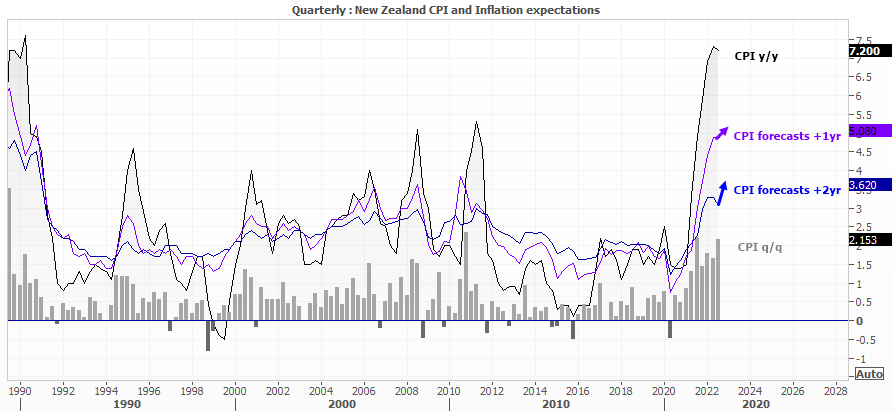

Whilst there has been some mild expectations that inflation around parts of the world have topped out, recent data for New Zealand is remining us that inflation can remain at elevated levels for longer than anyone would like.

CPI rose 2.2% q/q, up from 1.7% and well above the 1.6% consensus. Annual CPI rose 7.2% y/y - slightly below the 7.3% ‘peak’ – but if the quarterly is trending higher then it can send the annual higher too. Labour costs have risen to a record high of 3.8% y/y and, whilst the quarterly read pulled back from its (record), at 1.1% q/q labour costs remain quite elevated from its long-term average of 0.01%.

Inflation expectations are piling on the hawkish pressure

Despite the inflation figures, the consensus was still for the RBNZ to hike by 50bp tomorrow – until inflation expectations threw a spanner in the work. Central banks pay close attention to inflation expectations, as fear of higher prices can result in higher places as ‘fear of missing out’ demand drives prices.

So when the RBNZ’s own survey revealed that 1 and 2-year inflation expectations hit new cycle highs, expectations for a 75bp hike were quick to arrive.

What can we expect from the RBNZ’s November meeting?

- I suspect a 75bp hike is more likely, given the central bank does not meet again until February and rising inflation and inflation expectations are not showing signs of topping out.

- We should also see the RBNZ raise their OCR projections in their MPS (monetary policy statement) – and by how much will decide how much of a market reaction we get. A 4.5% terminal rate seems feasible (up from 4.1%).

- The consensus is for the RBNZ to hike by 75bp from 3.5% to 4.25%, with around one third of economists polled by Reuters opting for a 50bp hike.

- The 1-month OIS suggests an ~87.6% chance of a 75bp hike, which means a 50bp has been more than priced in and we may get more of a market reaction if the RBNZ only go for 50.

- For what it’s worth, the RBNZ Shadow Board has favoured a 75bp hike.

