB) remains more dovish than its European counterparts, including the Bank of England and European Central Bank, which are both at least entertaining the potential for eventual policy tightening. This, of course, places the SNB in a far more dovish position currently than the already-tightening Fed. Additionally, the SNB continues to consider its currency as overvalued, and has been known to intervene as it sees fit in stemming the rise of the franc.

- Against this current backdrop of rather acute monetary policy divergence between the Fed and the SNB, the potential for further strengthening of USD/CHF remains likely, especially in light of the high potential for a June rate hike by the Fed.

- Although March showed a series of lackluster economic data points out of the US, April has appeared to show a rebound, especially with respect to last week’s strong US employment figures – a sharp gain in jobs added to the economy in April and a long-term low in unemployment. As for US inflation, Thursday’s Producer Price Index showed a greater-than-expected rise in producer prices, which also helps support an upcoming Fed rate hike. Friday will bring the Consumer Price Index release, which is also expected to show a significant rise in April after a contraction in March.

- While USD/CHF, as noted, has pulled back from the key 1.0100 resistance level on Thursday, the fundamentals currently support a potential breakout to the upside, especially if US economic data continue to show strength. This week, the currency pair has already broken out above parity (1.0000) and an important downtrend resistance line extending back to the 1.0300-area highs in the beginning of the year. If USD/CHF manages to stay above this trend line, a breakout above 1.0100 could be imminent. In the event of such a breakout, USD/CHF could once again begin targeting major upside resistance around the noted 1.0300-area highs.

Latest market news

Today 02:05 PM

Today 11:59 AM

Yesterday 11:06 PM