Stock markets, the dollar, gold, and the Mexican peso all reacted sharply over reports on Sunday that the FBI has not discovered any further incriminating evidence in its re-launched review of Presidential Candidate Hillary Clinton’s past emails. FBI Director James Comey wrote in a letter to Congress, “based on our review, we have not changed our conclusions that we expressed in July with respect to Secretary Clinton.” In July, the FBI had stated that it would not pursue charges against Clinton over her use of a private email server when she was US Secretary of State.

Barring any further developments in this still-ongoing investigation, financial markets took this as a clear sign that Clinton is destined to be voted-in as the 45th President of the United States on Tuesday’s election. As a result, the markets’ persistent fears over a possible victory by Clinton’s unpredictable opponent, Donald Trump, have abated, sending key markets to overreact to the upside.

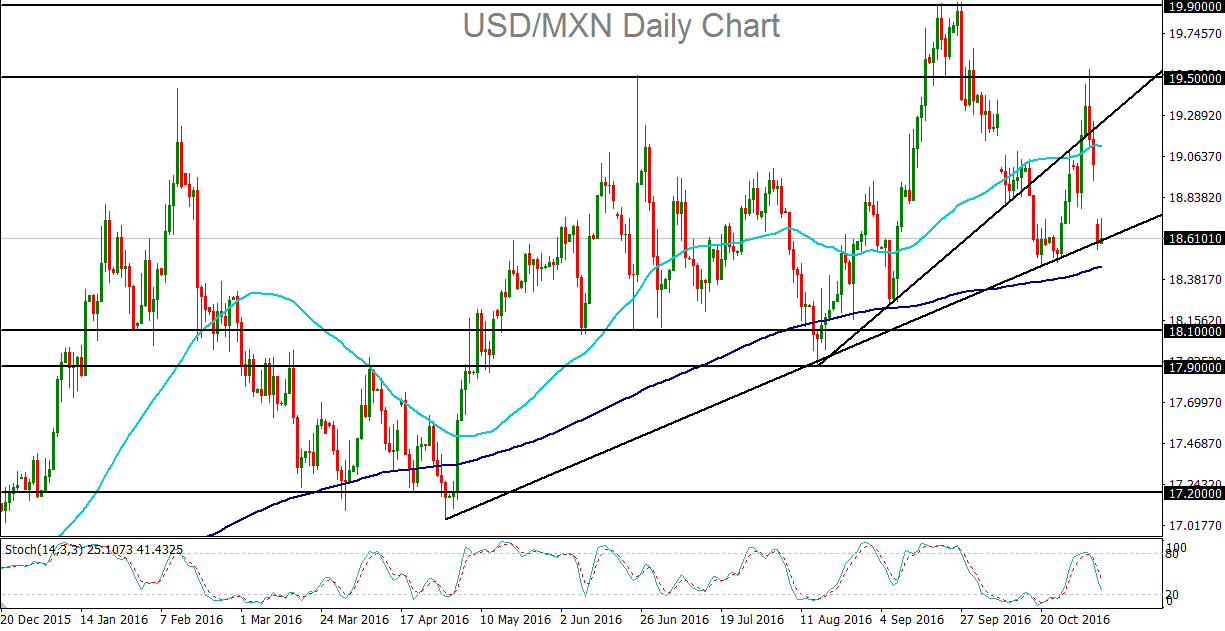

Late on Sunday, equity futures markets and the US dollar gapped up as the price of dollar-denominated, safe-haven gold gapped down on the abatement of Trump-fears. Notably, the Mexican peso, which has been inversely-correlated with the success of Trump’s campaign in recent months (due to his hardline positions on Mexican trade and immigration issues), shot up dramatically as a Trump defeat became increasingly likely. As a result, USD/MXN plunged precipitously despite US dollar strength.

Monday morning generally saw these moves maintained and extended as anticipation ran high that Clinton would extend her previously narrow lead after the FBI essentially cleared her of any legal wrongdoing.

As noted, the USD/MXN currency pair plunged on the FBI’s revelation, despite surging strength in the US dollar. This was due to the Mexican peso far eclipsing dollar-strength, sending USD/MXN plummeting down to a key uptrend support line that extends back to April’s lows. Despite the fact that some markets have overshot in a very short period of time in reaction to Sunday’s news, the peso is likely to have significantly further to run if Clinton wins tomorrow as the markets currently expect. In that event, a USD/MXN breakdown could pressure the currency pair down to a major support target around the 17.90 level. With any surprise victory by Trump, however, the peso (as well as the dollar) will likely go into a tailspin, potentially pushing USD/MXN swiftly back up towards 19.50 resistance to approach its 19.90-area all-time highs.

Barring any further developments in this still-ongoing investigation, financial markets took this as a clear sign that Clinton is destined to be voted-in as the 45th President of the United States on Tuesday’s election. As a result, the markets’ persistent fears over a possible victory by Clinton’s unpredictable opponent, Donald Trump, have abated, sending key markets to overreact to the upside.

Late on Sunday, equity futures markets and the US dollar gapped up as the price of dollar-denominated, safe-haven gold gapped down on the abatement of Trump-fears. Notably, the Mexican peso, which has been inversely-correlated with the success of Trump’s campaign in recent months (due to his hardline positions on Mexican trade and immigration issues), shot up dramatically as a Trump defeat became increasingly likely. As a result, USD/MXN plunged precipitously despite US dollar strength.

Monday morning generally saw these moves maintained and extended as anticipation ran high that Clinton would extend her previously narrow lead after the FBI essentially cleared her of any legal wrongdoing.

As noted, the USD/MXN currency pair plunged on the FBI’s revelation, despite surging strength in the US dollar. This was due to the Mexican peso far eclipsing dollar-strength, sending USD/MXN plummeting down to a key uptrend support line that extends back to April’s lows. Despite the fact that some markets have overshot in a very short period of time in reaction to Sunday’s news, the peso is likely to have significantly further to run if Clinton wins tomorrow as the markets currently expect. In that event, a USD/MXN breakdown could pressure the currency pair down to a major support target around the 17.90 level. With any surprise victory by Trump, however, the peso (as well as the dollar) will likely go into a tailspin, potentially pushing USD/MXN swiftly back up towards 19.50 resistance to approach its 19.90-area all-time highs.

Latest market news

Today 02:05 PM

Today 11:59 AM

Yesterday 11:06 PM