Asian Indices:

- Australia's ASX 200 index fell by -4.4 points (-0.06%) and currently trades at 7,153.60

- Japan's Nikkei 225 index has risen by 817.47 points (0.0298%) and currently trades at 28,263.57

- Hong Kong's Hang Seng index has risen by 505.98 points (2.92%) and currently trades at 17,831.64

- China's A50 Index has risen by 161.88 points (1.32%) and currently trades at 12,424.99

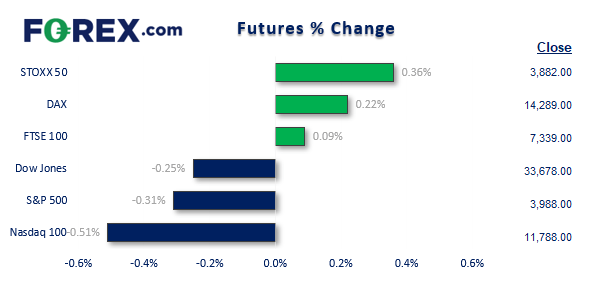

UK and Europe:

- UK's FTSE 100 futures are currently up 6.5 points (0.09%), the cash market is currently estimated to open at 7,324.54

- Euro STOXX 50 futures are currently up 14 points (0.36%), the cash market is currently estimated to open at 3,882.50

- Germany's DAX futures are currently up 32 points (0.22%), the cash market is currently estimated to open at 14,256.86

US Futures:

- DJI futures are currently down -91 points (-0.27%)

- S&P 500 futures are currently down -63.25 points (-0.53%)

- Nasdaq 100 futures are currently down -13 points (-0.32%)

US President Joe Biden is set to have his first face to face meeting with China’s President Xi Jinping. The meeting takes place in Bali ahead of the 2-day G20 meeting on Tuesday and Wednesday, and they are expected to discuss issues surrounding Taiwan, Ukraine and North Korea.

Equities were mixed across Asia, with China’s benchmark indices leading the pack on reports that China are slowly scaling back some of their COVID-19 restrictions.

Volatility was relatively tame compared to the levels seen on Thursday and Friday, with a quiet economic calendar during the Asian session allowing markets to catch their breath following recent turbulence. The US dollar is currently the strongest major and the Swiss franc is the weakest as prices have been allowed to retrace against their recent moves.

Fed member Christopher Waller highlighted that the markets were 'way out in front' regarding their reaction to the US inflation report, and that it was "just one data point". He said that the Fed will need to see a run of inflation reports (coming in softer) before the Fed can stop hiking, citing the "enormous" rate of inflation at 7.7%.

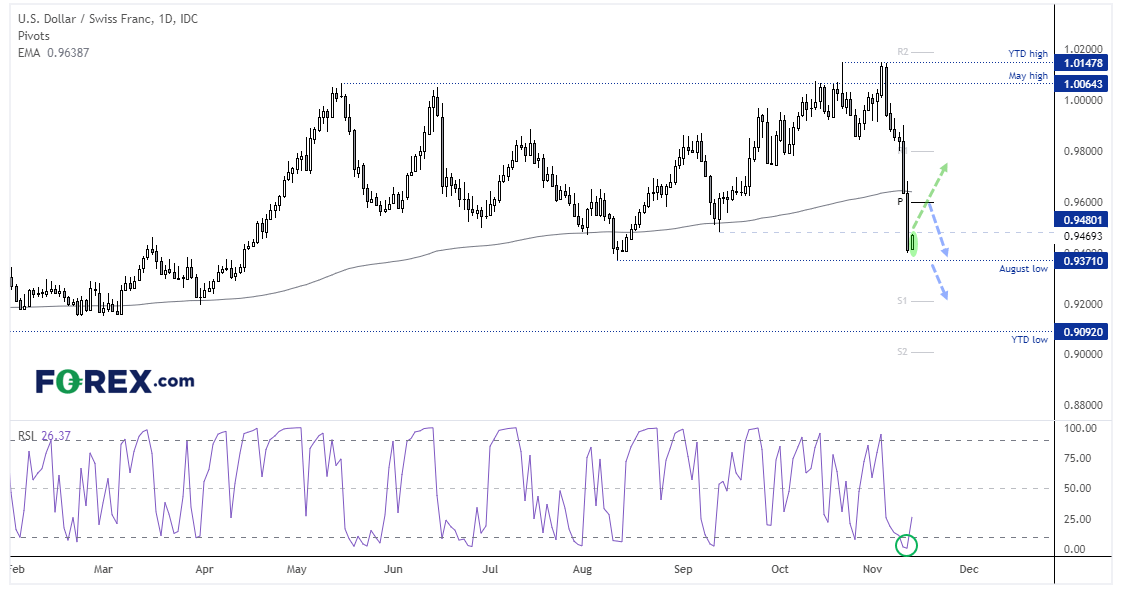

USD/CHF daily chart

USD/CHF fell over 5% on Thursday and Friday following the weaker inflation report, breaking beneath the 200-day EMA in the process. Yet it closed the week above the August low, and the RSI (2) was at an extremely oversold level of 0.62 which suggest some mean reversion is due. In fact it is currently the strongest major pair during light Asian trade and considering a break above the 0.9480 low – and could be set to retrace towards the weekly pivot point and 200-day EMA around 0.9600 to 0.9640. Whether it can break above that resistance level remains to be seen and also open to its potential to top out and break to new lows. But the bias is cautiously bullish over the near-term.

