Key takeaways:

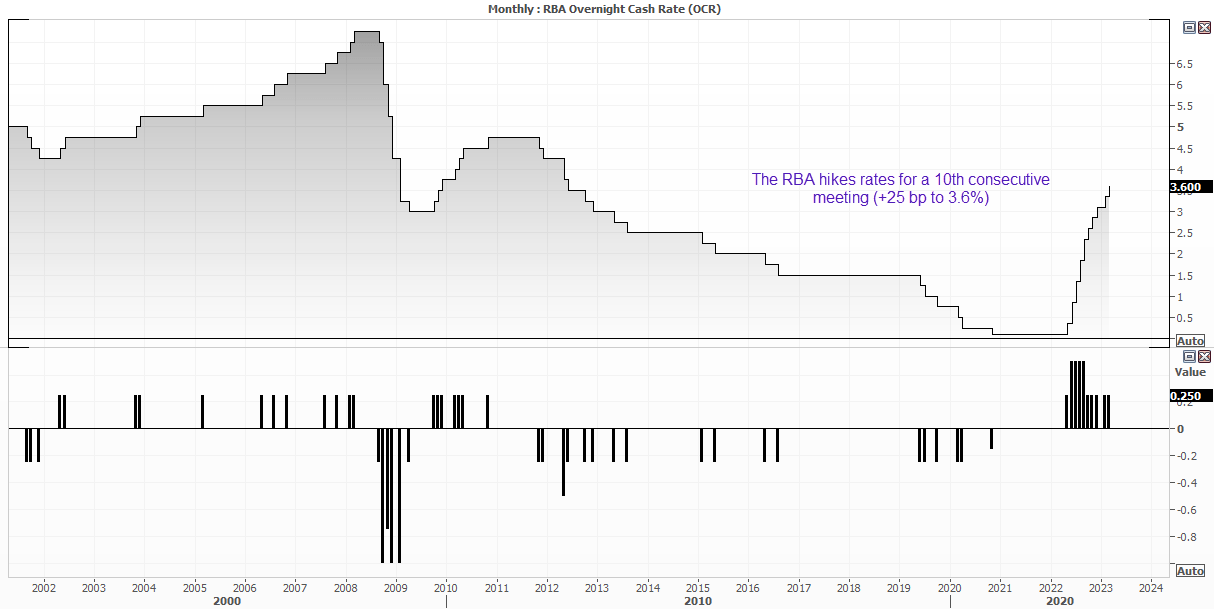

- The RBA hiked their overnight cash rate by 25bp to 3.6%

- It’s their 10th consecutive hike this cycle, totalling 350bp

- The statement is subtly less hawkish as they have removed a key sentence which effectively hinted at two or more hikes to come

- And this begs the question as to whether we’re now just one hike form the terminal rate, and whether they’re closer to publicly discussing a pause

Summary of the RBA’s March statement:

- Global inflation remains very high, although it is moderating

- … services price inflation remains elevated in many economies

- The monthly CPI indicator suggests that inflation has peaked in Australia

- Rents are increasing at the fastest rate in some years

- Medium-term inflation expectations remain well anchored, and it is important that this remains the case

- Household consumption growth has slowed due to the tighter financial conditions

- … the outlook for business investment remains positive

- The labour market remains very tight, although conditions have eased a little

- … recent data suggest a lower risk of a cycle in which prices and wages chase one another

- There is uncertainty around the timing and extent of the slowdown in household spending

An initial glance at RBA's statement suggests they are nearing the end of the tightening cycle, and perhaps one step closer to publicly discussing a pause. By removing "The Board expects that further increases in interest rates will be needed over the months ahead" in exchange for "The Board expects that further tightening of monetary policy will be needed to ensure that inflation returns to target", it means they’re no longer certain that two or more hikes will be coming. And that means there may be one final hike to come, to take rates to 3.85%.

Of course, a final 25bp hike is far from certain at this point, but the main takeaway for me is that the RBA have removed a key hawkish sentence from the February statement. And that is another step close to the end if their tightening cycle.

It’s also encouraging that they tipped their hat to the likelihood of ‘peak inflation’, acknowledged that a wage price spiral seems less likely and household consumption has slowed.

All in all, whilst price pressures and the potential for higher rates remain in place, this statement seems a lot less hawkish than the ones of the past few months.

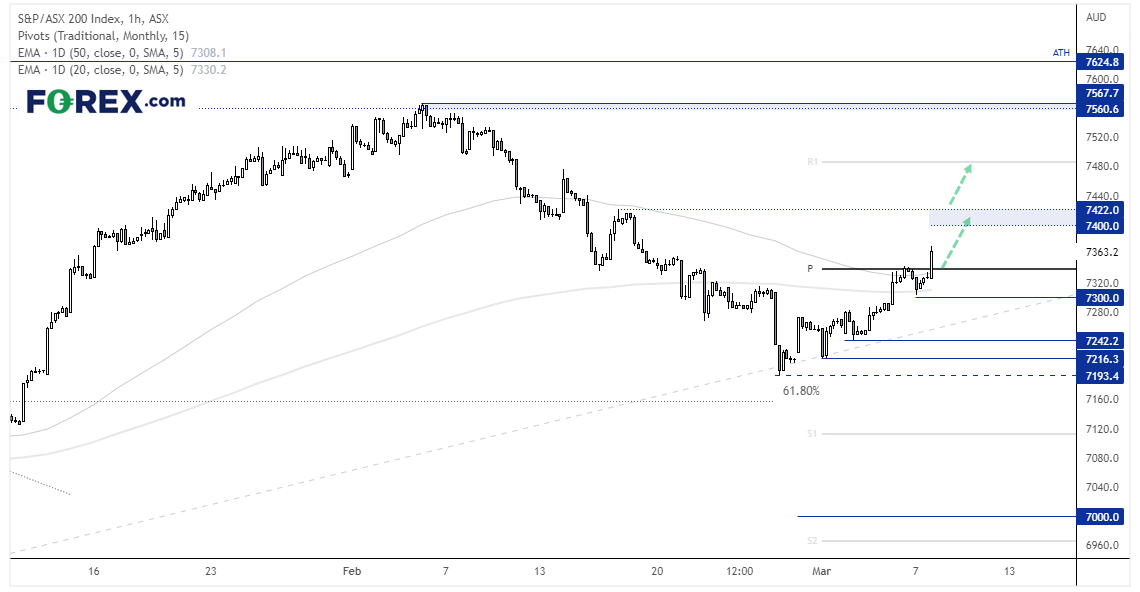

ASX 200 1-hour chart:

It would appear that markets agree with our view that the March statement is less hawkish, with the ASX rallying and the Aussie broadly lower. The ASX 200 has risen to a 12-day high, with 10 of its 11 sectors up for the day, led by energy and consumer discretionary. We had originally outlined a target for 7400 – and the market trades just 40 points below it. But if data continues to point towards softer inflation and lessen a need for an aggressive RBA, who knows we could even be looking at news highs for the index over the coming weeks or months. For now, our bias remains bullish above 7300, and are keep to seek bullish setups amidst low volatility retracements.

