US CPI Key Points

- US CPI expectations: 3.4% y/y headline, 3.5% y/y ‘Core” inflation

- Last May’s 0.1% m/m CPI reading will drop out of the year-over-year calculation, potentially driving up headline inflation, but Core CPI could still tick lower on a year-over-year basis

- USD/JPY’s year-to-date uptrends remains intact after a bounce from support in the 155.00 area last week.

When is the US CPI Report?

The May US CPI report will be released at 8:30am ET on Wednesday, June 12, 2024.

What are the US CPI Report Expectations?

Traders and economists expect the US CPI report to hold steady at 3.4% y/y on a headline basis, with the “Core” (ex-food and -energy) reading expected to fall to 3.5% y/y.

US CPI Forecast

After Friday’s (much) better-than-expected NFP report, the Federal Reserve’s aspirations for a summer interest rate cut are on life support, and even a pre-election reduction in September is looking questionable. Against that backdrop, this week’s US CPI report is unlikely to have an immediate impact on monetary policy, but it will still shape the Fed’s longer-term progress toward achieving its dual mandate

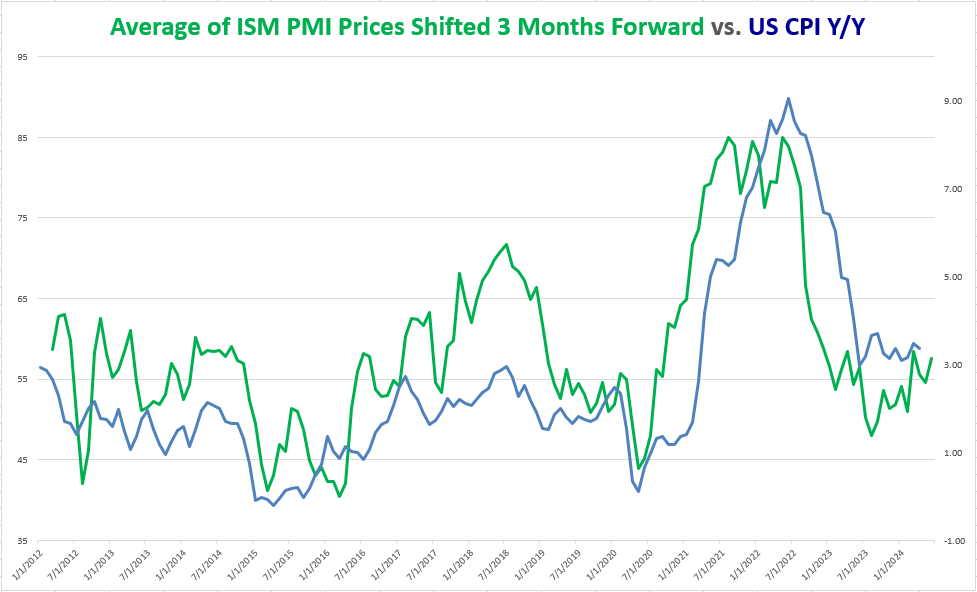

As many readers know, the Fed technically focuses on a different measure of inflation, Core PCE, when setting its policy, but for traders, the CPI report is at least as significant because it’s released weeks earlier. As the chart below shows, the year-over-year measure of US CPI has flatlined around 3.4% for the better part of a year now, and one of the best leading indicators for future CPI readings, the ISM PMI Prices component, has stopped falling and may be turning higher again:

Source: TradingView, StoneX

As the chart above shows, the “Prices” component of the PMI reports has remained in the mid- to upper-50 region, corresponding to CPI inflation holding steady its same 3-4% range.

Crucially, the other key component to watch when it comes to US CPI is the so-called “base effects,” or the influence that the reference period (in this case, 12 months) has on the overall figure. Last May’s 0.1% m/m reading will drop out of the annual calculation after this week’s reading, opening the door for an uptick in the headline year-over-year CPI reading. The base effect for Core CPI may have the opposite effect, with a 0.4% m/m reading dropping out of the relevant range.

