Asian Indices:

- Australia's ASX 200 index fell by -75.9 points (-0.99%) and currently trades at 7,623.50

- Japan's Nikkei 225 index has risen by 193.31 points (0.53%) and currently trades at 36,352.95

- Hong Kong's Hang Seng index has fallen by -23.14 points (-0.15%) and currently trades at 15,510.42

- China's A50 Index has risen by 127.41 points (1.16%) and currently trades at 11,071.24

UK and European indices:

- UK's FTSE 100 futures are currently up 7.5 points (0.1%), the cash market is currently estimated to open at 7,623.04

- Euro STOXX 50 futures are currently down -7 points (-0.15%), the cash market is currently estimated to open at 4,647.55

- Germany's DAX futures are currently down -42 points (-0.25%), the cash market is currently estimated to open at 16,876.21

US index futures:

- DJI futures are currently down -88 points (-0.23%)

- S&P 500 futures are currently down -13.25 points (-0.27%)

- Nasdaq 100 futures are currently down -51.5 points (-0.29%)

Jerome Powell said it would be “prudent” to give it more time to see if inflation is moving towards their 2% in a sustainable way. Translated, it means the Fed do not appear to have appetite for more than the three cuts the median estimate for the dot plot shows this year. It should also be noted that the pre-recorded interview with 60 minutes took place after the FOMC’s latest meeting and ahead of Friday’s blowout jobs report.

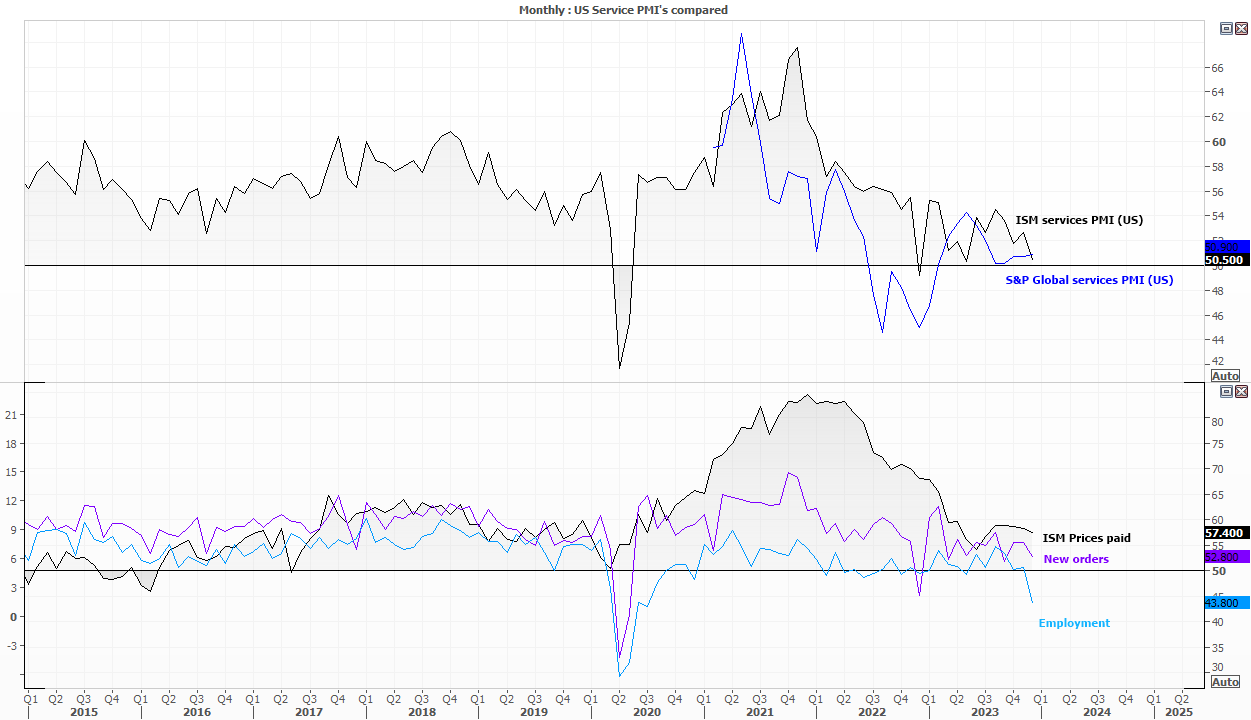

The ISM services report is released today, which fell a little too close to 50 for its own good last month. The employment sub index also fell at its fastest pace since the pandemic, which is at odds with Friday's NFP report. If it were to cross beneath 50 to denote contraction and is coupled with slower ‘new orders’ and ‘prices paid’, it could further weaken the US dollar and bolster gold prices on bets that the Fed will begin cutting rates in May. But if it contracts too fast and prices and new orders also tank, the recession alarm bill could ring and stock markets might actually see bad news as ‘bad’, for the first time in a while.

