US index futures

- Dow futures +0.0% at 35,891

- S&P futures +0.2% at 4713

- Nasdaq 100 futures +0.4% at 16,389

European indices

- FTSE -0.1% at 7,282

- DAX +0.9% at 15,771

- EURO STOXX +0.7% at 4227

Global risk appetite firms up heading into central bank bonanza

Market participants are feeling optimistic at the start of the week, with major indices in Europe rising and US stocks poised to open moderately higher and near record high territory, essentially erasing the turn-of-the-month drop on fears over a more aggressive Fed taper and the Omicron variant. Even news that the first UK patient died with the Omicron variant and that the country was preparing for a “tidal wave” of cases could not derail bulls’ sentiment. Yields on US Treasury bonds are also ticking lower, confirming the early strength in equity markets.

Looking ahead, this week’s market highlights will come from central bank pronouncements, with the most-watched gatherings taking place through the middle of the week, including monetary policy meetings from the Fed on Wednesday, as well as the BOE and ECB on Thursday.

See my colleague Joe Perry’s Week Ahead preview report for an overview of this week’s key events!

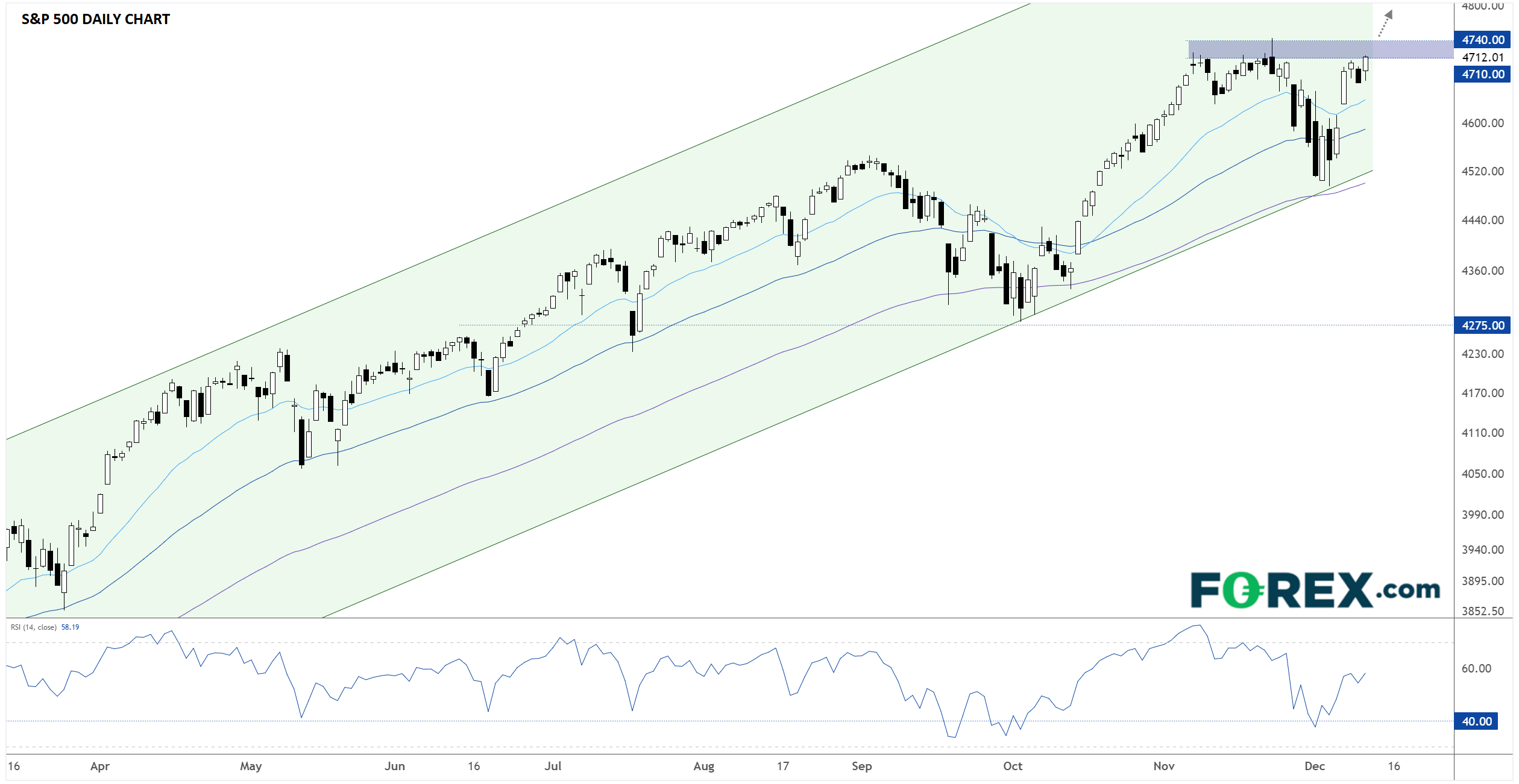

Where next for the S&P 500?

The widely-followed broad US index is set to open near record territory above 4,700, following a short-lived 4% pullback to end November. As any experienced trader will tell you, the trend is your friend when you’re trading using technical analysis, and in that vein, the path of least resistance remains to the topside for the S&P 500. If the index can confirm a close above 4,710 and ideally 4,740 this week, it would increase the odds of a year-end close above 4,800:

Source: TradingView, StoneX

FX: USD rises in otherwise quiet trade

The world’s reserve currency is the strongest of the majors heading into a US session with a barren economic calendar. After Friday’s relatively hot CPI report, most traders expect the Fed to accelerate its taper program later this week, a key step on the path to raising interest rates in the first half of next year. This, in turn, could underscore the widening monetary policy divergence between the US and Eurozone if the ECB hints at extending its asset purchases on Thursday.

- EUR/USD -0.25% at 1.1287

- GBP/USD -0.06% at 1.3259

Oil edges lower to start the week

Oil prices are ticking down nearly -1% to start the week after seeing its largest weekly gain since August last week on declining Omicron fears. Like most other major markets, oil is likely to take its cue from this week’s parade of central bank meetings before settling down as many traders leave their desks for the final two weeks of the year.

- WTI crude trades -0.8% at $71.35

- Brent trades -0.7% at $74.87

Looking ahead

- 17:30 GMT: BOE Governor Bailey speaks about the UK’s Financial Stability Report in London

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.