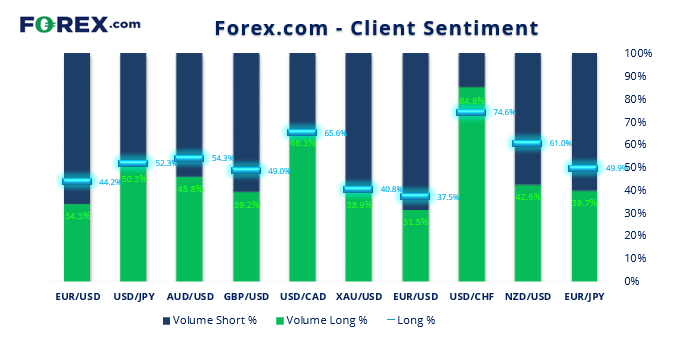

Furthermore, note that forex.com clients are currently bullish on the pair, with 84.8% if the net long and 74.6% of trading volume also long. Typically this might be read as a contrarian signal, yet given the overextended move to the downside I am making the assumption that in this instance the clients also have a contrarian mindset. And so far today, it seems to be working.

FTSE 350 – Market Internals:

FTSE 350: 4074.95 (0.66%) 11 November 2022

- 229 (65.43%) stocks advanced and 112 (32.00%) declined

- 6 stocks rose to a new 52-week high, 0 fell to new lows

- 12.57% of stocks closed above their 200-day average

- 50.57% of stocks closed above their 50-day average

- 5.43% of stocks closed above their 20-day average

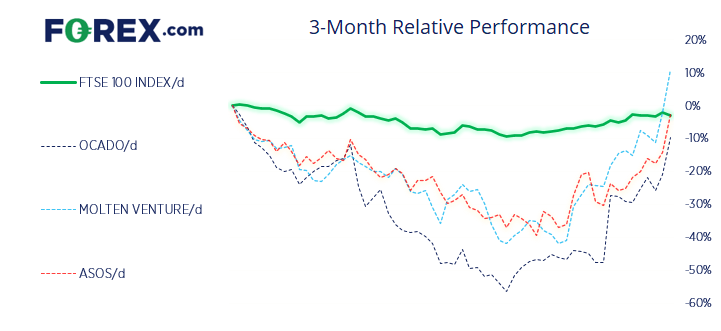

Outperformers:

- + 13.85% - Ocado Group PLC (OCDO.L)

- + 13.48% - Molten Ventures PLC (GROW.L)

- + 13.38% - ASOS PLC (ASOS.L)

Underperformers:

- -8.11% - BAE Systems PLC (BAES.L)

- -7.83% - Beazley PLC (BEZG.L)

- -6.01% - GSK plc (GSK.L)

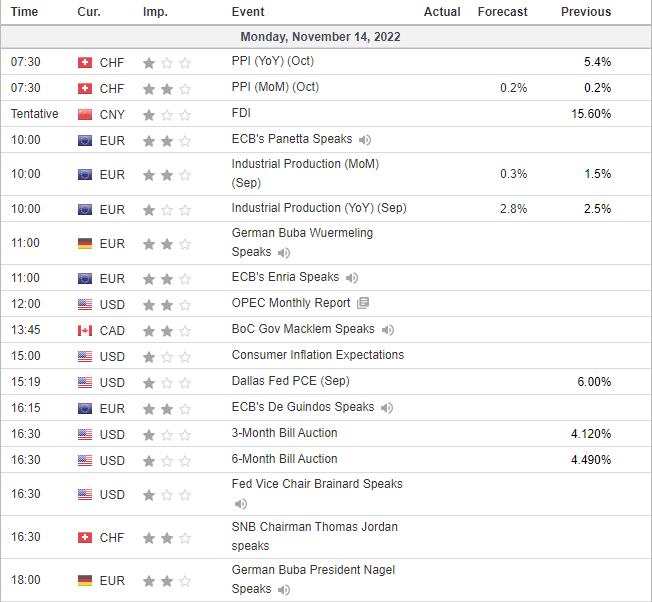

Economic events up next (Times in GMT)

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.