- DAX analysis: Why are stocks struggling for direction?

- Earnings focus turns to technology sector

- ‘Higher for longer’ narrative boosted by data

- DAX technical analysis: Lower lows paint a bearish picture for German index

The rally on Wall Street petered out on Tuesday as the session wore on, which discouraged bullish investors in the first half of Wednesday’s session, with European indices giving back their early advance and US futures drifting lower. As before, I reckon there are not many positive fundamental factors to help change investors’ risk appetite materially. So, I wouldn’t be surprised if markets remained under pressure for a while yet. As investors assess the risks of interest rates remaining high for longer, and of course, the escalation of the situation in the Middle East following the bombing of the hospital in Gaza, they are not going to be aggressive in risk-taking you would think.

DAX analysis: Why are stocks struggling for direction?

It all comes down to appetite for risk. Right now, and rightly so, there is not much appetite for excessive risk taking given these uncertain economic times and raised geopolitical risks. With interest rates being at their highest levels since before the financial crisis, and the full economic impact of those hikes not fully filtered through the economy yet, many investors are wondering what lies ahead in the months to come. Granted, there are signs that inflation and interest rates have peaked, and that looser monetary policy should follow. But we just don’t know how long inflation is going to remain elevated, which in turn raises question marks about the longevity of high interest rates. Judging by recent data in the US, oil prices and Fed commentary, it can be a long time before the Fed starts cutting rates again. Similarly, both the ECB and BoE have indicated rates will remain high for loner. That’s before we even put into equation the recent flare up in the Middle East crisis, a situation which could further fuel the oil rally and pressurise risk assets.

Earnings focus turns to technology sector

Following the mostly better-than-expected results from US banks, the focus will turn to technology earnings. The earnings calendar contains electric vehicle maker Tesla and streaming giant Netflix to kick things off today, ahead of the other tech giants next week. So far, company earnings have failed to materially lift market sentiment, but let’s see if that will change in the weeks ahead.

‘Higher for longer’ narrative boosted by data

This week’s major economic data are mostly out of the way. Chinese GDP, retail sales and industrial production all came in better-than-expected overnight, a day after US retail sales and industrial data also topped expectations. We also had a stronger UK CPI print today to remind us that the job of the BoE and other central banks fighting inflation is not completely over. While the stronger data will alleviate some concerns over the health of the global economy, the US numbers in particular will encourage the Fed to maintain interest rates high for longer. That may keep the pressure on bonds, keeping yields supported and hurting the appetite for stocks that pay low or no dividends.Today’s economic calendar is a bit quieter, although we do have some housing market data to look forward to. There are lots of Fed speakers this week, including Fed Chair Powell who is due to speak on Thursday at the Economic Club of New York Luncheon.

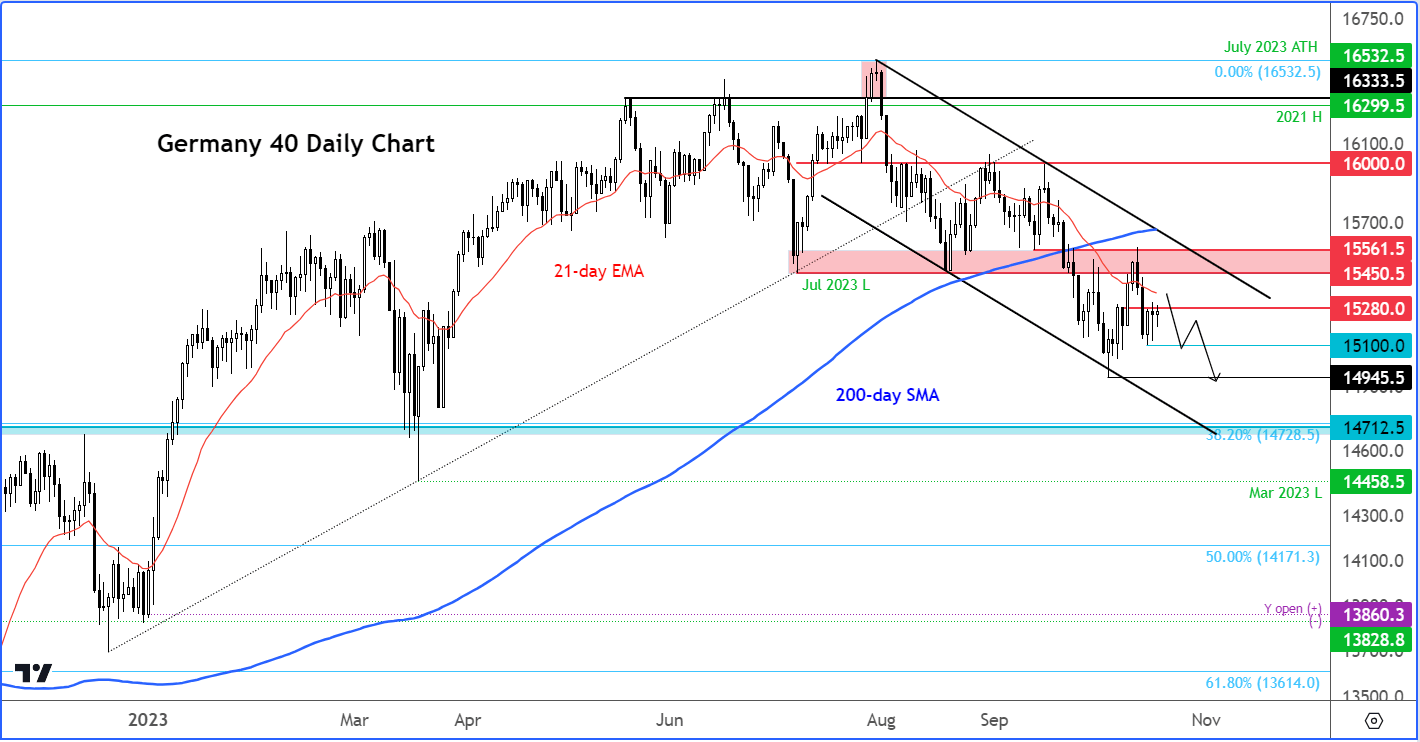

DAX technical analysis

Source: TradingView.com

Like many other global indices, the German DAX remains in an overall bearish trend ever since topping out in July.

The index has now spent a significant amount of time holding below the 200-day average. Recently, the 21-day exponential average has also moved below the 200. Taking these factors into consideration, we can objectively say that the trend is not bullish.

That’s before we even talk about the fact the DAX has formed several lower highs and lower lows. What’s more, the index has been on a run of 4 consecutive weekly losses. Though it was trading higher on the week at the time of writing, the ongoing bearish momentum means the risks remain skewed to the downside.

In terms of support and resistance, the DAX was testing broken support around 15280 at the time of writing. This level was the launchpad for the last burst of bullish momentum we saw last Tuesday, which ultimately ran out of steam around strong resistance in the 15500 area later in the week. So, if this level holds as resistance, then the bears will be targeting liquidity below last week’s low at 15100 initially ahead of 14945 next.

On the upside, I mentioned 15280 as resistance. If this level breaks, then this may pave the way for a run towards the bigger resistance range between 15450 to 15560, where we also have the resistance trend of the bearish trend line converging.

Still, given the bearish technical factors in play, any short-term bullish signs should be taken with a pinch of salt. While those lower lows are in place, and given the ongoing macro worries, raised geopolitical risks and still-high valuations (among many other risks), I would be on the lookout for fresh bearish signals to emerge in the coming days.

-- Content created by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R