Fed Atlanta President Raphael Bostic speaks ahead of the NY close on Monday, and he's unlikely to strike an overly dovish tone given he recently reiterated that cuts won't begin until Q3. So that could spur some US dollar strength and weigh on gold.

'

Events in focus (GMT):

- 08:55 – German final PMIs

- 09:00 – Eurozone final PMIs

- 09:30 – UK final PMIs

- 10:00 – Eurozone producer prices

- 14:45 – S&P global US final PMIs

- 15:00 – ISM services PMIs

- 17:30 – BOE chief economic Pill speaks

- 19:00 – FOMC member Bostic speaks

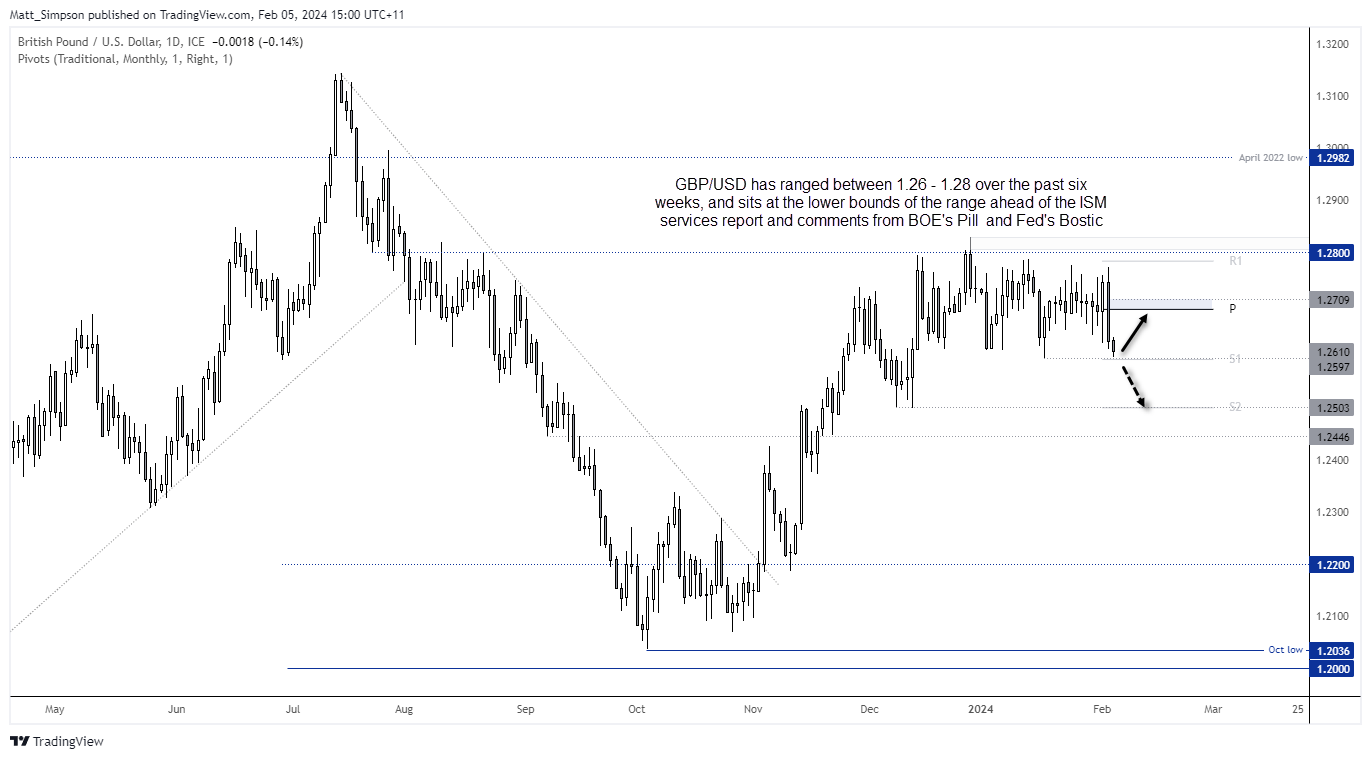

GBP/USD technical analysis (daily chart):

The daily chart shows that GBP/USD has effectively ranged between 1.260 and 1.280 over the past eight weeks. A prominent bearish engulfing candle formed on Friday thanks to the strong NFP report, and whilst it has extended Friday’s losses during Monday’s Asian trade, it appears reluctant to break 1.26 with any conviction for now.

