Additionally, revisions for previous months further weighed on the overall employment picture – March’s very weak 79,000 jobs added (previously already revised down from 98,000) was further revised down to 50,000. April’s previously better-than-expected 211,000 was also revised down – to 174,000. These revisions put the average job gains over the past three months at a relatively low 121,000 per month.

Though not nearly as dismal as March’s data, May’s reading and the accompanying revisions were sufficiently disappointing in the immediate aftermath of the release to shake some confidence in a mid-June interest rate hike by the Federal Reserve, placing extended pressure on the US dollar and providing a further boost for gold.

In terms of wage growth, or labor inflation, average hourly earnings in May rose by 0.2% on a monthly basis, which was in-line with prior expectations but lower than April’s initial reading of 0.3% growth. In addition, that April reading was also revised down from 0.3% to 0.2%.

One bright spot in an otherwise very weak jobs report was the unemployment rate for May, which came out slightly better than expected at 4.3% – even lower than April’s decade-long trough of 4.4% – hitting a new low not seen since 2001. This drop in unemployment, however, can partly be attributed to a decline in the labor force participation rate.

Overall, Friday’s US jobs data was a substantial disappointment, understandably hitting the dollar as a first reaction just as the struggling US currency was attempting to gain some footing after a prolonged decline. Despite the weak numbers and revisions, however, market expectations of a Fed rate hike in June have not yet been substantially affected. As of Friday morning shortly after the US jobs data release, the futures market’s view of the probability of a mid-June rate hike dipped below 90% at one point, but soon recovered. Of course, this could change quickly in the week-and-a-half run-up to the next FOMC meeting, but for now, markets are still mostly expecting at least another rate hike in June.

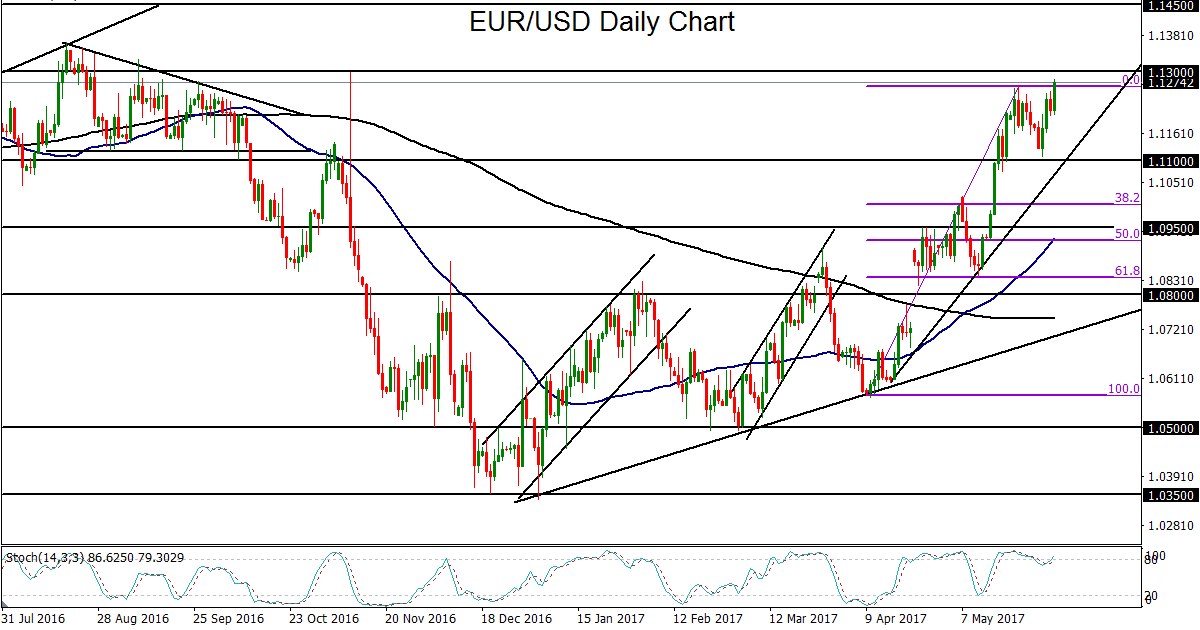

The immediate currency market reaction to the weak jobs report, as mentioned, was a sharp drop in the dollar and a similarly sharp surge in gold prices. The dollar slide boosted EUR/USD on Friday to a new year-to-date high, once again approaching key resistance around the 1.1300 level. Since early April, the currency pair has been entrenched in a steep uptrend that has broken out above successively higher resistance levels. Most recently, EUR/USD rebounded from a pullback to key 1.1100 support before embarking on its current leg of the rally. Having now tentatively confirmed a continuation of the uptrend on the NFP-driven drop in the dollar, any continued EUR/USD momentum that results in a breakout above 1.1300 could next target major resistance around the 1.1450 level.