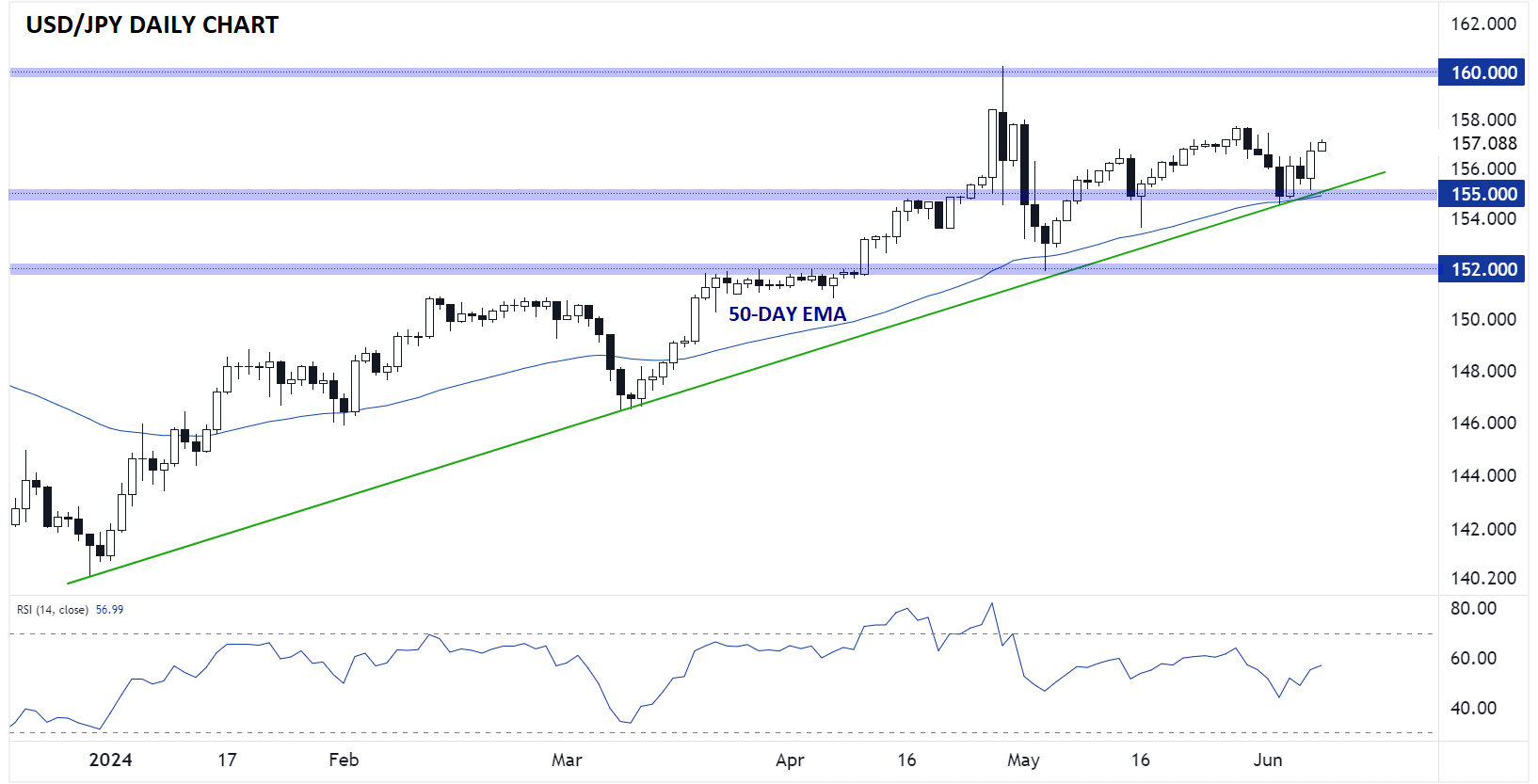

US Dollar Technical Analysis – USD/JPY Daily Chart

Source: TradingView, StoneX

As the chart above shows, USD/JPY’s year-to-date uptrends remains intact after a bounce from support in the 155.00 area last week. This month’s CPI reading may have a more limited impact on the pair than most, given the lack of near-term policy implications and FOMC meeting immediately following it, but as long as it comes in at (or especially better than) expectations, USD/JPY could extend its rally toward 158.00 resistance next. Only a break below 155.00 would call the longer-term bullish trend into question

-- Written by Matt Weller, Global Head of Research

Check out Matt’s Daily Market Update videos on YouTube and be sure to follow Matt on Twitter: @MWellerFX