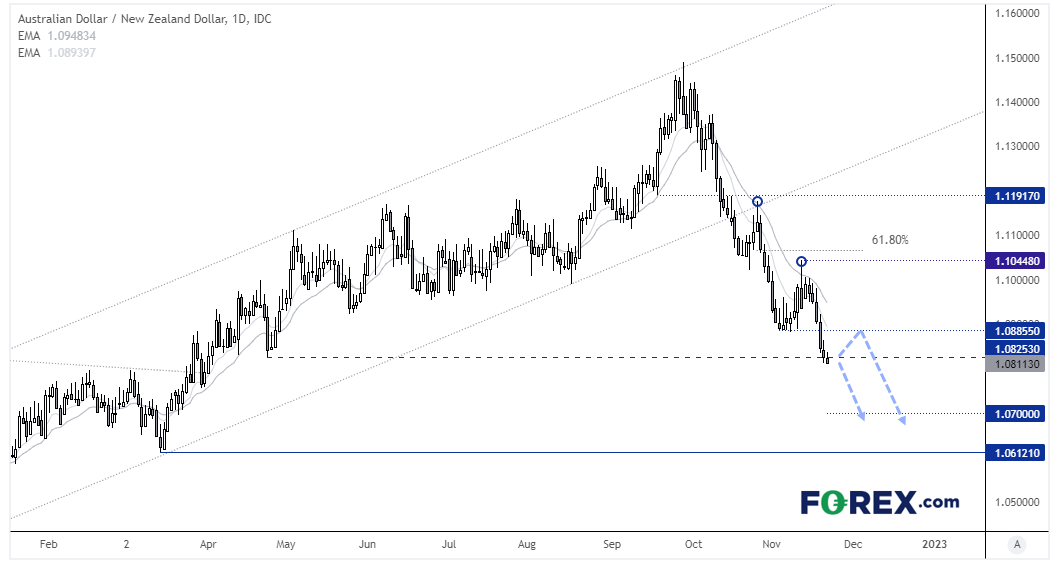

AUD/NZD daily chart:

Back in October we called for a retracement from the 1.15 highs, given the shift in policies between the RBNA and RBA. Since then, the divergence has become stronger, with the RBA pulling back to 25bp hikes and the RBNZ increasing maintaining 50bp and potentially going for 75.

This has allowed AUD/NZD to develop a nice bearish trend on the daily chart with timely swing highs, and prices are now on the cusp pf breaking lower and heading for 1.0700 and 1.0612. Unless we see a surprise 50bo hike tomorrow, the past of resistance appears lower for the cross and bears could seek to fade into rallies or short a break of new lows.

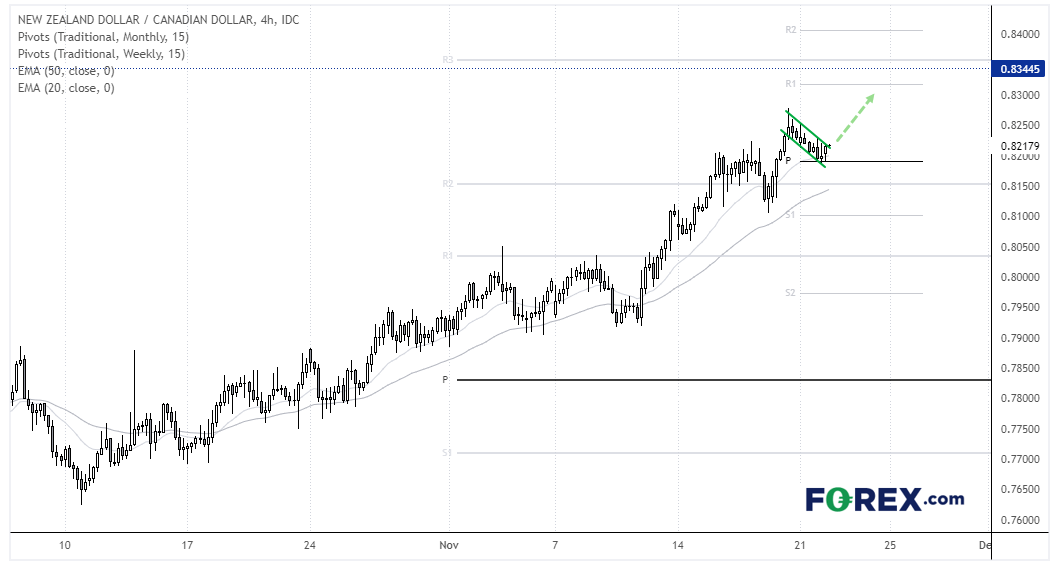

NZD/CAD 4-hour chart:

A nice trend has developed on the 4-hour chart of NZD/CAD. A potential bullish flag is forming on above the weekly pivot point, and prices are respecting the 20-bar EMA. Given that NZD tend to move in line with expectations ahead of RBNA meetings (more so than other currencies, as per my own observation) then it could be a cross for bulls to consider ahead of the meeting given its strong trend.

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.