- Dollar analysis: Greenback gets modest boost on hot inflation

- US CPI comes in hotter-than-expected at 3.4% y/y

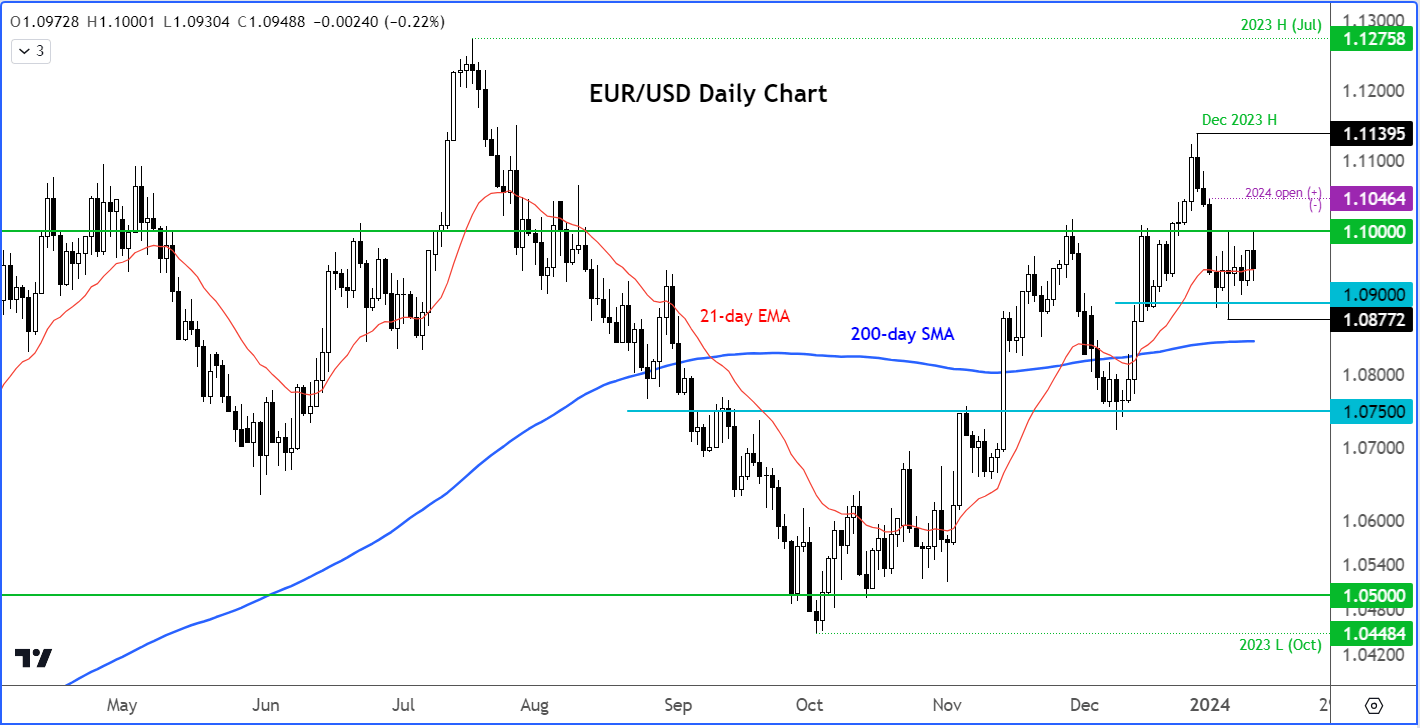

- EUR/USD

All week, investors had been eagerly waiting for today’s CPI report to inject much-needed volatility into the markets. The market was positioned for a positive surprise, and as it turned out, that’s more than what they got. The December inflation report was a little hotter than expected and this caused the dollar to bounce, and equity indices fell in the immediate aftermath of the inflation report. Gold took its time, but it too had drifted into the negative at the time of writing.

Why have FX markets shown subdued reaction post CPI?

The FX market’s somewhat subdued reaction suggests investors were perhaps happy to take profit on their long dollar positions. They clearly still expect rate cuts will come this year, but not sure precisely when. In fact, the odds of a March rate cut remained at around 70%, according to the CME FedWatch tool. Perhaps investors expect inflation to go back down again, so they are just looking past the December inflation report, arguing that weakness in the economy should put downward pressure on prices in the months ahead. Still, the somewhat muted reaction is surprising to say the least.

EUR/USD analysis: Single currency holds between key levels

The dollar’s muted reaction could also be that investors view foreign central banks as being more hawkish than the Fed. For example, the European Central Bank official Isabel Schnabel delivered a hawkish speech to counter recent dovish ECB commentary Schnabel said that “it is too early to discuss rate cuts” and “additional data confirming the disinflationary process” will be required to move from restrictive monetary policy.

Despite the US inflation report coming in hotter, the EUR/USD managed hold well above the 1.09 handle, but also was unable to break the 1.10 barrier earlier in the day. A move outside of this range should trigger follow-up technical buying/selling in that direction.

