Asian Indices:

- Australia's ASX 200 index rose by 37.4 points (0.5%) and currently trades at 7,556.60

- Japan's Nikkei 225 index has fallen by -3.53 points (-0.01%) and currently trades at 36,222.95

- Hong Kong's Hang Seng index has risen by 223.03 points (1.4%) and currently trades at 16,122.90

- China's A50 Index has risen by 119.45 points (1.08%) and currently trades at 11,229.60

UK and European indices:

- UK's FTSE 100 futures are currently down -26 points (-0.35%), the cash market is currently estimated to open at 7,501.67

- Euro STOXX 50 futures are currently down -6 points (-0.13%), the cash market is currently estimated to open at 4,558.11

- Germany's DAX futures are currently down -40 points (-0.24%), the cash market is currently estimated to open at 16,849.92

US index futures:

- DJI futures are currently up 75 points (0.2%)

- S&P 500 futures are currently up 0.75 points (0.02%)

- Nasdaq 100 futures are currently down -4.75 points (-0.03%)

Events in focus (GMT):

- 09:00 – German Ifo business sentiment

- 13:15 – ECB interest rate decision

- 13:30 – Canadian average earnings

- 13:30 – US GDP, jobless claims, durable goods orders, Chicago Fed national activity index

- 13:45 – ECB press conference

- 15:15 – ECB President Lagarde speaks

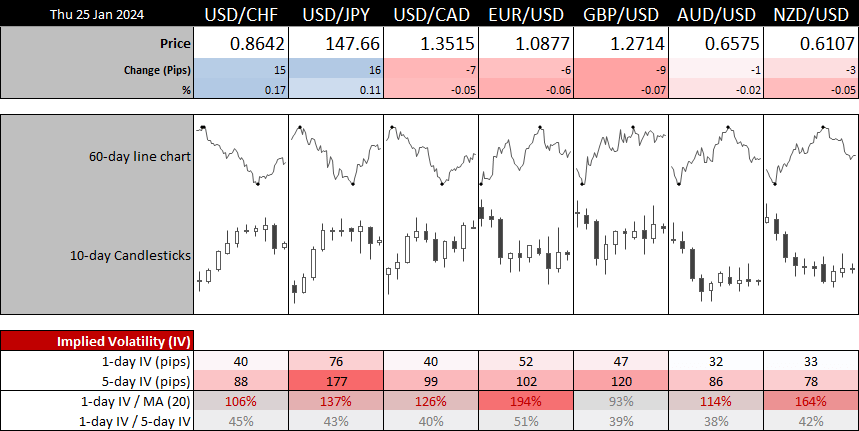

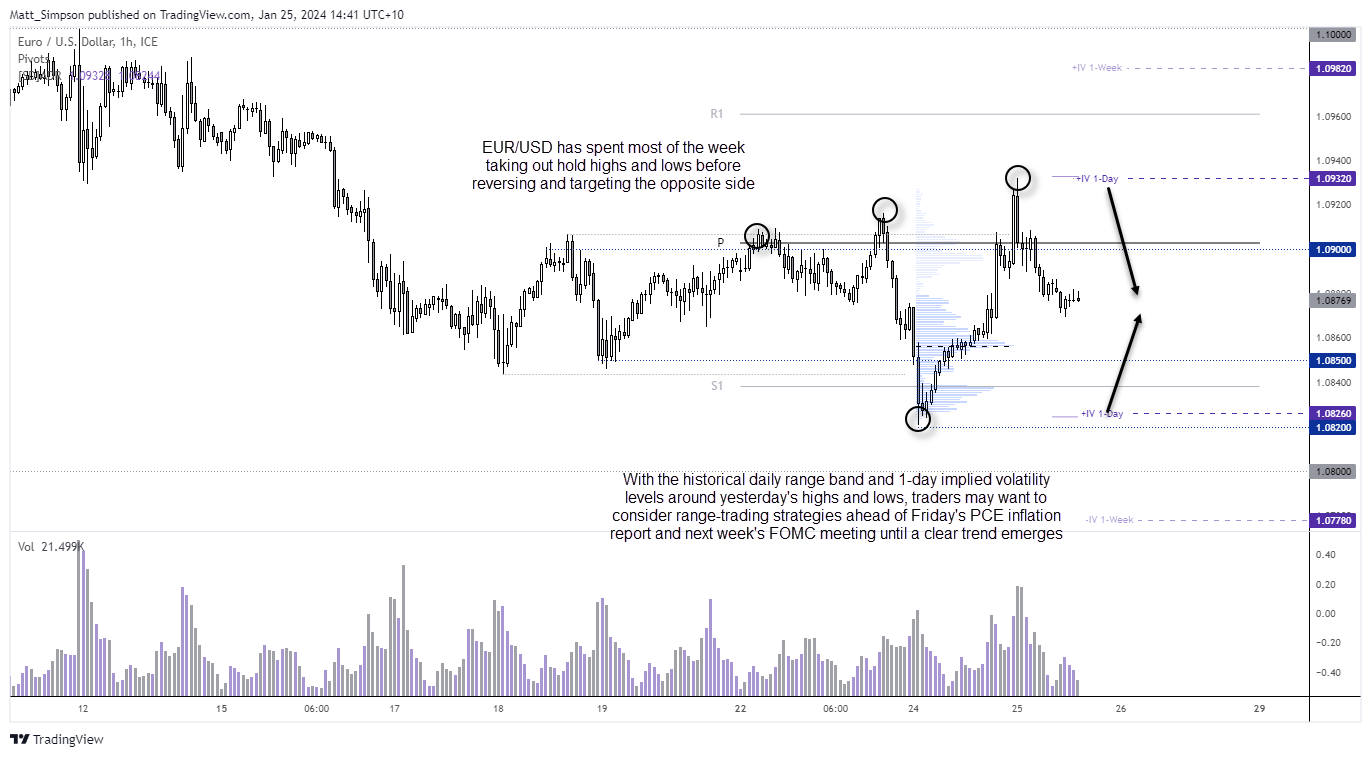

EUR/USD technical analysis (1-hour chart):

The 1-hour chart for EUR/USD is a sight for sore eyes. It lacks a defined trend and has seen bursts of volatility in both directions before reverting to the centre of its sideways chopfest. Whilst this is now what I typically like to see, I can make some sense of the carnage. We have an ECB meeting in a few hours, with US GDP also up for grabs and of course PCE inflation tomorrow. And that means we seem to be in a ‘seek and destroy’ week, where sudden market moves aim to seek pockets of liquidity out of a trading range before heading for the opposite side.

This is by no means a pleasant trading condition to be in, but it is what it is. That means traders can decide to step aside and wait until a clearer picture emerges or seek bullish reversals around swing lows of bearish ones around swing highs.

Note that the 1-day implied volatility band actually sits in line with the 1-day historical ATR band, which roughly ranges between 1.0825 – 1.0930. Which is in line with yesterday’s high and low.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge