- Chinese markets have responded positively to stimulus measures announced on Tuesday

- Speculation about a possible fiscal stimulus program continues to swirl

- Chinese markets will shutter for Gold Week holidays next week

Bullish stimulation

China’s latest stimulus package squeezed bearish bets hard on Tuesday, delivering mammoth gains across commodity and Chinese stock futures, along with the offshore-traded Chinese yuan. While the price action has been undeniably bullish, whether the move has legs remains debatable. We’ve seen plenty of short squeezes before that have quickly run out off puff. But with speculation swirling that policymakers may follow up the monetary policy easing with fiscal stimulus ahead of Golden Week holidays, that may be enough to promote further gains in the days ahead.

This analysis, linked back to research written as the policy announcements were being made public on Tuesday, provides an update on levels across individual Chinese markets that traders should be aware of when considering potential setups.

USD/CNH smashes below 7.0000

Hinting that capital may be starting to be repatriated back to China, USD/CNH has fallen below 7.0000 for the for the first time since May 2023, breaking long-running support at 7.01265 along the way.

With momentum indicators firmly bearish, traders contemplating going short could do so around these levels with a tight stop above 7.01265 for protection. There’s not a lot of visible support until the 2022 uptrend around 6.9200, making that an initial target.

Should the pair reverse back through 7.01265, the bearish bias would be invalidated.

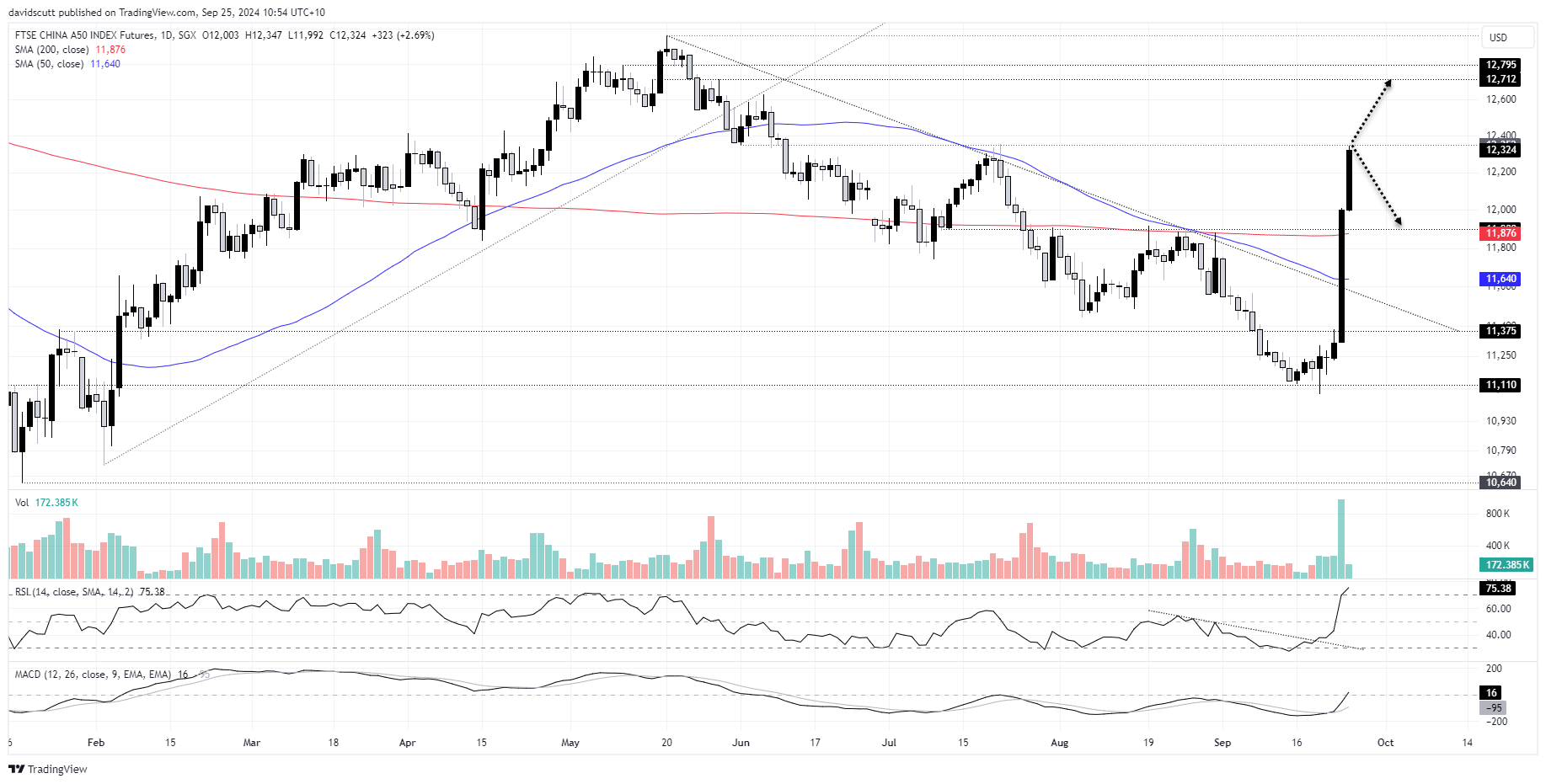

China A50 rockets through key levels

Looking at the price action in China A50 futures, it’s not difficult to see where capital is being deployed with a mammoth bullish candle on Tuesday followed by another massive bullish candle in overnight trade, both accompanied by huge volumes.

The move stalled at resistance at 12352 before reversing fractionally lower, providing a potential setup to build trades around. With the contract now overbought on RSI (14), going long carries an elevated risk of reversal given how fast it’s moved, meaning traders should be extra attentive to price action.

If the contract manages to clear 12352, consider buying with a tight stop below for protection. Possible targets include 12712, 12975 and 12960. Alternatively, if the price is unable to extend the move, you could sell with a tight stop above 12352 for protection. Targets include 11900 and 200-day moving average.

Even with overbought conditions, the bias is to buy dips and breaks unless the price provides a compelling reason to do otherwise.

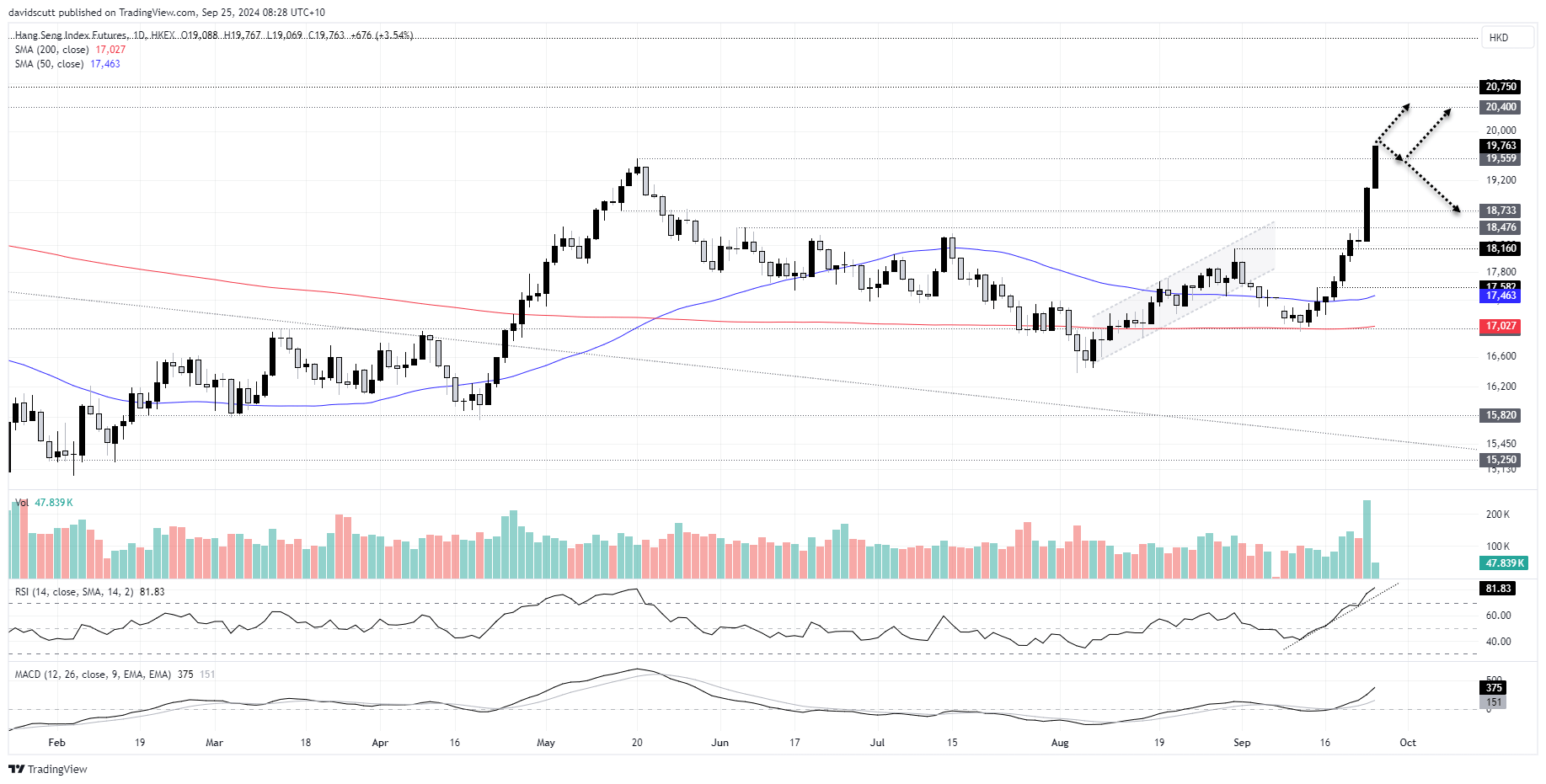

Hang Seng hits YTD highs

It’s a similar story for Hang Seng futures which are extremely overbought on RSI (14) on the daily after surging to July 2023 highs overnight on heavy volumes. With momentum with the bulls, buying dips and breaks is preferred in the near-term.

Given the break above 19559, that level can now be used to build setups around, allowing traders the opportunity to buy above with a tight stop below. Topside targets include 20400 and 20750.

If the price were to reverse back through 19559, the bullish bias would be invalidated, providing fresh scope to look for downside with a stop above the level for protection. 18733 is the first level of note.

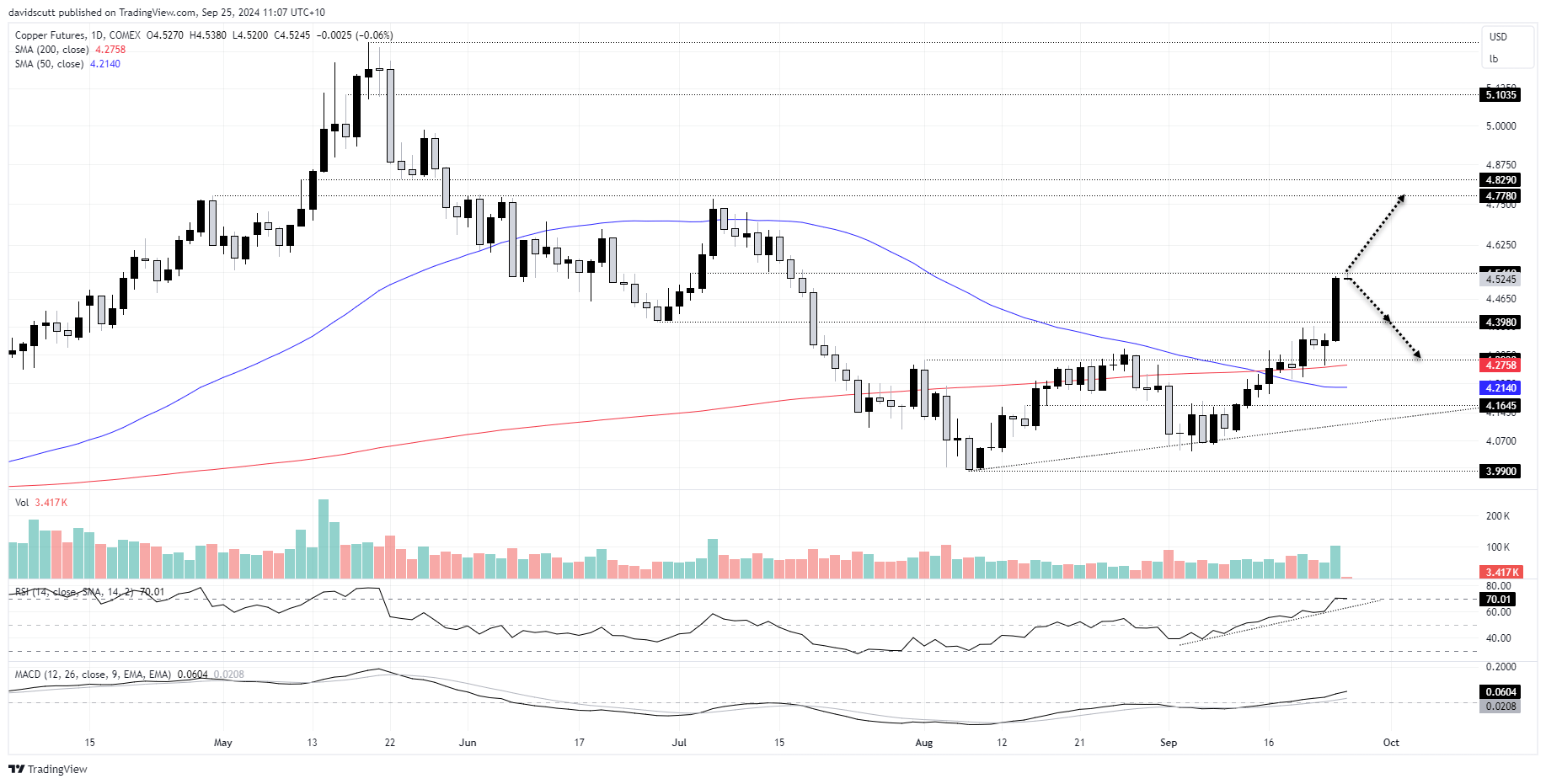

Copper rallies on heavy volumes

Turning to the commodity space, COMEX copper broke to multi-month highs on Tuesday, again on the back of heavy volumes. With MACD and RSI (14) providing bullish signals on momentum, the bias remains to buy dips and breaks.

The rally stalled at minor resistance at $4.541, providing a level to build setups around. A break above this level allows for longs to be established with a stop below for protection. Potential targets include $4.778 and $4.829. If the price can’t get established above the level, you could sell with a tight stop above for protection. Possible targets include $4.398 and 200-day moving average.

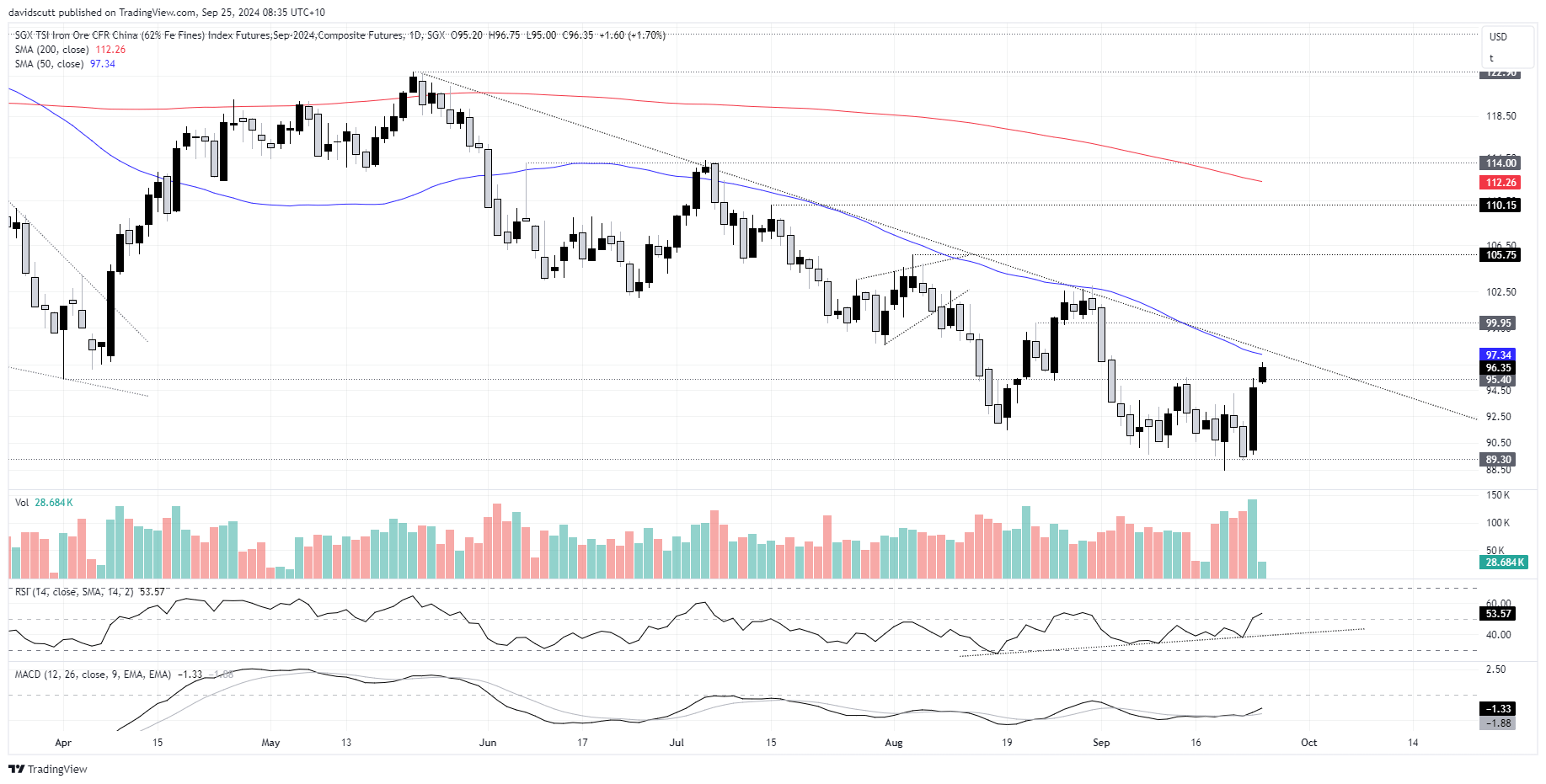

Iron ore eyes key resistance zone

SGX iron ore is also getting in on the bullish act, breaking to multi-week highs. After the latest run higher, it’s now staring at a key resistance zone comprising of the 50-day moving average and downtrend resistance dating back to May.

A break of this zone would bring a retest of $99.95 and $102.50 and $105.75 on the table, allowing traders to establish longs with a stop beneath the level for protection. Alternatively, if the price is unable to clear this zone, consider selling with a tight stop above for protection. Targets include $95.40 and $89.30.

-- Written by David Scutt

Follow David on Twitter @scutty