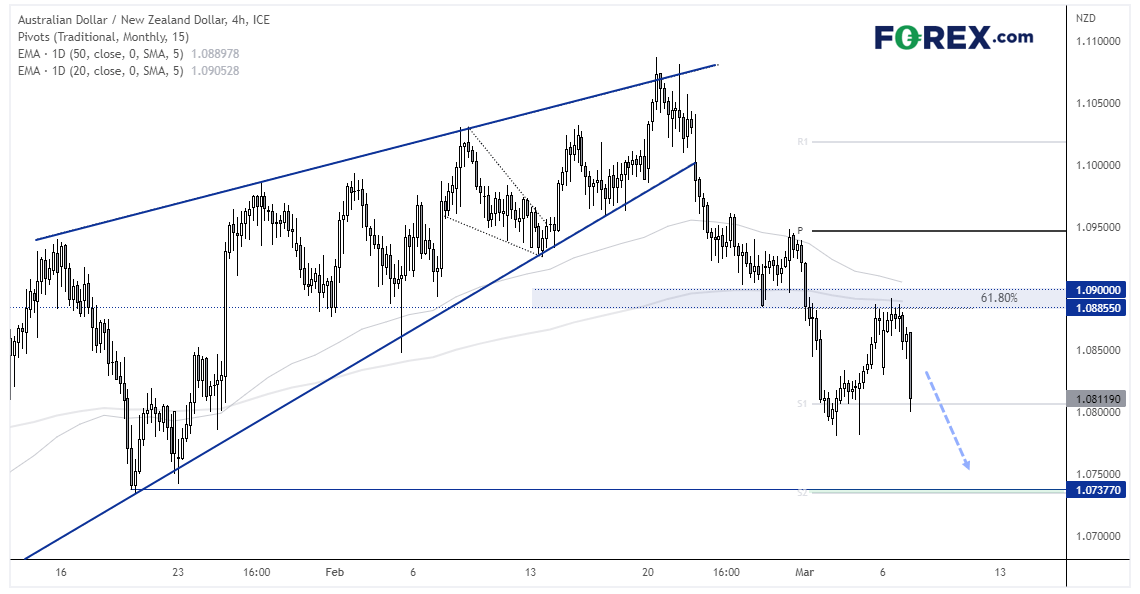

AUD/NZD 1-hour chart:

A setup we discussed in this morning’s client report is playing out nicely, with the resistance zone around 1.09000 holding ahead of the (less hawkish) RBA meeting, which has helped a prominent swing high form on the 4-hour chart. From here the bearish target remains the 1.0737 low which is projected from the rising wedge pattern still in play.

As we’re reacting to the news, we would prefer to wait for low volatility pullbacks within the current candle before reconsidering shows down to the next support level.

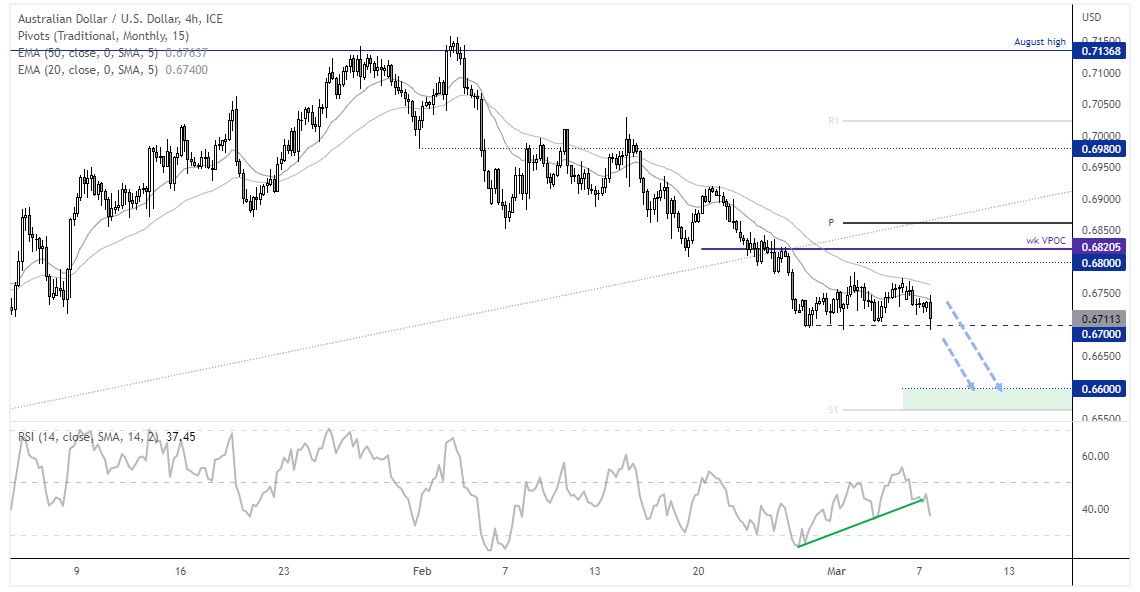

AUD/USD 4-hour chart:

The trend on the 4-hour chart remains bearish and it now appears as though the Aussie is ready to break below 0.7600 to mark the end of its consolidation phase. A hawkish testimony from Jerome Powell tonight could help with such a bearish break, assuming traders don’t push it lower at the European open. From here, the bias remains bearish below 0.6780 and for a move down to the monthly S1 / 0.6600 handle.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge