Despite acute US dollar strength throughout the month of October thus far, the USD/MXN currency pair has been in a virtual state of free fall due to a sharp and prolonged rebound for the Mexican peso that has corresponded with the deterioration of Donald Trump’s campaign for the US presidency.

This sharp rebound for the peso was initially triggered immediately after the first 2016 presidential debate between Donald Trump and Hillary Clinton on September 26th, in which Clinton was widely considered to be the victor. At that point, USD/MXN had just reached an all-time high around 19.92, which meant that the peso was at a record low against the dollar. The Mexican currency had become extremely oversold on concerns over Trump’s very public and hardline positions on trade and immigration with respect to Mexico.

Since that first presidential debate, the situation for the Trump campaign has continued steadily to deteriorate due to subsequent debate performances and various controversies surrounding Trump’s questionable comments in the past, attitudes towards women and minorities, claims of political conspiracy, and tax issues. This is not to say that Clinton has been lacking at all in her own very serious issues regarding her past words and actions, but Trump’s problems appear to have far eclipsed Clinton’s, especially among undecided voters. The situation has left the vast majority of polls and projections showing an increasingly wider lead by Clinton over Trump.

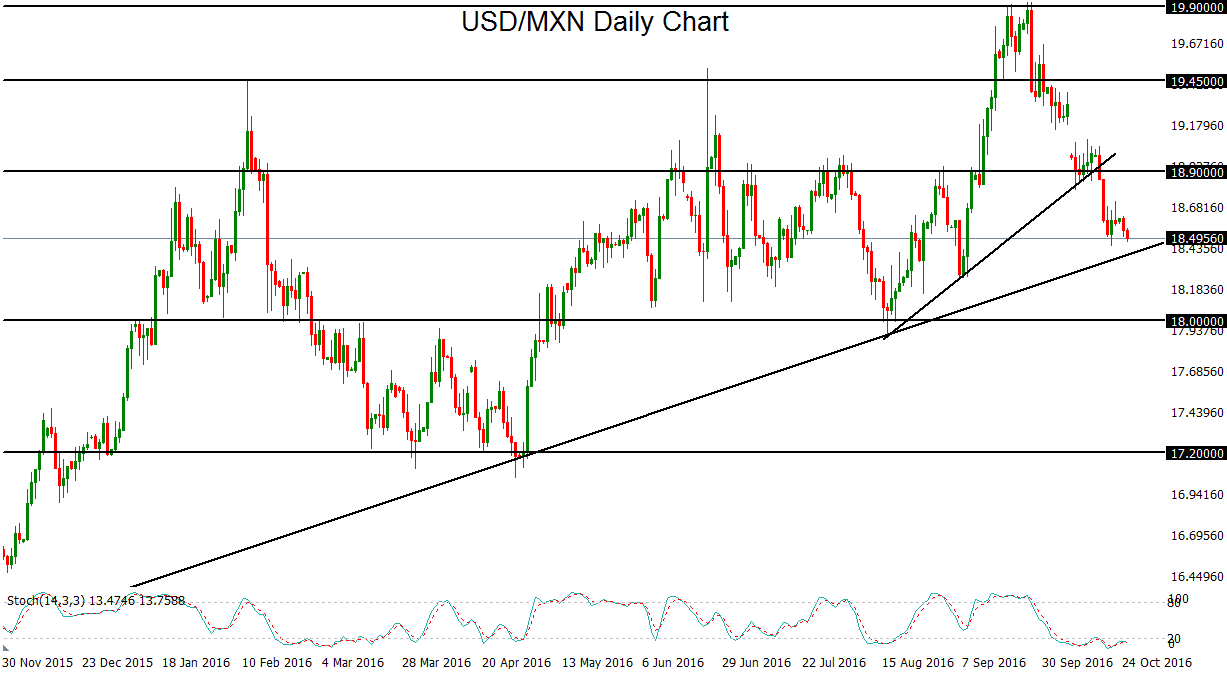

As a result, the oversold Mexican peso has found new life, even against the recent strength of the US dollar. After falling from its record high in late September, USD/MXN initially broke down below a key support level around 19.45 (prior resistance), and then went on to plunge further, below the 18.90 support level and a key short-term uptrend line extending back to the mid-August lows. As Trump’s standing further decreased the perceived risk of his victory in November, the peso continued to recover and USD/MXN followed-through to the downside to end up at its current position around 18.50, near a new October low.

Although the election is not yet over, with exactly two weeks left before the November 8 election, polls and markets are leaning rather heavily towards a Clinton victory. If this continues to be the case, barring any last-minute upset by the Trump campaign, the Mexican peso could have significantly further to rebound and recover. Currently nearing a long-term uptrend support line that extends back more than two years to late-2014, any subsequent breakdown below this major trend line should open the way towards a downside target at the key 18.00 psychological support level.

This sharp rebound for the peso was initially triggered immediately after the first 2016 presidential debate between Donald Trump and Hillary Clinton on September 26th, in which Clinton was widely considered to be the victor. At that point, USD/MXN had just reached an all-time high around 19.92, which meant that the peso was at a record low against the dollar. The Mexican currency had become extremely oversold on concerns over Trump’s very public and hardline positions on trade and immigration with respect to Mexico.

Since that first presidential debate, the situation for the Trump campaign has continued steadily to deteriorate due to subsequent debate performances and various controversies surrounding Trump’s questionable comments in the past, attitudes towards women and minorities, claims of political conspiracy, and tax issues. This is not to say that Clinton has been lacking at all in her own very serious issues regarding her past words and actions, but Trump’s problems appear to have far eclipsed Clinton’s, especially among undecided voters. The situation has left the vast majority of polls and projections showing an increasingly wider lead by Clinton over Trump.

As a result, the oversold Mexican peso has found new life, even against the recent strength of the US dollar. After falling from its record high in late September, USD/MXN initially broke down below a key support level around 19.45 (prior resistance), and then went on to plunge further, below the 18.90 support level and a key short-term uptrend line extending back to the mid-August lows. As Trump’s standing further decreased the perceived risk of his victory in November, the peso continued to recover and USD/MXN followed-through to the downside to end up at its current position around 18.50, near a new October low.

Although the election is not yet over, with exactly two weeks left before the November 8 election, polls and markets are leaning rather heavily towards a Clinton victory. If this continues to be the case, barring any last-minute upset by the Trump campaign, the Mexican peso could have significantly further to rebound and recover. Currently nearing a long-term uptrend support line that extends back more than two years to late-2014, any subsequent breakdown below this major trend line should open the way towards a downside target at the key 18.00 psychological support level.

Latest market news

Today 02:05 PM

Today 11:59 AM

Yesterday 11:06 PM