- The economic calendar is incredibly quiet this week

- With no top tier data to consider, Fed members are likely to retain the higher for longer narrative regarding the US rates outlook

- Higher US yields points to upside risks for USD/JPY

Fed to remain higher for longer narrative

US bond yields are pushing higher, retracing some of the ground ceded following last Wednesday’s inflation and retail sales reports. With no top tier economic data to navigate this week, Fed speak is likely to be more influential than usual. And given the Fed is data dependent when assessing the US interest rate outlook, with no new information to consider, it’s difficult to see their narrative shifting from it still being far too soon to consider rate cuts.

That points to upside risks for USD/JPY, especially if risk appetite holds up.

Too soon to stop buying USD dips

With US Treasury yields drifting higher as markets pare Fed rate cut bets, the bullish breakout in US two year note futures last week looks to have been a false one. I’ve been watching this indicator closely as a sustained topside break of 101*24 may increase downside pressure on the US dollar in the absence of a risk-off environment. Given the price has fallen back below this level, I’m reverting to buying dollar dips rather than selling rallies near-term.

That puts USD/JPY in the radar given its strong, positive correlation with US bond yields often seen for extended periods.

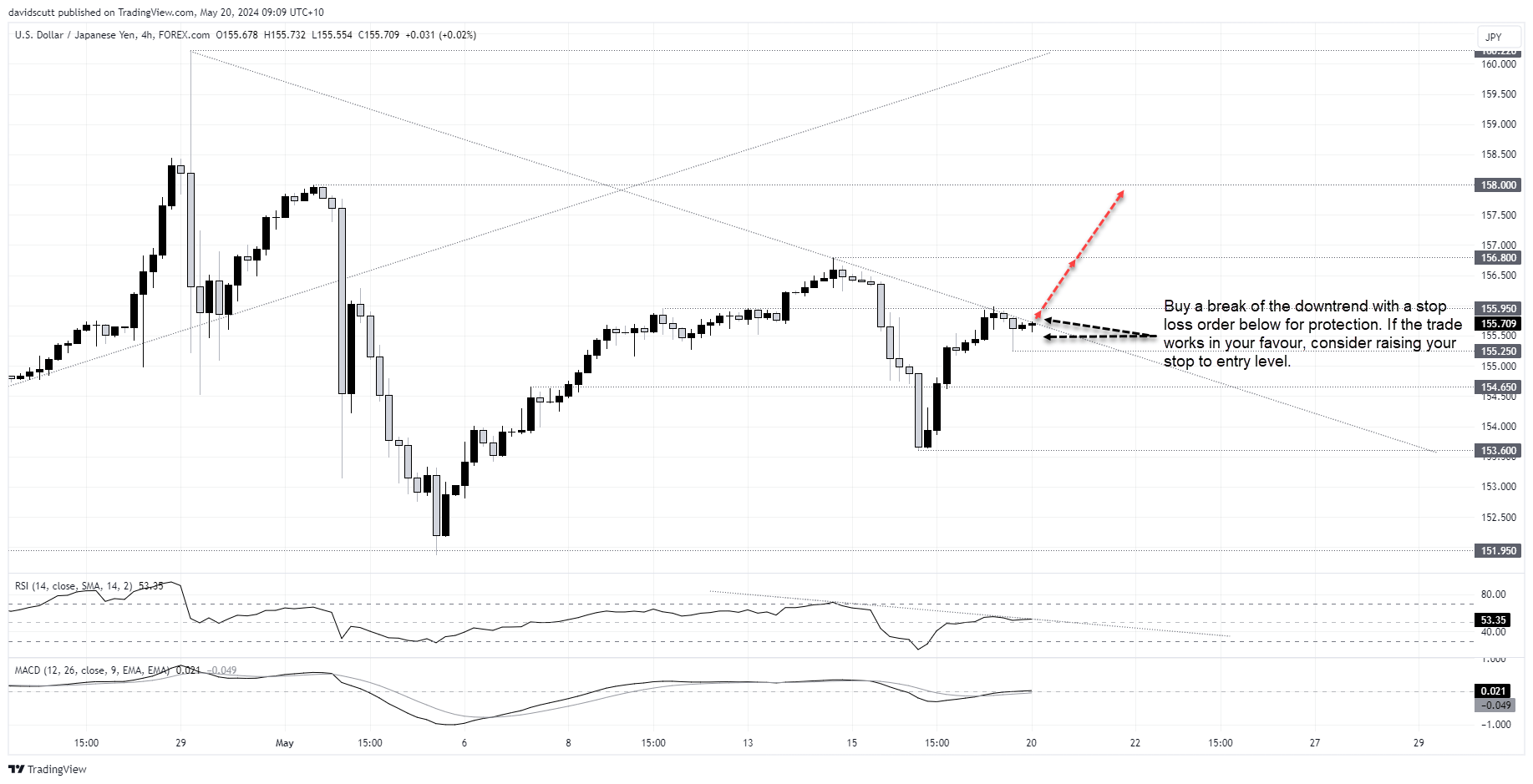

USD/JPY threating downtrend

Having added over 200 pips from the lows hit last Wednesday, USD/JPY is now testing downtrend resistance dating back to the multi-decade highs above 160 set in April. With MACD crossing over from below on the four hourly timeframe and RSI threatening to break its downtrend, downside momentum looks to be ebbing, pointing to the potential for the price to start another run higher.

Should the downtrend give way, traders could buy the break with a stop loss order below the trendline for protection. The initial target would be horizontal resistance at 155.95. Should that go, the high of 156.80 set on May 14 would be in play. Above, there’s very little on the charts until 158.

With rhetoric from Japanese policymakers expressing displeasure on the yen’s level abating for the moment, the threat of intervention from the BOJ on behalf of the government looks limited unless the price runs rapidly higher without any fundamental explanation.

-- Written by David Scutt

Follow David on Twitter @scutty