USD/CNH fell 9% from the top of 2020 as investors expected the recovery of the economy after the pandemic. Investors sold the safe-haven assets dollars to other assets. In addition, the strong China economic data also support the CNH.

On the economic front, China's industrial production rose 7.0% on year in November, as expected, while retail sales grew 5% on year,as expected, according to the government. China's economy shows a great recovery after the outbreak of COVID-19.

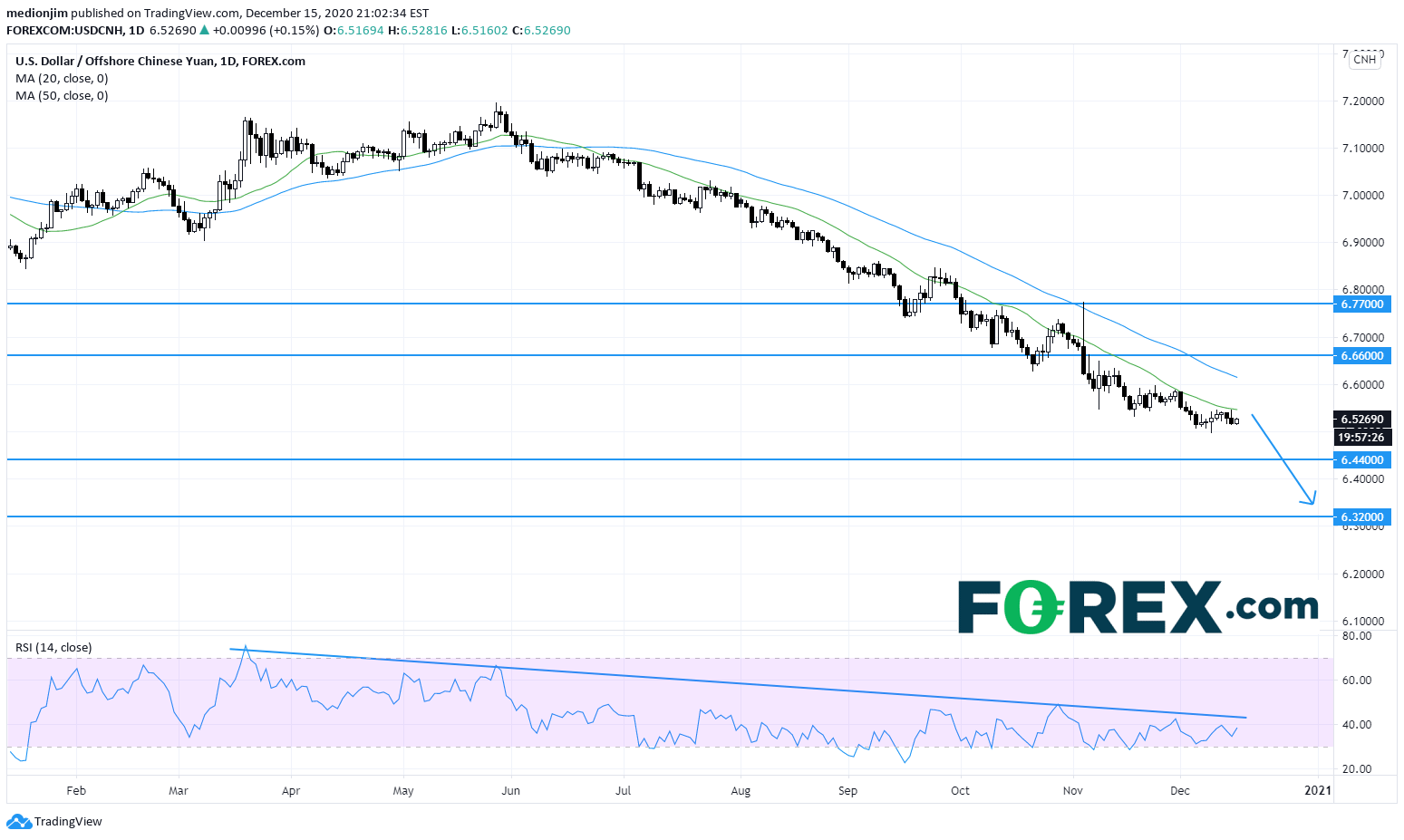

On a daily chart, USD/CNH is under pressure below both declining 20-day and 50-day moving averages. The relative strength index is capped by a declining trend line. Currently, the pair is near the 52-week low, suggesting the strong downside momentum for the prices. The bearish readers could set the resistance level at 6.6600, while resistance levels would be located at 6.4400 and 6.3200.

Source: GAIN Capital,TradingView

On the economic front, China's industrial production rose 7.0% on year in November, as expected, while retail sales grew 5% on year,as expected, according to the government. China's economy shows a great recovery after the outbreak of COVID-19.

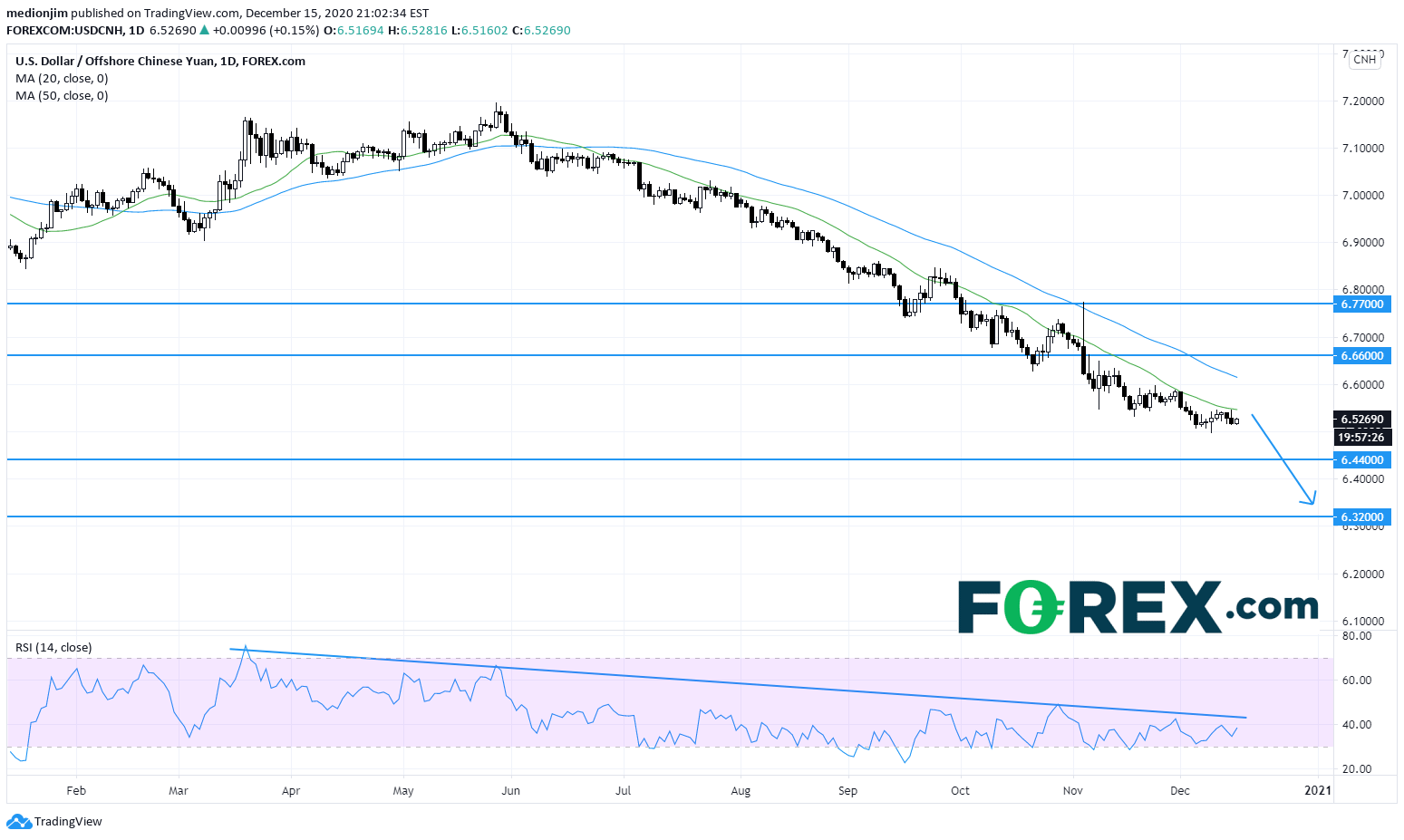

On a daily chart, USD/CNH is under pressure below both declining 20-day and 50-day moving averages. The relative strength index is capped by a declining trend line. Currently, the pair is near the 52-week low, suggesting the strong downside momentum for the prices. The bearish readers could set the resistance level at 6.6600, while resistance levels would be located at 6.4400 and 6.3200.

Source: GAIN Capital,TradingView

Latest market news

Today 11:59 AM

Yesterday 11:06 PM

Yesterday 01:00 PM

November 30, 2024 12:00 PM