It might be down to the ISM services report or comments from either BOE’s Pill or Fed’s Bostic as to which side of 1.26 is closes, but whilst prices remain above 1.26 then the bias is for some mean reversion to the centre of the range. A break beneath 1.26 opens up a run for 1.25, near the monthly S1 pivot point.

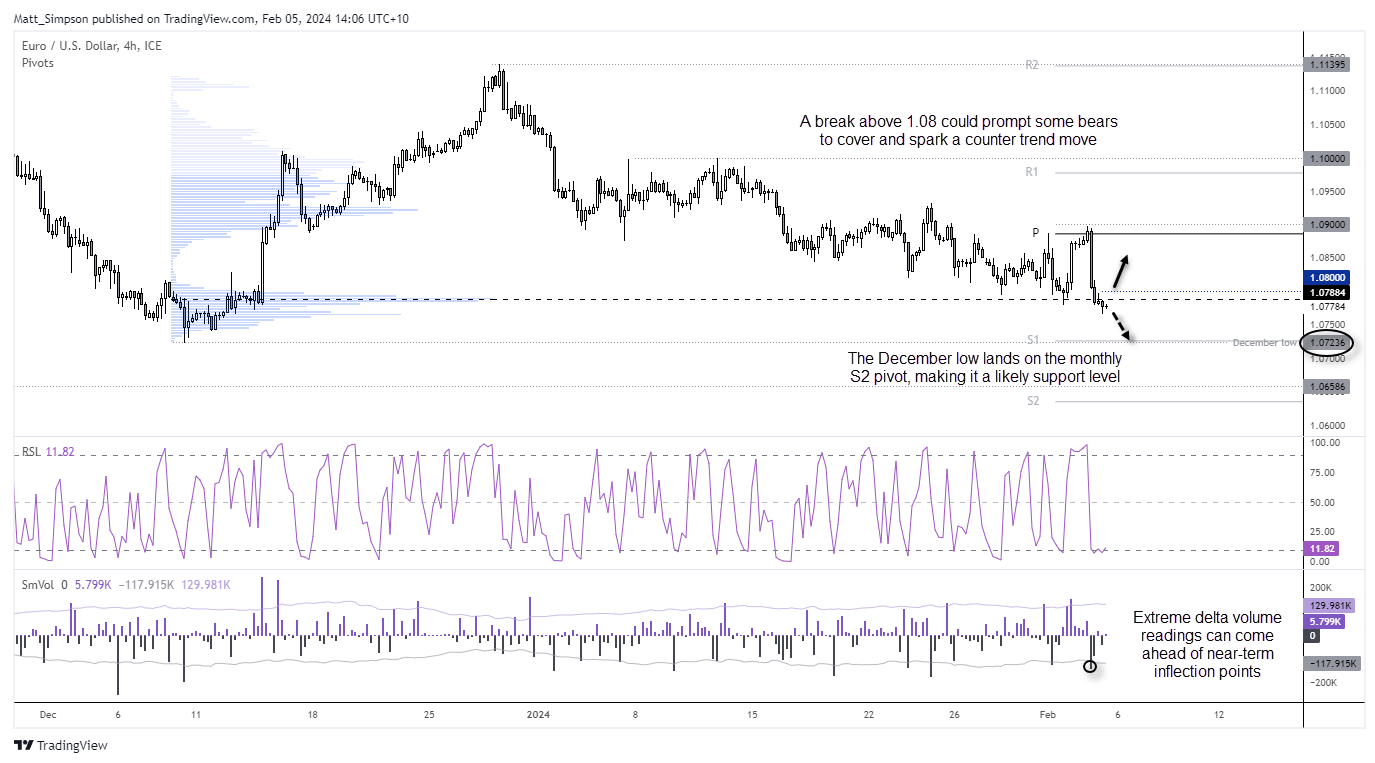

EUR/USD technical analysis (1-hour chart):

EUR/USD finds itself at a fresh YTD low ahead of the European open, but I don't trust these Monday Asian moves; USD is stronger, but the 'follow-through' pales in comparison to Friday's moves. Hence the bias for a countertrend bounce for EUR/USD and GBP/USD.

The 1-hour RSI is oversold and a small bullish hammer has formed. Note the heavy selling around the highs on Friday, so if prices are to recover and break above 1.08 it could force bears to capitulate and trigger a deeper countertrend bounce. Should prices continue to fall, the December low makes a likely support level given the milestone level sits around the monthly S2 pivot.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge