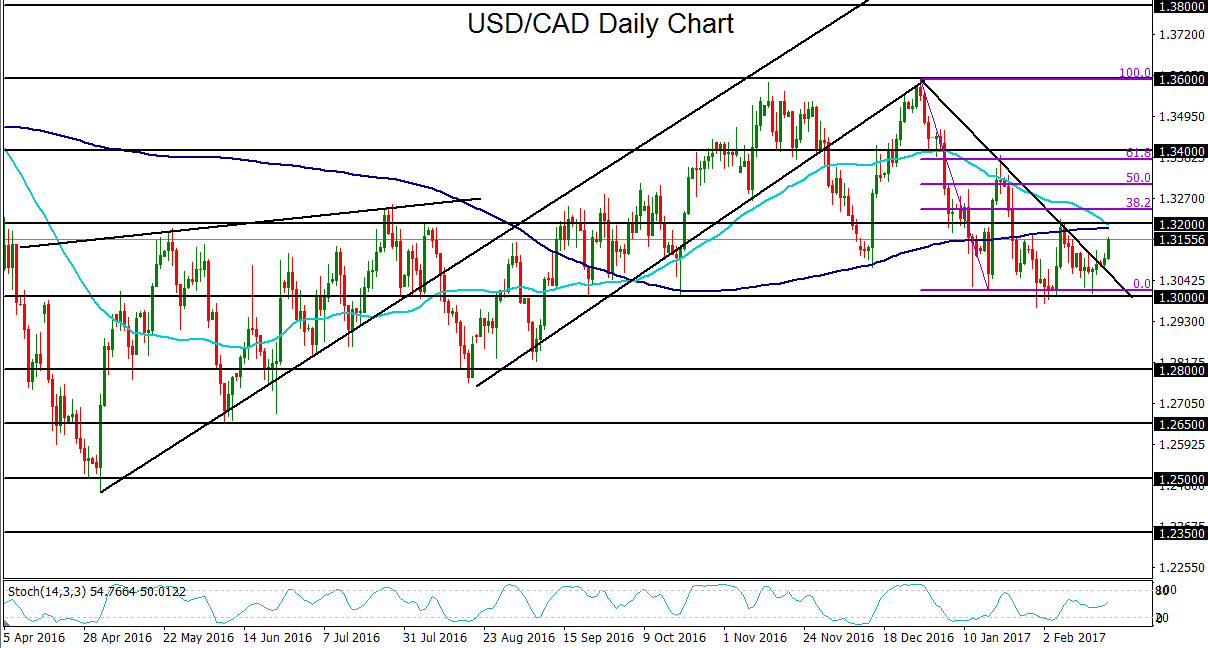

- USD/CAD has tentatively broken out above a key descending trendline and triangle consolidation.

- The USD/CAD breakout was supported by a surging US dollar early on Tuesday as Federal Reserve officials continued to provide hawkish hints of a potential Fed rate hike in the coming month(s).

- Upcoming economic events/releases out of the US and Canada this week could have a profound effect on USD/CAD movement in the short-term.

- Most critical of these events will likely be Wednesday’s release of meeting minutes from the last FOMC meeting that concluded in early February. Any clues within those minutes of a bias towards a possible March rate hike could lead to a further surge for the US dollar and extended breakout for USD/CAD. A dovish-leaning bias, however, could lead to a retreat for the US dollar.

- Also on Wednesday will be the release of Canadian retail sales and core retail sales (excluding automobiles) for December. Sales growth for these two data points are expected to be 0.1% and 0.8%, respectively.

- Friday brings Canadian Consumer Price Index (CPI) inflation data for January. Consensus expectations are for +0.3% price growth after the previous month’s disappointing -0.2% decline in prices.

- Crude oil prices on Tuesday surged as OPEC members were seen to be adhering closely to production guidelines set forth by December’s agreement to cut crude oil output. Despite this oil surge, the energy-linked Canadian dollar did not benefit substantially from higher oil prices as would typically be the case.

- Tuesday’s USD/CAD breakout above the descending trendline and triangle consolidation pattern is significant from a technical perspective. This breakout follows a clear bounce from major support around the 1.3000 psychological support area.

- In the event of continued bullish momentum off this support bounce and tentative triangle breakout, key resistance directly to the upside lies at the important 1.3200 level, where the 50-day and 200-day moving averages also appear to be converging. In a continued bullish scenario, if USD/CAD is able to break out above 1.3200-area resistance, the next major upside resistance target lies around the key 1.3400 level.

Latest market news

Yesterday 11:06 PM

Yesterday 01:00 PM

November 30, 2024 12:00 PM

November 29, 2024 05:53 PM