It’s been another rough day for global stock investors (see my colleague Fawad Razaqzada’s note “Global stocks extend decline as Chinese markets resume slide” for more), so it’s not surprising that the safe haven Japanese yen is once again at the top of the FX relative performance charts. What is interesting is the price action in the US dollar, which is the worst-performing major currency on the day.

Long seen as the ultimate safe haven, the greenback has become a “risk” currency of late due to its higher yield. In other words, when investors are optimistic about the outlook for the global economy, they tend to buy the buck because they expect the Federal Reserve to continue raising interest rates more quickly than its rivals. On the other hand, if investors become concerned with the prospects for accelerating global growth, they are now selling the US dollar because the Fed may be forced to slow its rate of interest rate increases in 2019. While another interest rate increase is likely in December (at least unless we get some truly shocking economic readings), the Fed’s “reaction function” looking out to next year is more fluid than many of its contemporaries.

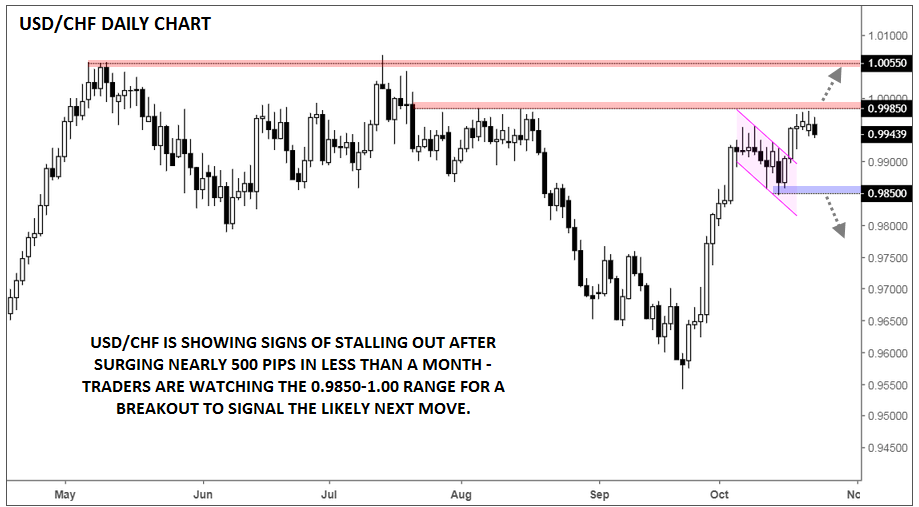

Technical View: USD/CHF

The above dynamic is a sharp contrast to the “Steady Eddy” Swiss National Bank, drawing our attention to the USD/CHF pairing. USD/CHF has rallied sharply over the last month, tacking on nearly 500 pips trough-to-peak since the low on September 21.

The pair formed a brief “bullish flag” pattern before breaking out last week, but the follow-through has been less than impressive so far, with rates stalling out below previous highs and key psychological resistance in the 0.9985-1.0000 area. Moving forward, we’ll be keeping a close eye on this resistance zone (with a break above potentially opening the door for a continuation toward the year-to-date highs in the mid-1.00s) and support at last week’s low near 0.9850 to signal the next big swing in USD/CHF.

Source: TradingView, FOREX.com