How strong was US CPI?

In case you missed it, CPI rose 0.3% MoM, ahead of the 0.2% expected, pushing the annual rate up to 3.4% in December from 3.1% in November. A reading of 3.2% was expected. Core CPI rose 3.9% annually versus forecasts of a 3.8% increase. We also had better than expected data from the jobs markets, with jobless claims coming in at 202K, down from 210K in previous week.

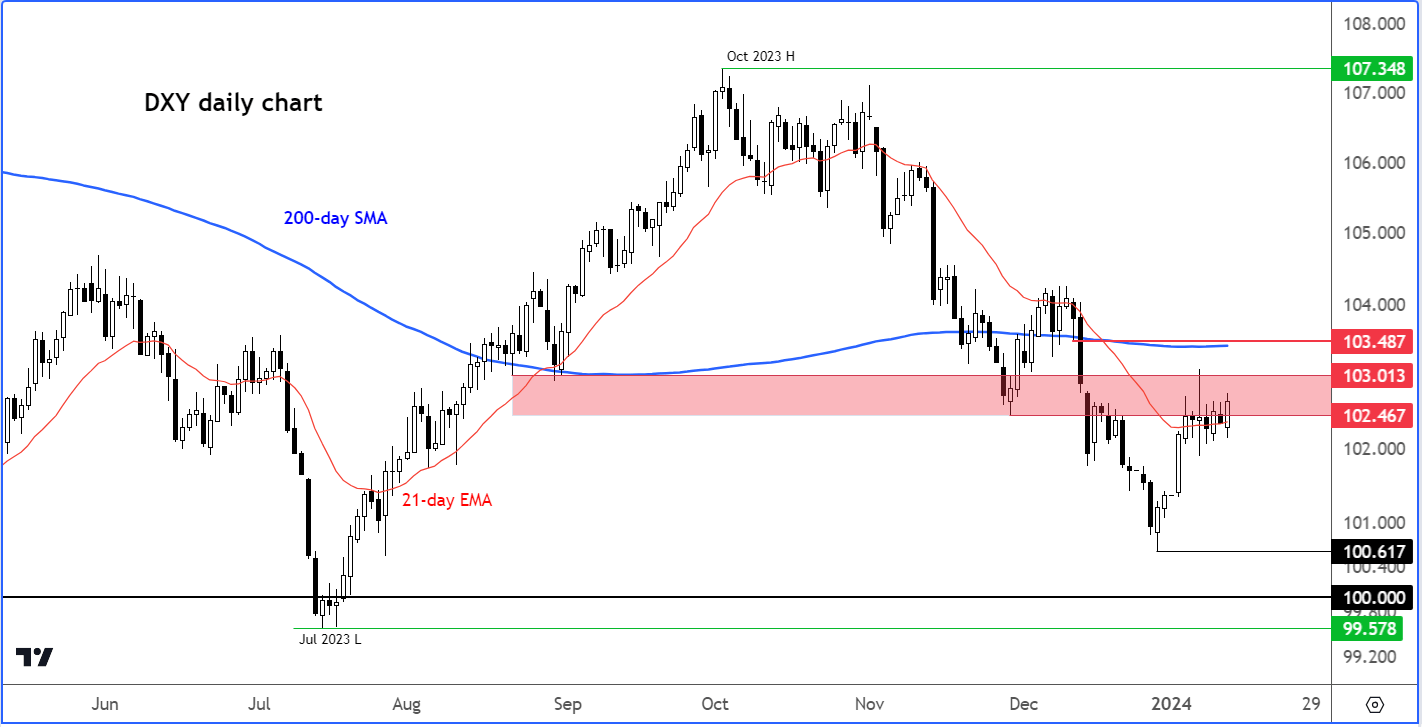

Dollar analysis: Dollar index technical levels to watch

Following the CPI data, the Dollar Index was up only 0.3%, reflecting a subdued FX market response. It was turning positive on the week, so perhaps we may see a more profound response later in the day.

The bearish trend is being tested though, and the dollar sellers must step in around these levels if they want to maintain control. The 200-day average could be the next upside target in the event the dollar bulls maintain control over the next couple of session.

However, zooming out a little, larger time frames show lower lows since it peaked in October at 107.35ish. With that in mind, the key resistance zone to watch today is between the 102.45 to 103.00 area, where the DXY was residing at the time of writing. This zone had acted as strong support on a couple of occasions back in August and again in November, before giving way on the back of the Fed’s last policy meeting in mid-December.

Thus, for as long as that 102.45 to 103.00 area holds as resistance today, this should keep a bearish bias on the dollar, else 103.50 where the 2000-day MA comes in could be the next target for the bulls.

So, watch today’s closing prices closely to determine the directional bias for the dollar heading into the final day of the week.

Source for al charts used in this article: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R